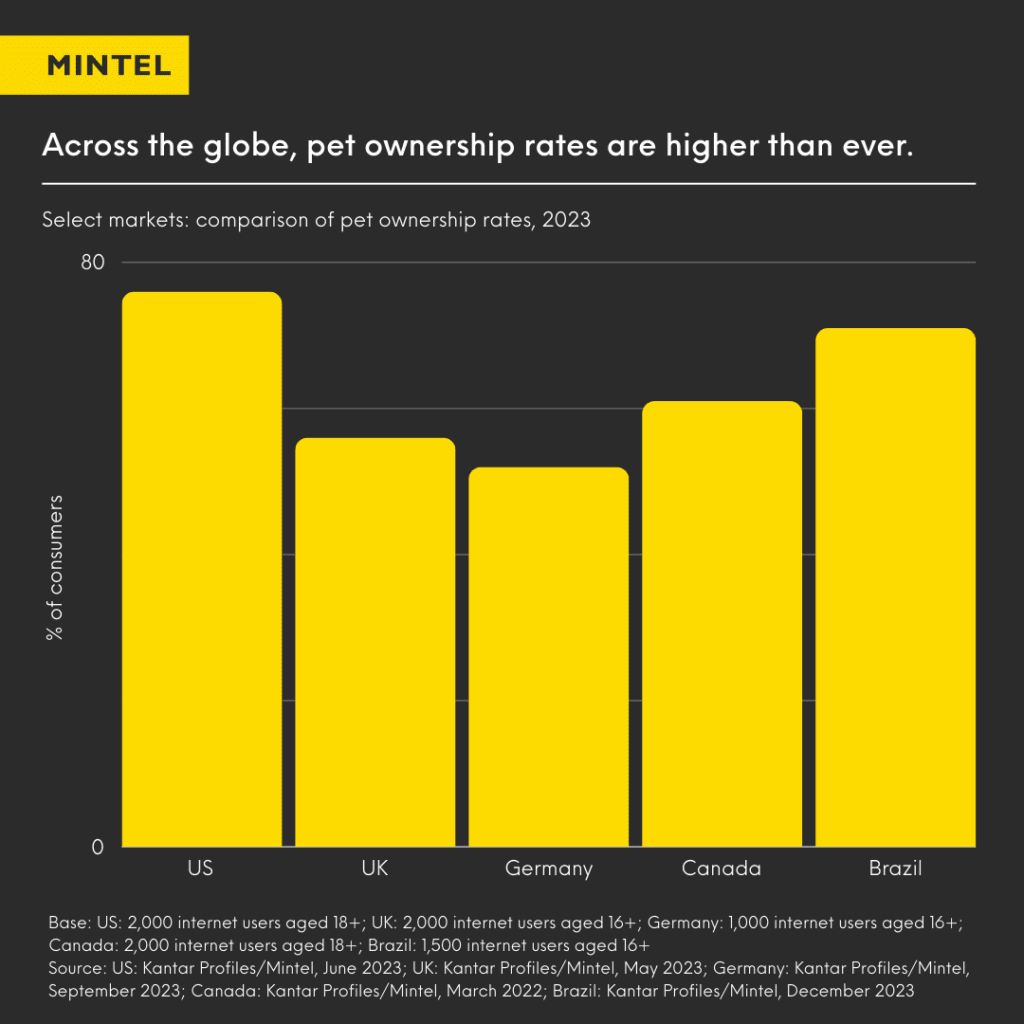

It’s official: the world has gone to the dogs (and cats, and hamsters, and mice, and axolotls). Across the globe, pet ownership rates are higher than ever. Mintel’s consumer research found that levels of pet ownership are highest in the US and Brazil, with a pet ownership rate of 73% and 71% respectively. It’s not just consumers in the Americas who have a fondness for a fuzzy friend, over half of consumers in the UK and Germany own a pet.

What’s driving the increase in pet ownership?

These levels of pet ownership aren’t surprising, as pets have always been popular, however the reasons given for owning a pet are changing. With research into the link between pet ownership and pet owners’ physical and mental health, owning a pet has become more appealing. Pets don’t just provide companionship – pet owners are now hoping that they can help with real-life problems such as depression, anxiety, and even heart health. Furthermore, with society embracing single and child-free lifestyles, pets are now increasingly seen as part of the family, and pet owners are increasingly considering themselves as parents.

This sentiment is evident across the globe, resonating with 86% of Irish pet owners, and 92% of Brazilians. Not only does it transcend continents, but also age demographics: In China, younger pet owners aged 18-24 are more likely to view their pets as life partners, whereas pet owners over 55 are more likely to see their pets as children. The same is true in the US, where younger adults see pets as companions and a precursor to parenthood. As is evident from this, the role of the pet is being redefined as they are increasingly included in all aspects of life. So what does this mean for the future of the pet industry? In this article we take a deep dive into the impact of the pet-parent demographic.

Healthy Meals, Naturally – Pet Food Industry Trends

The humanisation and incorporation into the family unit does not automatically make a healthy pet. Pet obesity in Europe rose during the pandemic, which led to over half of pet owners in Europe acknowledging that their pets could benefit from losing weight. But let’s be fair to our four-legged friends, the pandemic worsened weight management issues for many, and while a global shift towards health-conscious eating has emerged post-pandemic, this has been reflected in consumers’ preferences for healthier pet food. For example, the prevalence of no-added sugar claims in the pet food industry mirrors a similar trend in human food.

Pet owners are increasingly looking for pet foods that promote overall health and wellness, with an emphasis on natural ingredients. Consumers are scrutinising ingredient lists, and prefer products with a simple, transparent list of recognisable ingredients over more processed options (in a similar vein to the current concern around ultra-processed foods in human diets). Functional benefits are sought after, particularly in the APAC region. According to Mintel’s GNPD data, digestive health claims appeared in almost a quarter of all pet food product launches in 2023. Despite digestive health claims being most common in Asia, there is interest elsewhere, over half of US consumers who purchase pet food are interested in alternatives that improve the digestive health of their pet. It is becoming more common for consumers to prioritise functionality when choosing pet food, so brands should focus on natural ingredients with functional benefits that aid in holistic pet wellbeing.

Explore Mintel’s Pets Market Research

Bonding Through BPC – Pet Care Industry Trends

There is an increasing trend of pet owners engaging in pet bathing and grooming. This trend is driven by the bonding experience it provides, as noted by the 51% of pet owners in Brazil who view basic pet care as a bonding moment. When it comes to bathing and grooming pets, a simple anti-odour shampoo won’t do anymore. The integration of human beauty and personal care trends into pet care is becoming more prominent. For example, pet grooming products are calling out familiar skincare ingredients. This is demonstrated by TropiClean Essentials Collection, which uses ingredients popular in the human BPC category such as shea butter, jojoba and goat’s milk. New product development in the pet grooming industry is also blurring with the human skincare category, and is increasingly promoting gentleness and naturalness, alongside skin barrier protection and suitability for sensitive skin. It is now vital for brands in the pet care space to integrate human-led trends into new product development.

Image Source: Tropiclean.

Putting Family First – Pet Insurance Industry Trends

Pet owners want to take care of their pet’s health as they would any other member of the family. Pet owners who view their pets as family members are more likely to purchase pet insurance. Specifically, the majority of pet owners who consider their pet a family member have pet insurance, compared to 54% who do not. Mintel’s consumer research highlights how much value pet owners place on their pet’s health, almost half of UK pet owners would be willing to go into debt to cover a pet’s medical bill. This speaks to a wider issue impacting the pet insurance industry: the rising cost of living. As a result of the ongoing income squeeze, pet insurers are offering flexibility in coverage and tiered service plans to accommodate pet owners with constrained budgets. For example, in the US, Pets Best offers multiple tiers of accident and illness coverage, plus wellness add-ons and an accident-only plan, providing flexibility for different needs and budgets.

Pets Best is not the only insurer to be offering wellness add-ons, pet insurers are increasingly incorporating wellness and preventative care into their insurance policies to enhance the value of their product and to set themselves apart from competitors. Pet wellness is by no means a new trend, however consumer interest is growing as pet owners begin to take a more holistic approach to their pets’ health, incorporating physical, mental, and emotional wellbeing.

Looking Ahead With Mintel

The pet industry landscape is changing. Pet food now needs to be functional, promote wellness, and also, at times, integrate pets into family gatherings. Pet care and pet insurance brands also need to take the increasing interest in pets’ holistic wellbeing into account. Marketing for brands in the pet industry should focus on speaking to the evolving role pets are playing in consumers’ lives. Clearly, pets are no longer confined to the kennel, which means there’s a wealth of products, services and experiences that could be re-imagined with pets in mind – particularly when it comes to areas that haven’t historically catered to them.

Explore our extensive range of Pets Market Research, or fill out the form below to sign up to Spotlight, Mintel’s free newsletter for exclusive insights.

Sign up to Spotlight