Rmcarvalho

REITs fell during the week ended Sep. 8 but managed to outperform wider markets.

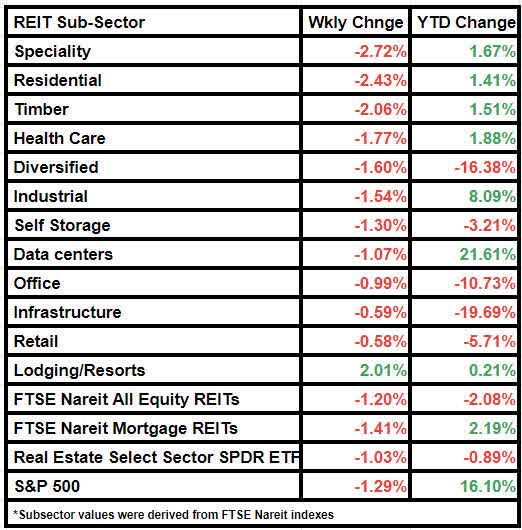

FTSE Nareit All Equity REITs declined by 1.20% from last week, while the Dow Jones Equity All REIT Total Return Index was down by 1.13%.

Comparatively, S&P 500 decreased by 1.29% on a weekly basis.

Meanwhile, the broader Real Estate Select Sector SPDR ETF fell by 1.03% and the FTSE NAREIT Mortgage REITs by 1.41%.

Notably, U.S. REITs continued to show a decrease in share repurchase activity in Q2, according to a report by S&P Global Market Intelligence.

The sector repurchased shares worth $553.9M during the quarter, representing a Y/Y decline of 64.3% and Q/Q decline of 34.6%, the report showed.

Speciality REITs were major laggards, having declined by 2.72%.

Residential REITs followed with a fall of 2.43%.

Housing REITs face risks from recessions, elevated interest rates, and upcoming supply, but offer attractive valuations and growth opportunities, Seeking Alpha contributor Colorado Wealth Management Fund said in a report.

Hotel subsector was an outlier compared to the other subsectors. The subsector increased by 2.01%.

Here is a look at the subsector performance: