The S&P 500 (SP500) on Friday retreated 2.93% for the week to close at 4,320.00 points, posting losses in four out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) slipped 2.92% for the week.

The benchmark index notched its worst weekly performance since early March, while also slumping to a three-week losing streak. The main catalyst behind the decline was the Federal Reserve’s indication that interest rates will be higher for longer.

The central bank was the main event of the week. The Fed’s monetary policy committee on Wednesday chose to keep rates steady, as widely anticipated. However, the latest dot plot – a summary of economic and rate projections – signaled one more rate hike this year along with fewer rate cuts in 2024.

Moreover, Powell at the post-decision conference said that a soft landing was not a baseline expectation, which further shook investor confidence. The Fed chair also highlighted that economic activity had been stronger than all expectations.

In reaction to the Fed, markets slumped on Wednesday and extended that decline on Thursday. In the latter trading session, the S&P 500 (SP500) at one point hit its most oversold level of the year, according to Bespoke Investment Group.

Also weighing on equities was a surge in Treasury yields, as traders sold-off bonds on the Fed’s higher for longer signal. This week, the shorter-end 2-year yield (US2Y) – which is more sensitive to interest rate decisions – scaled a level not seen since 2006, while the longer-end 10-year yield (US10Y) hit its highest since 2008.

See how Treasury yields have done across the curve at the Seeking Alpha bond page.

It was a big week for central banks in general. The Bank of England on Thursday joined the Fed in keeping interest rates steady, a day after UK consumer inflation came in cooler than expected in August. The Bank of Japan on Friday maintained its ultra-loose policy while giving a dovish guidance.

Aside from the Fed, the week also saw several other notable highlights: WTI crude oil futures (CL1:COM) snapped a three-week advance, helped in part due to the recent larger-than-anticipated OPEC+ production cuts. Rising energy prices have added to inflationary concerns.

Stocks of the so-called “Detroit Three” carmakers – General Motors (GM), Ford (F) and Stellantis (STLA) – garnered significant attention, amid the first full week of the United Auto Workers strike. There were some signs of headway on Friday, with the union saying they had made significant progress in their talks with Ford (F) while calling for strikes at 38 General Motor (GM) and Stellantis (STLA) locations.

The initial public offering (IPO) market grabbed some of the spotlight this week following British chip designer Arm Holdings’ (ARM) strong market debut. Grocery deliver app Instacart (CART) launched on the Nasdaq on Tuesday to similar enthusiasm. However, in the past few days, both Arm (ARM) and Instacart (CART) saw declines, while also breaking below their IPO prices.

Merger and acquisitions activity saw a major bump this week, especially in the tech space. Cisco (CSCO) on Thursday announced a $28B deal to buy cybersecurity firm Splunk (SPLK), a move that Wedbush Securities believes could usher in a “tidal wave” of mergers. Meanwhile, the UK on Friday issued a preliminary approval for Microsoft’s (MSFT) planned $69B takeover of videogame publisher Activision Blizzard (ATVI).

Turning to the weekly performance of the S&P 500 (SP500) sectors, all 11 ended in the red. Consumer Discretionary was the top loser, declining more than 6%, while Real Estate slipped more than 5%. Defensive sectors Health Care, Utilities and Consumer Staples fell the least. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from September 15 close to September 22 close:

#1: Health Care -1.18%, and the Health Care Select Sector SPDR ETF (XLV) -1.54%.

#2: Utilities -1.73%, and the Utilities Select Sector SPDR ETF (XLU) -2.54%.

#3: Consumer Staples -1.78%, and the Consumer Staples Select Sector SPDR ETF (XLP) -2.65%.

#4: Energy -2.33%, and the Energy Select Sector SPDR ETF (XLE) -2.93%.

#5: Information Technology -2.63%, and the Technology Select Sector SPDR ETF (XLK) -2.66%.

#6: Industrials -2.69%, and the Industrial Select Sector SPDR ETF (XLI) -3.06%.

#7: Financials -2.79%, and the Financial Select Sector SPDR ETF (XLF) -3.36%.

#8: Communication Services -3.23%, and the Communication Services Select Sector SPDR Fund (XLC) -2.80%.

#9: Materials -3.69%, and the Materials Select Sector SPDR ETF (XLB) -4.09%.

#10: Real Estate -5.36%, and the Real Estate Select Sector SPDR ETF (XLRE) -6.03%.

#11: Consumer Discretionary -6.35%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) -6.32%.

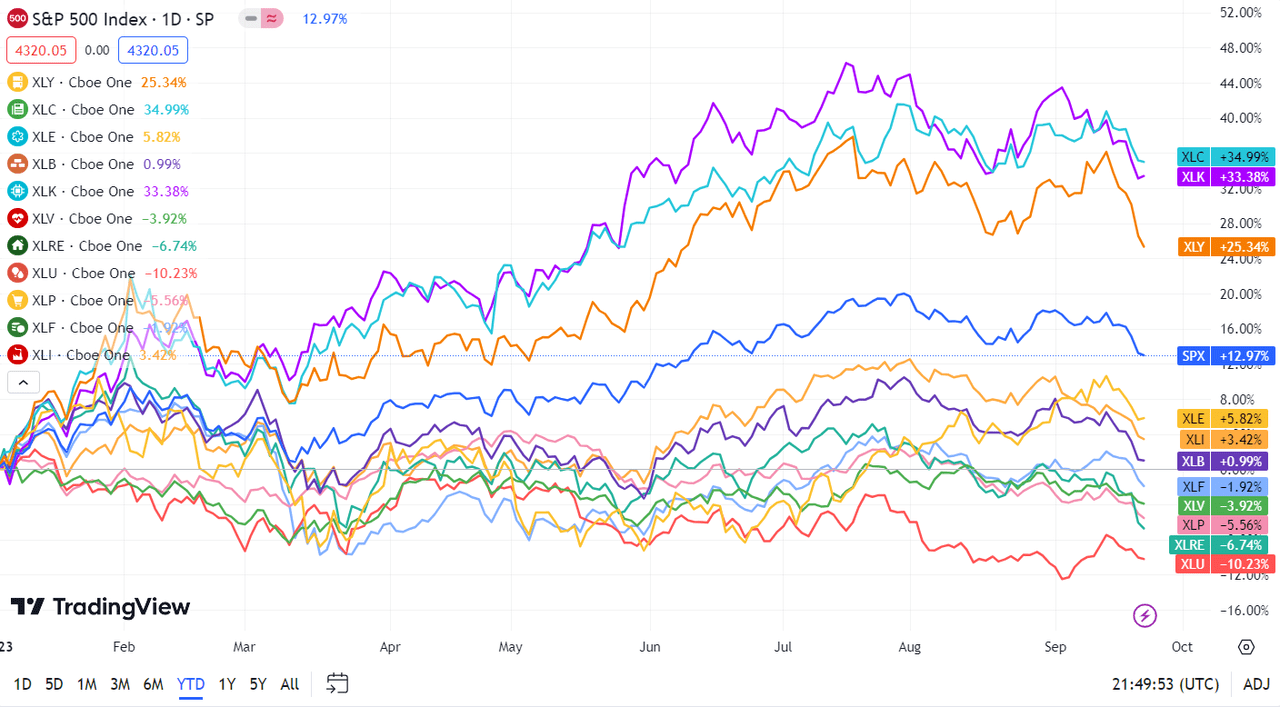

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.