I compared Net Promoter Score℠ (NPS) to our apricot tree in my blog, NPS Q&A Part 1: Controversy, Fit, And Alternatives: Both sometimes disappoint, but both have been around for a while, our landlords (your execs) have the final say on using it, and replacing either is a bet with an uncertain outcome.

That’s why you should ask yourself the pragmatic question, “If we have NPS, how do we use it optimally as a CX KPI?” (rather than the soul-searching question “Is it the right KPI?”).

To help you answer that question, my colleague Pete Jacques and I used insights from two decades of research and updated our report Net Promoter Score℠ (NPS) Essentials (client access).

In the first blog, I explained why NPS is controversial, that it can be (but doesn’t have to be) a good CX beacon metric, and the alternatives. And I shared that NPS has a wicked gravity that makes replacing it hard.

In this blog, I will dive deeper into this topic and answer these remaining questions:

- How Do Companies Tie NPS To Financial Success?

- How Should We Benchmark NPS?

- How Do We Set NPS Targets?

- Should We Pay Employees For Achieving NPS Targets?

And for a long list of Forrester resources, check out the end of this blog.

How Do Companies Tie NPS To Financial Success?

First, pick a meaningful business metric to which you can link NPS: A meaningful metric represents a goal your executives care about, because it is their fiduciary responsibility or a personal goal or a goal from their bosses. Consider business metrics along three levers: revenue, cost, and resilience. If you are a Forrester Decisions client, use the outcome metric inventory for B2C, B2B, or B2B2C.

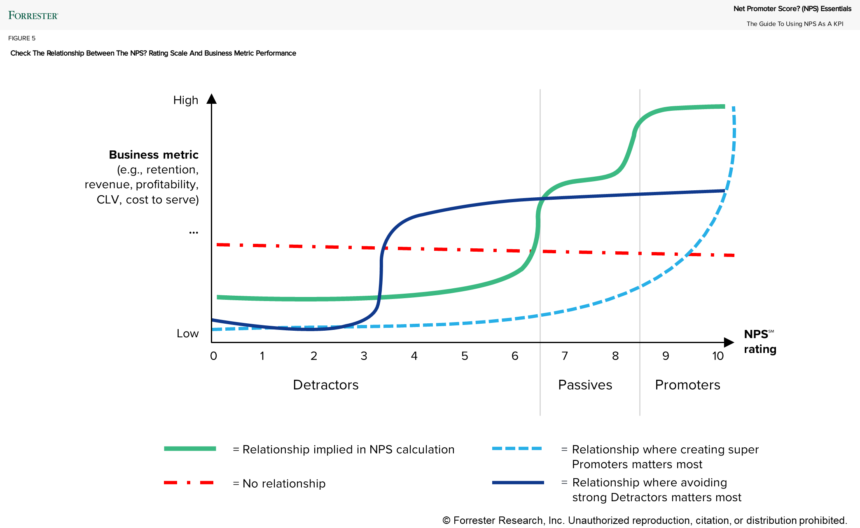

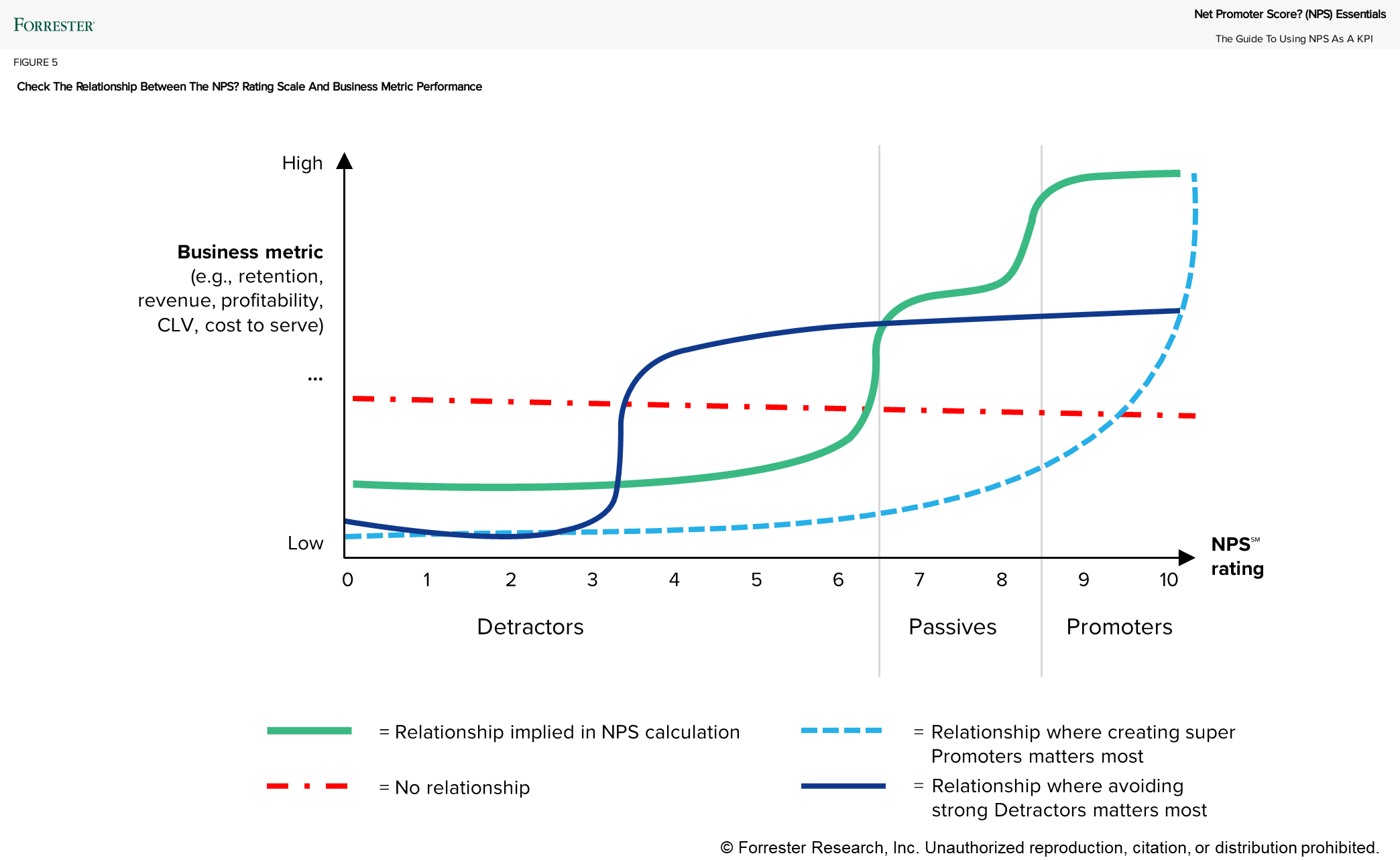

The specific challenge with NPS is that it’s a composite metric, and the calculation implies a specific relationship between what customers rate and their actions that matter to you financially: For example, if we take how much customers spend, the idea is that promoters spend the most, passives spend less, and detractors even less. But you need to figure out if that is true for your customers, as well.

That’s why you need: scenarios and granularity.

- Scenarios. These dig deeper than the NPS score. It looks not just at how many points the score moved but why. What drove the change? Did you add promoters? Reduce detractors? Both? Different scenarios will potentially drive a different financial impact. We have a tool for Forrester Decisions clients to do that.

- Granularity. To go more granular, do three things:

- Check whether a shift in promoters drives other metrics than a shift in detractors.

- Check whether you need to go beyond the three categories because the business performance of customers deviates from the NPS logic (e.g., strong detractors behave differently than other detractors who behave more like passives).

- Do a business case at the journey level. For more tips on making the case, see Top 15 Tactics For A Compelling CX Business Case (client access).

How Should We Benchmark NPS?

Because NPS is standardized, it seems super easy. But it’s not. Make sure that you don’t do the following: 1) benchmark scores measured at a different level of measurement; 2) compare an NPS that you measured internally with an NPS measured externally; 3) compare across organizational units (e.g., countries, brands, lines of business); and 4) compare to data that doesn’t adhere to the standard (I still get people asking if they could use 8–10 ratings as promoters, so do check that the methodology of any benchmark is correct).

Also, keep in mind that benchmarks at the relationship level are exciting for leaders, but they leave you blind to what’s happening underneath. That’s why you should benchmark at the journey level.

Where do you get actual benchmark data? There are some public studies. If you are a Forrester Decisions client, you can access our data. And most Forrester clients can view NPS trends in our annual CX benchmark studies (for example: The US Net Promoter Rankings, 2023; The Canada Net Promoter Rankings, 2023; The European Banking Net Promoter Rankings, 2023; The European Net Promoter Rankings, 2022).

How Do We Set NPS Targets?

One thing is for sure: NPS cannot keep rising. It can be a hard thing for executives to wrap their heads around. They deal with a lot of numbers that continue rising if execs make the right decisions (like stock price, revenue, etc.).

NPS has a ceiling.

- Mathematical: 100

- Realistic: It’s lower than 100 because you cannot get rid of all detractors. Even in the unlikely best case that you have only 1% of detractors and everybody else is a promoter, your NPS will be at 98.

- Desirable: This is where it’s not economically desirable to increase NPS because it costs too much.

Make sure to first follow these sound target-setting practices:

- Establish a performance baseline and forecast the trend.

- Determine a desired lift in score.

- Check whether the desired lift is possible.

- Check whether a desired lift is necessary.

- Scale targets across different parts of the business.

For more details, check this blog about goal setting research from Pete Jacques and Rich Saunders.

Follow this specific advice for setting NPS targets:

You need to decide whether to set a target for the score only or whether you also need additional targets on the share of promoters and detractors.

If adding promoters has a higher financial impact than removing detractors, simply increasing your NPS score might not be the right focus. You need an additional target for increasing the share of promoters. Similarly, if moving strong detractors (0–3) to a 4–6 rating has the highest business impact, you should definitively add a target for reducing the share of strong detractors.

Should We Pay Employees For Achieving NPS Targets?

It is a pretty common practice: Our data shows that half of CX leaders say their firm does this. Many of you credit it with having people actually pay attention to CX.

But the risk is really high. Even Fred Reichheld says that tying NPS to compensation can do more harm than good.

Our report, Why Paying Employees For Delivering Good CX Is A Bad Idea, along with the associated blog I wrote about this topic explain that monetary incentives drive attention initially, but over time, executives and employees become score-obsessed rather than focused on improving CX, leading to gaming behaviors at all levels of the organization.

And avoid an excessive focus on the number. For example, ask that meetings across the firm start with customer insights rather than NPS numbers, especially when executives lead the meetings, because executives cast a big shadow.

Resources For Your NPS “Apricot Tree” Moment

If you feel an apricot tree moment coming on with regard to NPS, I hope the above was useful for you. Please be in touch with any questions through the usual means (guidance session or inquiry call). And check out the resources below if you are a client.