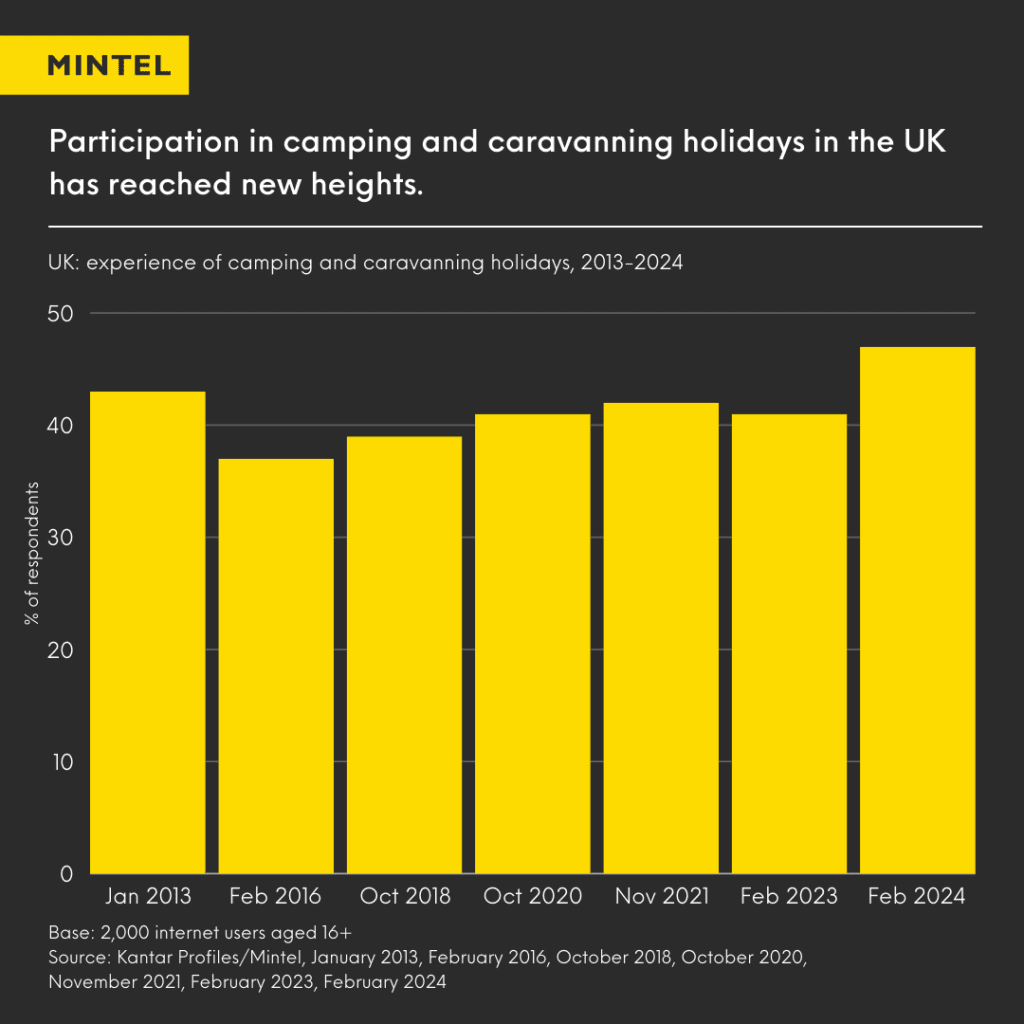

It’s been a turbulent few years for the domestic tourism market across Europe, particularly in the UK. The aftermath of the COVID-19 pandemic led to a substantial increase in staycations as travel restrictions and safety concerns made international travel less feasible. The UK camping and caravanning market was one of the sectors to benefit the most. Between the start of the pandemic and November 2023, over one in five UK adults went on a camping or caravanning holiday, and over a third of those adults were first-timers. The outdoor, socially-distanced nature of camping holidays also appealed to consumers during these uncertain times.

However, the overseas travel industry began to recover following the lifting of restrictions in 2022, and has seen a significant recovery in the years since. Naturally, the camping industry has been impacted, and saw a dip in the immediate aftermath. But just as the overseas holiday industry was getting back on track after the significant impact of the pandemic, along came the cost of living crisis. Consumer concerns may have changed from health-related to financial, but the impact remains the same: a notable shift towards domestic tourism. The cost of living crisis has resulted in price-sensitive behaviour among holidaymakers across Europe. Mintel’s market research found that nearly half of UK travellers planned to spend less on their main holiday in 2024 compared to previous years. This trend is being felt across Europe, with less than a fifth of German consumers who are struggling financially plan on prioritising holiday spending. This could be good news for the camping industry, as the budget-friendly appeal of camping holidays can attract households with constrained finances.

Emerging Trends in the Camping Industry

A Little Bit of Luxury

Over half of UK consumers who are not interested in taking a camping holiday cite uncomfortable sleeping and weather concerns as the biggest barriers to camping. While the camping industry can’t do anything about the British summer weather, campers’ sleeping situation can be improved. Sleep health is increasingly important to holidaymakers. Mintel’s market research has shown that more than a third of hotel guests say hotel rooms designed to enhance sleep quality are important when choosing accommodation. Hotels in the UK have responded to this consumer demand by introducing sleep-enhancing features in their rooms. This desire to get a good night’s sleep while on holiday is perhaps the reason why glamping (a portmanteau of ‘glamorous’ and ‘camping’) has become so popular. Over the past decade, the UK glamping industry has shown significant growth and is expected to remain popular due to the increased consumer demand for luxurious holiday experiences.

A similar trend has been seen in Germany, where luxurious and weatherproof accommodation like small huts and heated vans are in demand. One company that is leading innovation within the camping industry is the German-based brand, Bubble Tent, which has shown how brands can make camping a more luxurious experience, with comfortable glamping domes and private bathrooms. In addition to attracting new holidaymakers, weatherproof accommodations provide the potential to extend the camping season beyond the summer. In fact, in Germany there is a growing interest in off-season camping, which can include winter activities such as skiing and ice skating.

In order to attract new campers who have previously been put off by the discomfort of camping, UK campsites should take inspiration from the German camping industry and German initiatives such as Bubble Tent, who are redefining what the camping experience can be like for consumers. Even for campers who eschew the luxury glamping experience for something a bit more modest, there is still significant interest in additional features or upgrades. such as private bathroom facilities, or on-site facilities such as restaurants or swimming pools. Brands that have these facilities should draw attention to the added benefit of luxury in a more rustic environment to attract a wider range of consumers.

Explore Mintel’s Holidays and Travel Market Research

Back to Nature

Despite some consumers’ reservations about comfort, the link between the camping and the wellness industry is growing. In the UK, nearly half of potential domestic wellness travellers show interest in a rural or countryside break, and what could be more rural than camping? Additionally, spending time outside is the most common method used by Brits to tackle stress, so the camping industry is perfectly positioned to offer consumers a holiday likely to improve emotional and mental wellbeing. Travel brands in the UK are already promoting the benefits of spending time in nature by emphasising the mental and physical health advantages associated with nature-based activities. For example, Center Parcs recently launched a new Forest Spa that offers experiences like forest bathing, which are designed to harness the benefits of spending time in natural environments.

Camping brands across Europe are also introducing wellness-inspired features, albeit on a smaller scale. German-based Bubble Tent can provide further inspiration here, they offer simple, relaxing outdoor areas, such as outdoor hot tubs, which foster emotional and mental wellbeing. Pensthorpe, a 700-acre nature reserve in Norfolk, is making connecting with nature more accessible by opening a pop-up glamping and camping site, which includes guest access to the park and reserve.

The Camping Industry Cares For Sustainability

As outlined in Mintel’s 2024-25 Global Outlook on Sustainability, consumers are becoming more conscious about sustainability and their carbon footprint. There is a growing interest in sustainable travel and holidays, with almost half of potential travellers wanting to know the environmental impact of holiday activities before booking. Fortunately for the camping industry, camping holidays are seen as more environmentally friendly than other types of holidays by around three-quarters of Brits. Camping holidays are already an attractive choice for eco-conscious consumers, therefore, camping sites should focus on innovations that go beyond standard eco-friendly efforts. For example, sites can offer volunteering opportunities and activities with minimal environmental impact. Additionally, to appeal to the growing group of electric vehicle owners, brands should be investing in electric vehicle charging infrastructure to accommodate this shift in behaviour.

Despite the growing consumer interest in sustainability, there is a significant level of scepticism among consumers regarding the authenticity of brands’ sustainability claims. Two-thirds of travellers believe that companies are guilty of greenwashing. This highlights the importance of transparency and effective communication around sustainability for brands. The camping industry is rightfully seen as a sustainable and eco-friendly category, and it has a huge opportunity to build on its green image.

Looking Ahead with Mintel

The best routes to growth in the camping industry emerge from the industry’s pre-existing green image. The industry is well positioned to adopt a holistic approach to sustainability, addressing economic, social, and environmental impacts. To not only nurture the health of the planet, but also the health of holidaymakers, by offering the opportunity to connect with nature, improve mental wellbeing, and provide a much-needed respite from everyday stressors and anxiety. Overall, the outlook for the camping industry is sunny, even if the weather often isn’t…

To learn more about the camping and domestic travel industries, explore our extensive range of Holidays and Travel Market Research, or fill out the form below to sign up to Spotlight, Mintel’s free newsletter for exclusive insights.

Sign up to Spotlight