There’s one crucial retirement finance question that is so difficult that most investors get it wrong even when you tell them the answer in advance.

The question focuses on “life expectancy,” and needless to say answering it correctly is an essential prerequisite to good retirement planning. Underestimate how long you’re likely to live and you run the risk of outliving your money. If you overestimate it, in contrast, you run a good chance of leaving a lot of money on the table, so to speak—money that you could otherwise spend to enjoy your retirement.

Researchers have known for some time that most of us have a poor understanding of life expectancy. At the beginning of this year, for example, the TIAA Institute and George Washington University’s Global Financial Literacy Excellence Center (GFLEC) released results of a survey showing that two-thirds of U.S. adults were unable to answer basic questions such as “what is life expectancy among 60-year-old men in the U.S.” (I devoted a mid-January column to this survey.)

That’s disheartening enough, since you can’t plan for a retirement if you don’t know how long it will last. But even more depressing are the results of follow up research that the TIAA Institute/GFLEC published two weeks ago. The researchers found that “longevity literacy” doesn’t improve even when you give away the answer.

To appreciate what the researchers discovered, see if you can correctly answer the following question that they posed to the adults taking their survey: “If life expectancy among 65-year-old individuals is 20 years, which of the following statements is true?”

- About one-half of 65-year-olds will live past age 85

- The vast majority of 65-year-olds will not live past age 85

- About one-half of 65-year-olds will die between age 84 and 86

The correct answer is the first. That’s because, as the researchers write, the precise meaning of life expectancy “is the number of additional years beyond which one-half of the group members will live, while the other one-half will not.”

Don’t be too hard on yourself if you got this wrong; only 35% of survey respondents got it right.

The most common answer among respondents who got it wrong was the second one, and you can understand why. Upon being told that our life expectancy is, say, 85 years, most of us assume that the prudent thing to do is figure out how to pay for a retirement that lasts until then. In fact, however, half of us can expect to live longer than that, which in turn means 50% of us are likely to outlive our money if we construct a retirement financial plan that lasts only through our life expectancy.

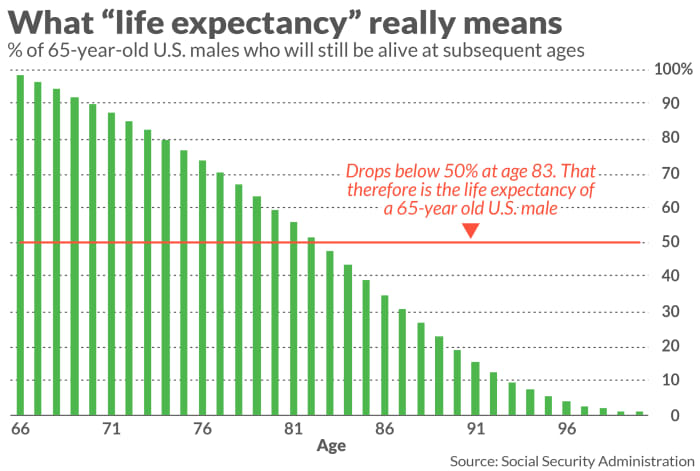

This true meaning of “life expectancy” is illustrated in the accompanying chart. It plots the percentage of 65-year-old U.S. males who are still alive at various subsequent ages. Notice that 50% will still be alive at age 83, according to the latest Social Security actuarial tables, which is why Social Security reports the life expectancy of a 65-year-old male to be 83. (A chart for 65-year-old women would extend out further; the percentage of them still alive doesn’t drop below 50% until age 86.)

What if you want only a 10% probability of outliving your money? Then 65-year-old males need to figure out how to pay for retirement through age 93. If you want only a 5% probability, you need to finance your retirement standard of living through age 96. (For women it is 96 and 98, respectively.)

Given this new understanding of life expectancy, many of you may now need to reconstruct your retirement financial plans. But it’s better to know this now than later. Forewarned is forearmed.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.