Consumers still believe in tried-and-tested ingredients, with niacinamide and hyaluronic acid as top-searched ingredients on social media. This loyalty stems from the enduring faith in proven ingredients that cater to individual skin needs. To stand out in the saturated market, beauty brands can reimagine well-known ingredients while maintaining their efficacy. According to Mintel research, over half of Chinese consumers say they would select a skin tone management product based on well-known ingredients.

Niacinamide was first registered on Mintel GNPD in 1998 and has continued to grow in popularity. Renowned for its anti-inflammatory, brightening, and moisturizing benefits, it has become a household name in facial skincare. Olay’s recent introduction of Super Serum, featuring a new low-pH activated niacinamide formulation, is said to minimise skin irregularities (‘skin chaosity’) and reduce micro-inflammation through an innovative low-pH buffer system.

Vitamin C stands as another popular antioxidant ingredient, offering protection against skin damage, a collagen production boost and improved skin tone. NIVEA Malaysia’s recent launch of the Extra Bright C&HYA Vitamin Anti-Spot Serum utilizes cold extraction technology, claiming to preserve vitamin C’s properties optimally while enhancing its antioxidant potency. The unique ‘kitchen logic’ approach communicates efficacy, though further efforts to highlight the value of switching to vitamin C with cold-extraction technology are essential for consumer persuasion.

Hyaluronic acid, a well-known humectant for skin hydration, takes centre stage in Shiseido’s Bio-Performance Skin Filler Serums. The two-step regimen involves delivering shrunken hyaluronic acid molecules in the evening for better absorption and enlarging them in the morning to volumize the skin. This innovative concept simplifies product efficacy communication, making it easy for consumers to grasp and visualize.

Unlocking the potential of traditional medicinal ingredients

Beyond popular ingredients, brands can captivate beauty consumers by incorporating indigenous ingredients with local heritage. In Japan, 8 in 10 consumers view Chinese herbal medicine as beneficial for physical health, while nearly a third of Indian female consumers believe in the preventive properties of Ayurvedic ingredients in beauty and personal care products.

The emergence of Ayurvedistry combines skin and wellness rituals, ingredients, and practices with modern dermatology. One example is the Manjishtha Mud Clay Mask from the Indian beauty brand 82E. This light-brown clay mask, formulated with powerful antioxidants like manjishtha and bioflavonoids, is said to be clinically proven to brighten and rebalance the complexion. Providing a sensory experience distinct from traditional clay masks, it retains skin moisture after use.

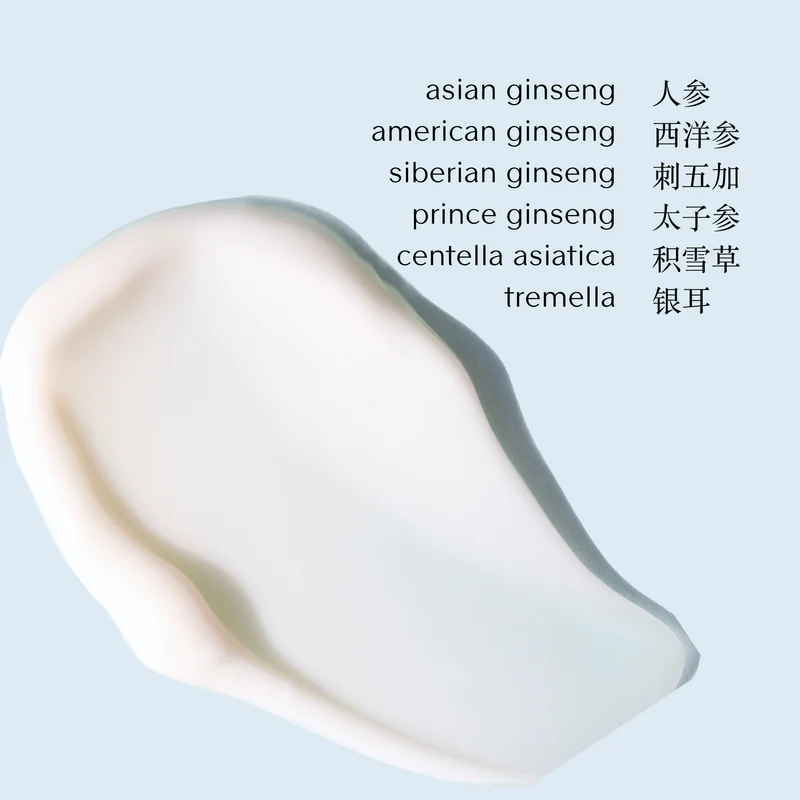

Ginseng, a traditional root/herb in Asia Pacific, has seen growth in North America and Europe, rising from 18% to 24% between January 2018 and December 2022. YINA Hydracloud Cream, a Chinese beauty brand, harnesses the power of East Asian medicinal plants, including ginseng, for anti-inflammatory benefits. In South Korea, Sulwhasoo, known for its medicinal actives like ginseng, partners with singer Rosé, adding modernity and playfulness to attract younger consumers.

What we think

As consumers increasingly scrutinise skincare ingredients, brands can gain a competitive edge by innovating familiar ingredients. Whether through novel formulations or creative communication of efficacy, brands can renew interest in established ingredients. Additionally, tapping into ancient remedies like traditional TCM and Ayurvedistry, supported by clinical evidence, offers an opportunity to engage new consumers and encourage the exploration of traditional ingredients.