Receive free Currencies updates

We’ll send you a myFT Daily Digest email rounding up the latest Currencies news every morning.

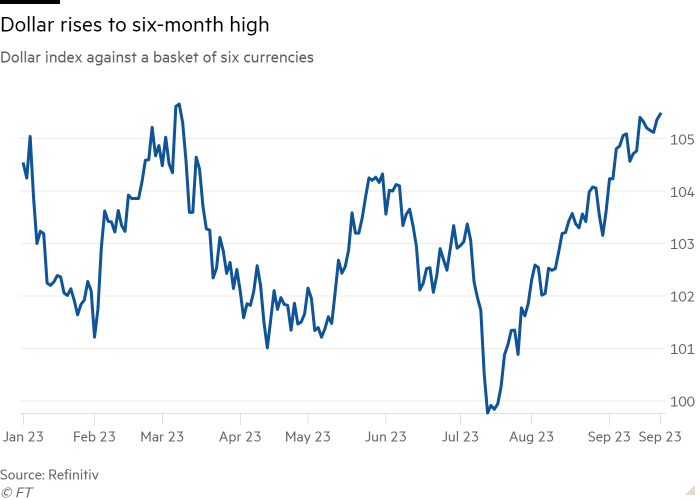

The dollar climbed to a six-month high on Friday at the end of a week when US stock and bond markets weakened and investors prepared for a prolonged period of high interest rates.

The currency hit its highest levels against the euro, the pound and the yen since at least March after the Federal Reserve set out plans to cut interest rates — now at a 22-year high — much more slowly than economists had thought.

US government bond prices fell, sending yields to their highest levels in 16 years, while the S&P 500 benchmark index of blue-chip US stocks suffered one of its deepest weekly declines of the year.

“Markets have taken the Federal Reserve quite negatively,” said James Briggs, a portfolio manager at Janus Henderson Investors. “Higher for longer is clearly entrenched and the conviction is that we are in a new regime.”

The Fed’s decision to keep rates on hold this week and to signal its resolve to reduce them only slowly throughout next year and in 2025 was followed by the Bank of England, which also stressed the importance of maintaining high rates.

The European Central Bank raised its own benchmark rates to an all-time high this month.

Recent slides in US and eurozone bond prices come after months of sell-offs in global fixed-income markets, largely because of higher benchmark interest rates and higher inflation.

Some market participants warn the chilling effect of an extended period of high interest rates also makes equity markets more fragile, because of the impact of higher borrowing costs on the broader economy.

“It’s an unstable situation,” said Joseph Davis, global chief economist at Vanguard, who argued inflation has historically usually been vanquished at the cost of lower growth. “There have been hardly any examples ever of inflation coming down with hardly any trade-offs,” he said.

Signs the US is proving more resilient than other major economies have helped the dollar climb 6 per cent against a basket of other currencies since mid-July.

Jobless claims fell to their lowest level since January this week while applications for unemployment aid fell close to an eight-month low.

“I think the US is in a leading spot,” said Robert Tipp, head of global bonds for PGIM fixed income. He argued the markets were finally being convinced that the Fed would keep interest rates high — partly because the country’s economic prospects are better than elsewhere.

In its efforts to tame inflation that topped 9 per cent last year, the Fed has increased rates 5.25 percentage points over 18 months — one of the most aggressive monetary tightening cycles in its recent history.

“Investors had been living in the future, pricing in cuts but markets got brought round to the Fed as growth has been decent,” Tipp said.

By contrast, ECB chief economist Philip Lane on Friday said risks to the region’s growth were “tilted to the downside”, with manufacturing activity “set to remain weak” and “clear signs of a slowdown” in services.

The ECB has suggested it remains open to more rate rises, but the closely watched purchasing managers’ index on Friday showed businesses are reporting month-on-month falls in output and orders. The euro weakened following publication of the data.

Sterling also fell after UK PMIs showed weakening services activity, deepening the currency’s losses in a week when inflation fell faster than expected and the BoE bucked expectations by declining to raise rates.