Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

US stocks declined and oil prices hit 2023 highs on Tuesday, stirring investors’ concerns about mounting price pressures a day before the release of the closely watched US inflation report.

Wall Street’s benchmark S&P 500 slipped 0.3, as declines for Apple and several other big tech stocks outweighed an advance for oil and gas companies. The Nasdaq Composite declined 0.7 per cent.

Traders are looking ahead to US consumer price index figures due on Wednesday, which will mark the last piece of top-tier economic data before the Federal Reserve announces its decision on interest rates next week. Officials earlier this month signalled they will hold the federal funds rate steady at this upcoming meeting.

The rate of annual price growth in the world’s largest economy is expected to have increased to 3.6 per cent in August, up from 3.2 per cent in the previous month.

“While that won’t move the needle for next week’s Fed decision, where a pause is widely anticipated, it would indicate hawkish risks to the broader Fed outlook,” said Benjamin Schroeder, senior rates strategist at ING.

In contrast, core inflation, which strips out volatile energy and food costs, is expected to fall to 4.3 per cent from an annualised rate of 4.7 per cent in July.

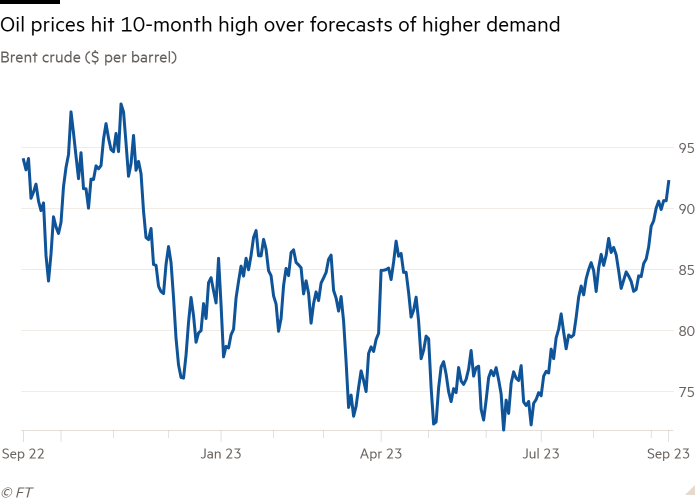

The uptick in headline inflation is expected in part because oil prices have climbed steadily since the middle of summer, as top producers Russia and Saudi Arabia announced a series of supply cuts to last until the end of year.

Oil prices surged further on Tuesday, after Opec in its monthly report forecast a tighter supply outlook and growing demand in 2024.

Brent crude, the international benchmark, rose 1.8 per cent to $92.28 per barrel on Tuesday and US marker West Texas Intermediate added 2 per cent to $89.10. Both prices reached their highest level since November 2022.

The S&P 500’s energy sector was the benchmark’s top performer, rising 2.3 per cent.

Among individual stock moves on Wall Street, Apple was down 1.7 per cent in afternoon trading after the tech group unveiled its newest line of iPhones in a presentation featuring its new products. The company’s share price came under pressure last week after Beijing ordered some public officials not to use iPhones or other foreign devices for work.

Elsewhere, UK government bond yields and the pound dropped, as investors took a mixed set of jobs data as a sign that the labour market may be cooling.

The pound weakened 0.2 per cent to trade at $1.2481 against the dollar after figures showed record wage growth despite signs the labour market is weakening.

The yield on the interest rate-sensitive two-year gilt fell 0.05 percentage points to 5.02 per cent and the 10-year yield dropped by a similar amount to 4.42 per cent. Bond yields move inversely to prices.

UK unemployment rose to 4.3 per cent in the three months to July, above the Bank of England’s forecast for the third quarter. However, annual pay growth was 7.8 per cent in the three months to July, the highest rate on record going back to 2001.

The pace of wage growth has helped convince the majority of market participants that the BoE will increase interest rates, which are already at a 15-year high, by another quarter-point to 5.5 per cent next week.

“Signals coming from the labour market have simply been too strong to justify a pause in rate rises”, said Hugh Gimber, global market strategist at JPMorgan Asset Management.

The jobs data comes a day after Catherine Mann, one of the central bank’s more hawkish policymakers, said she would “rather err on the side of over-tightening”, as price pressures remained well above the BoE target.

In Europe, the region-wide Stoxx Europe 600 gave up early gains to end the day 0.2 per cent lower.

Asian equities were mixed, with Hong Kong’s Hang Seng index down 0.4 per cent and China’s CSI 300 losing 0.2 per cent, while Japan’s Topix rose 0.8 per cent.