-

Stocks are following the same path they did ahead of the 1987 stock crash, Societe Generale said.

-

Investors are bullish in the face of rising bond yields, in an “echo” of late 80s sell-off.

-

Any sign of recession now could spark big losses for investors, the bank’s Albert Edwards said.

The stock market is sending worrying signals, and any sign of recession now could spark a big sell-off, according to Societe Generale strategist Albert Edwards.

Edwards pointed to the strength of US stocks despite rising bond yields, which have surged as investors see higher for longer interest rate policy from the Federal Reserve. The yield on the 10-year US Treasury recently passed a 16-year-high, climbing to around 4.768% on Tuesday.

And yet, US stocks have been relatively resilient all year. Despite hefty losses in August and September, the S&P 500 is still up 10% from levels in January.

But the outperformance in the face of soaring bond yields could be a warning of pain to come, if history is any guide. The landscape today is reminiscent of the run-up to Black Monday, Edwards said, when stocks were resilient amid rising bond yields before the Dow plunged 22% in a single trading session, its sharpest one-day decline in history.

“The equity market’s current resilience in the face of rising bond yields reminds me very much of events in 1987, when equity investors’ bullishness was eventually squashed,” Edwards said in a note on Tuesday. “Just like in 1987, any hint of recession now would surely be a devastating blow to equities.”

There’s growing uncertainty about the path of the economy, and forecasts have wavered all year. While economists had been warming up to the idea of a soft landing for the economy in the middle of 2023, the latest spike in bond yields has clouded the outlook.

“Never in my career have I witnessed such uncertainty about where we are in the economic cycle. Is that long promised recession still lurking around the corner or are we at the start of a new economic cycle,” Edwards wrote.

Signs of trouble have been brewing. A weaker labor market coupled with a US consumer that has depleted their excess savings from the pandemic could mean the economy will enter an inflection point as soon as this quarter, Raymond James said in a recent note.

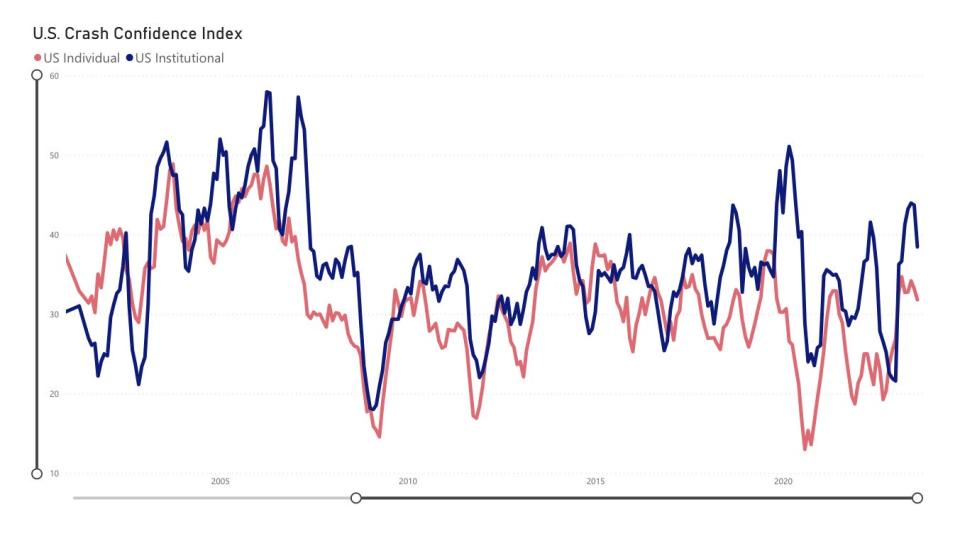

The New York Fed has priced in a 61% possibility that the US will tip into recession by August 2024. Meanwhile, only 32% of individual investors think the chance of a 1987-style stock market crash over the next six months is less than 10% according to Yale’s US Crash Confidence Index.

Read the original article on Business Insider