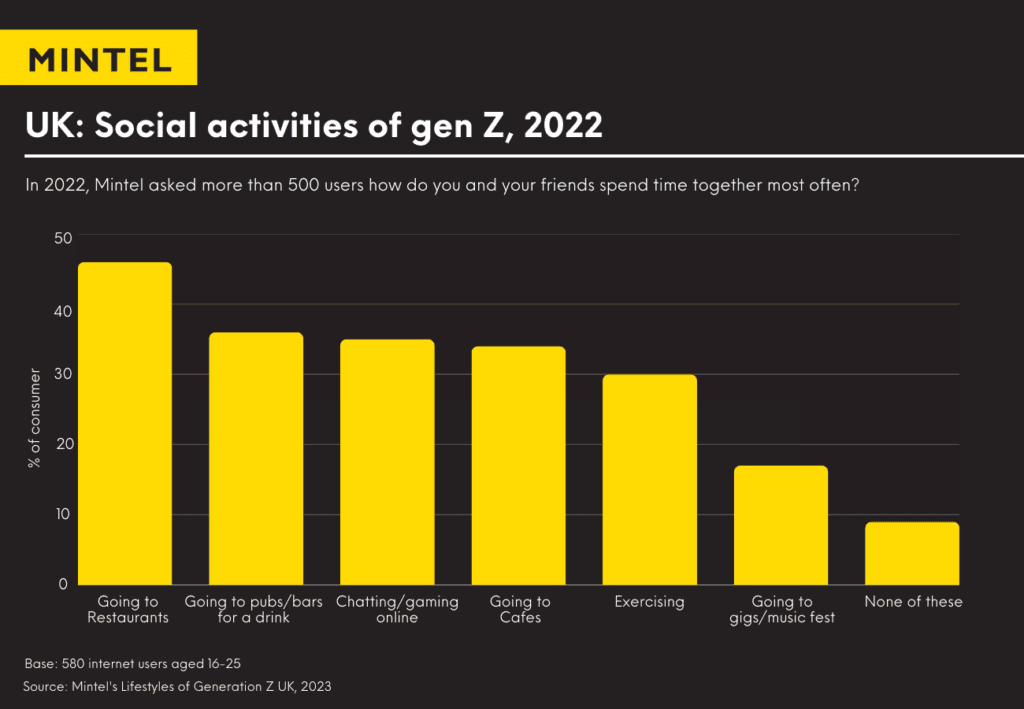

As part of Mintel’s research into the lifestyles of Gen Z in Britain, our findings indicate that 36% of young adults aged 18-25 most commonly socialise by going to bars and pubs with their friends. In 2023, going to restaurants is one of the most popular choices for socialising, while online gaming, visiting cafes, and going to the cinema have gained comparable popularity to going out for a drink.

We can also see how Gen Z is rejecting alcohol more significantly than other generations by comparing between generational British lifestyles. A distinct pattern emerges when examining age groups, revealing that British consumers aged 20-24 are almost half as likely to prioritise spending on alcoholic drinks for the home than consumers aged over 75. This suggests that a significant number of Gen Z are shifting their focus away from drinking alcohol, both inside and outside the home, and opting instead for sober socialising.

Gen Z’s Alcohol Consumption

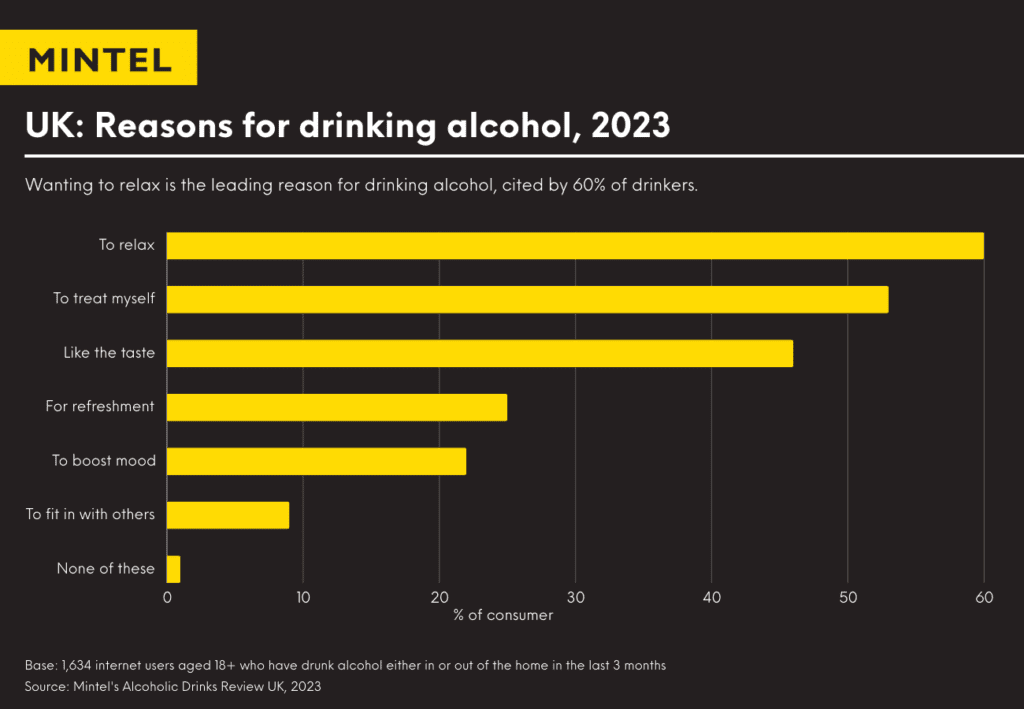

Gen Z has gained recognition for limiting their alcohol consumption, though that doesn’t mean that they aren’t drinking at all. Around a third of people aged 18-24 do not drink alcohol at all, but those who do tend to drink primarily as a treat, to relax, or to mark a special occasion. Relaxation is the most popular reason for drinking alcohol across the generations. However, Gen Z stands out from older generations in how little alcohol is used as a refreshment or to elevate meals. This contrast in alcohol usage suggests that, for Gen Z, alcohol is an occasional treat, whereas for older generations it is a considered as a regular, relaxing refreshment.

For more information on current trends within the alcohol industry, you can discover Mintel’s key insights and industry reports on the alcohol industry.

What are the benefits of the sober curious generation?

It becomes clear why Gen Zers are being labelled ‘the sober curious generation’, when compared to, half of over 65s who did not limit their alcohol consumption in 2023, whereas 40% of Gen Zers did. So we can see that young people are turning away from alcohol and overconsumption, but what has caused this shift? Why is Gen Z drinking less alcohol than previous generations?

Almost two-thirds of consumers aged 18-24 have said that they worry about the emotional impact of alcohol, while a similar number reported that they would like to learn more about drinking mindfully. It seems that, with mental health being a priority for many, Gen Z has honed in on reducing their alcohol intake as a way to manage their emotional wellbeing and mindfulness.

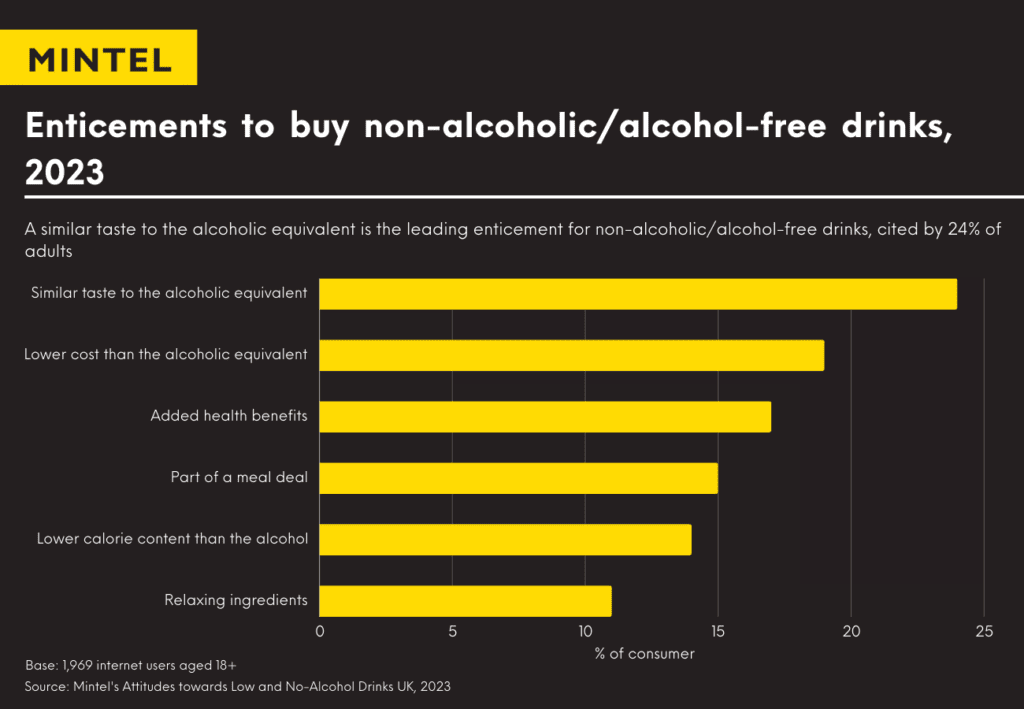

On a more pragmatic level, there is also a nutritional factor. Around a quarter of Gen Z consumers reported that they choose low- and no-alcohol drinks as they have lower calorie content, or due to added functional benefits (such as prebiotics and vitamins). With Gen Zers being drawn to non-alcoholic drinks due to potential health benefits, at a far greater rate than other age groups, it is clear that many young people perceive nutrition to be one of the primary benefits of sober curiosity.

Finally, Gen Zers who are drinking less alcohol are often doing so because it costs less. Almost a third of young people asked noted that they choose low- and no-alcohol drinks because they are cheaper than the alcoholic versions. Indeed, in 2023 the most popular alcoholic drinks in the UK were still wine and lager, known for their relatively lower cost when compared to premium drinks like ale, stout, and cocktails.

What are Gen Z choosing instead of alcohol?

Gen Z is shifting their focus away from alcohol-centric socialising, but what kinds of plans, occasions, and products are they choosing instead? Though it may seem obvious that non-drinkers would choose low- and no-alcohol drinks which imitate alcoholic beverages, this is not necessarily the case. Just under half of Gen Zers reported drinking low- and no-alcohol beverages, which suggests that many prefer other beverages entirely.

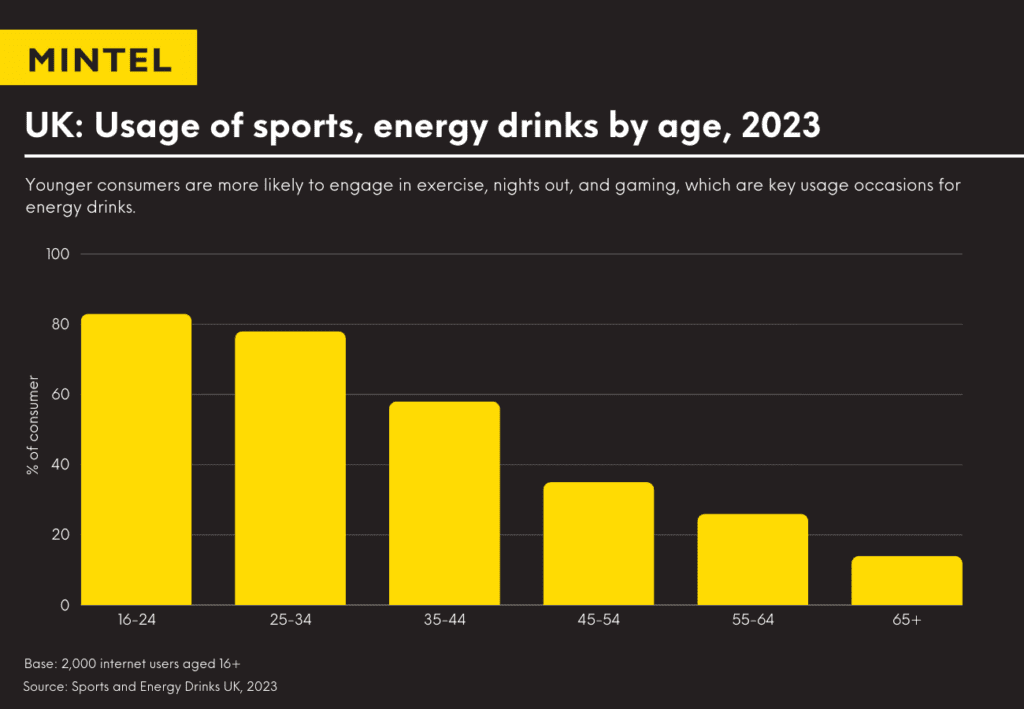

In terms of fizzy drinks, Gen Z consumers actually reported a lower intake of carbonated soft drinks at bars and pubs than Millennials. However, when it comes to home consumption, Gen Zers do drink more carbonated soft drinks than some older generations. Notably, Gen Zers were above average in agreeing that fruit juices with sophisticated flavours are a better alternative to alcoholic beverages than regular fruit juices. This indicated that upgraded fruit juice may be a good alternative option for young people. Finally, Gen Z consumers drink energy drinks on a night out more than twice as much as older groups. This heightened consumption could be attributed to the energy boost provided by energy and sports drinks which offer a similar effect to drinking alcohol when partying.

Looking Ahead with Mintel

So what does this all mean for Gen Z consumers and drinks brands? Mintel anticipates that the trend away from drinking alcohol among young people will continue to grow, but may not expand into older generations – who appear to be more consistent in their alcohol consumption levels.

Brands looking to capitalise on the growing consumer base of young people staying sober should take into account that Gen Zs are choosing elevated low- and no-alcohol drinks, such as fruit juices with sophisticated flavours, rather than sticking with traditional soft drinks. Soft drinks and juice brands should look to elevate traditional flavours to offer a beverage for special occasions that still feels luxurious and tastes great. Additionally, offering energy-boosting elements to drinks may be a great option for sober curious consumers who still like their nights out to go into the early hours!

Explore our extensive Drinks Market Research, or fill out the form below to sign up to Spotlight, Mintel’s free newsletter for exclusive insights.

Sign up to Spotlight