The World Health Organization (WHO) has declared that COVID-19 is “no longer a public health emergency of international concern” but there remains a prevailing sense of caution.

Consumers are taking proactive steps to safeguard their health and wellbeing but face rising food costs. Health and wellness concerns and the realization that taking care of themselves should not just be a response to a specific threat like COVID-19 but a long-term investment in their lives have resulted in people making lifestyle changes.

Value for money

The higher prices of essential commodities, such as food and drinks, are expected to affect 46% of SEA consumers.

Overall, consumers are now more price-conscious and they expect value delivered through tangible benefits like large sizes for food and drink products. For brands, this is an opportunity to offer versatility, simplicity, and accessibility on top of nutrition.

In Thailand, 58% of consumers said a food/drink product that can be used in many different recipes is good value for money. In Malaysia, 40% of consumers said a food/drink product that is easier to prepare than other products is good value for money. In the Philippines, 38% of Filipino consumers said a food/drink product that comes in a large size is good value for money.

Mintel’s 2023 Food and Drink Trend Savvy Sustenance explained that when there is less money to spend, consumers will look for nutritious and filling everyday essentials to fuel them throughout the day.

Making smart purchases with BFY ingredients

In Malaysia, over half of consumers save money on food and drink by cutting back on treats. For brands, this is an opportunity to use better-for-you ingredients to deliver a less processed image in indulgent categories.

Heal Chocolate Crunch Breakfast Protein Bar (Malaysia) is made with real cocoa and is a source of fibre and protein. It is also dairy-free; Mintel GNPD

Quaker Oatmeal Dessert Blueberry Nut and Oats Dessert (Taiwan) contains less than 200kcal per serving. It has oat flakes and dried blueberries; Mintel GNPD

The same proportion of Indonesian consumers said their food choices are driven by the desire for good nutrition. Customers now seek products rooted in trusted traditional ingredients that address various health needs. Thus, brands can connect with consumers by focusing on holistic wellbeing to pave the way for the growth of traditional Asian ingredients such as lemongrass, ginger, turmeric, and ginseng.

Healthy ageing, not anti-ageing

The rapid rise in the proportion of the SEA population aged over 60, particularly in Singapore and Thailand, means brands should meet ageing consumers’ needs.

To achieve this, brands should prioritise investment in products that align with the evolving tastes and dietary needs of the older demographic. These needs may include softer foods and low sodium.

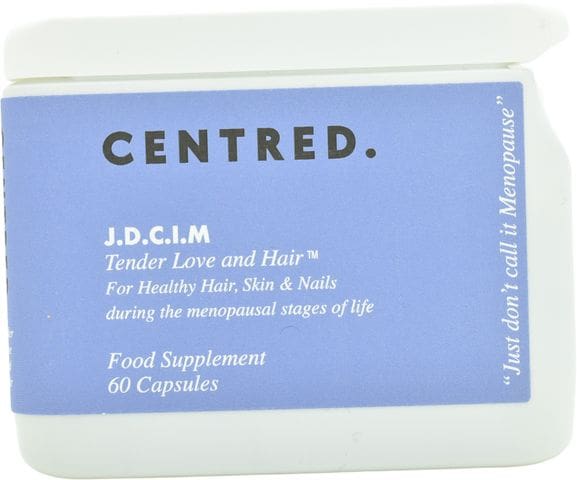

Brands can start to shift their focus on proactive prevention instead of disease treatment, as described in Mintel’s 2024 Food and Drink Trend Age Reframed, by targeting consumers in their 30s and 40s with products and messages focused on preventing age-related diseases. Brands need to develop food, drink, and supplement products that can be beneficial for the immediate health concerns affecting younger consumers.

Centred. is a food supplement that offers support for perimenopause (UK); Mintel GNPD

Clutch Cognition Energy Drink supports psychological function and counteracts fatigue (Denmark); Mintel GNPD

What we think

Brands can make nutritious food accessible to the whole family so they can prioritise their health while keeping within their budget.

Consumers’ interest in holistic wellbeing is an opportunity for brands to incorporate trusted and traditional local functional ingredients into their products.

Brands can shift their focus and present a more inclusive and realistic perspective on the ageing process.