Andrii Yalanskyi

REITs bounced back this week, even as a traditionally difficult September continued to drag wider markets down.

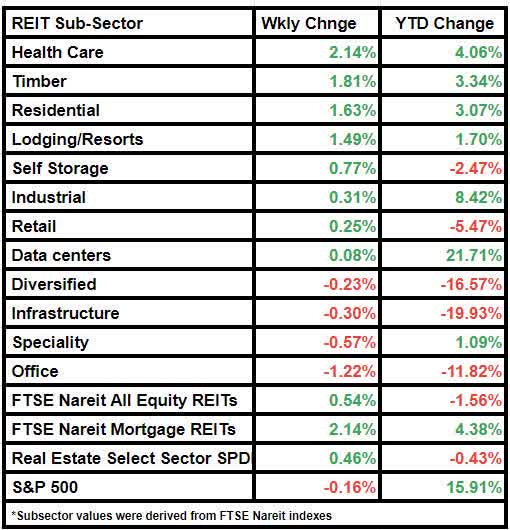

FTSE Nareit All Equity REITs rose 0.54% from last week, while the Dow Jones Equity All REIT Total Return Index increased by 0.82%. Comparatively, the S&P 500 declined by 0.16% on a weekly basis.

The broader Real Estate Select Sector SPDR ETF gained by 0.46%, while mortgage REITs rose by 2.14%.

September is generally described as a difficult month for the stock market, sometimes attributed to investors making changes to their portfolios by taking profits as summer ends, according to a recent report by Benzinga.

While the broader markets continued their falling trend this week, REITs gained despite some recent analyst downgrades. Federal Realty Investment Trust (FRT) and Innovative Industrial Properties (IIPR) were some notable downgrades that drove the REIT indices down last week.

The story was different this week despite rising interest rates, given the resilient balance sheet and financials across the REITs sector. Health care and industrial REITs are especially seeing double-digit revenue growth, a report by Finsum said.

Health care was the biggest gainer among subsectors this week, having gained 2.14% W/W.

Timber followed, with an increase of 1.81%.

Office subsector was a laggard, having declined by 1.22% on a weekly basis.

Here is a look at the subsector performance: