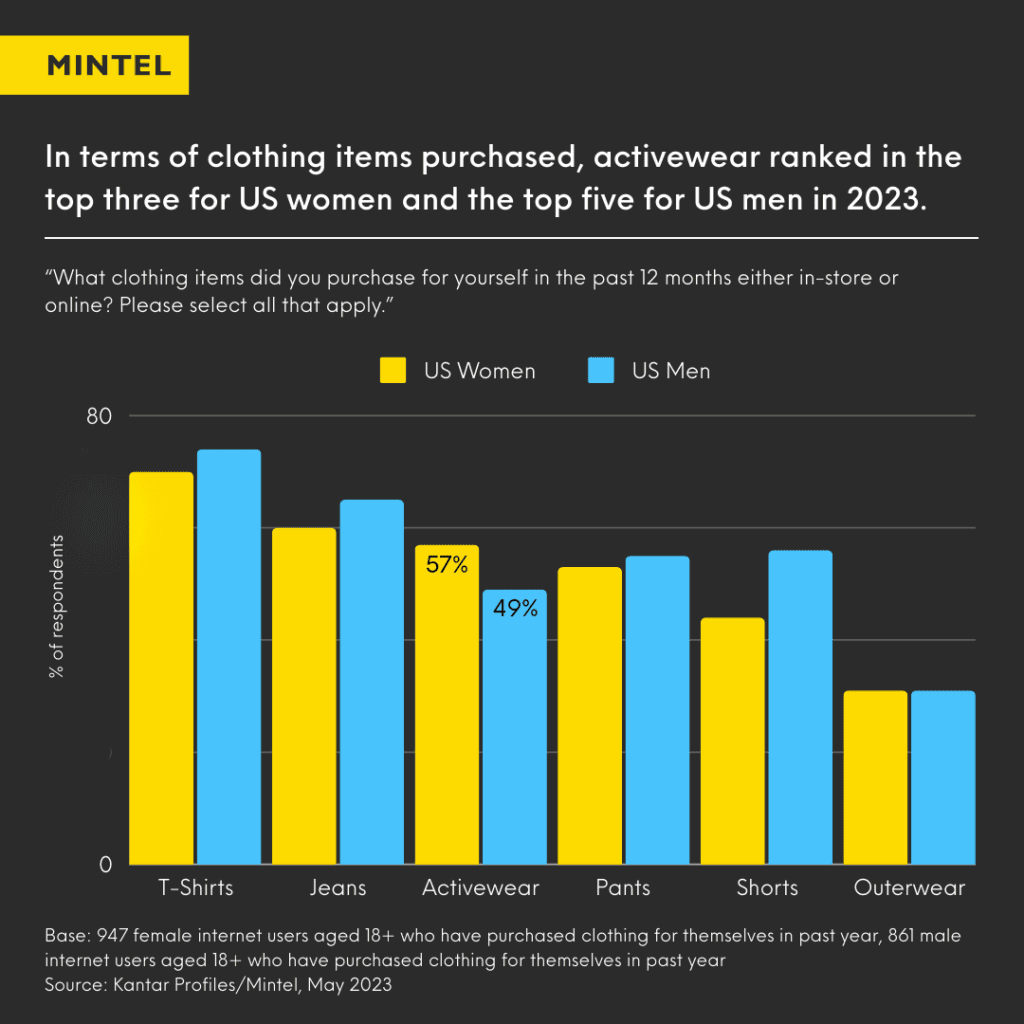

The casualisation of fashion is nothing new. Since the mid-2010s, we have seen athleisure revolutionising the fashion industry. But in recent years, consumers have been integrating more and more sportswear items into their everyday wardrobe. This has led to a sustained growth in the sportswear market, driven by the blurring boundaries between fitness and fashion. Mintel’s consumer research has found an increase in US consumers purchasing activewear since 2022 and activewear was the third most popular item to buy for women in the US in 2023, behind the classic staples of t-shirts and jeans. In Europe, Intersport and Sport 2000, two of Germany’s largest sports retail networks, saw record-breaking years for sales in 2022. Equally, in China, opportunities for the sportswear industry are increasing, and positive market development is expected to follow.

So how are fashion brands and retailers responding to growing consumer demand for fashion and functionality? Read on to find out.

Sportswear Industry Trends – How is the market adapting to blurring boundaries between fitness and fashion?

Functional Fashion

How we work has changed. By the end of 2023, around half of the working population of the UK worked entirely or partially from home. Similar trends have been observed globally. In 2022, a third of US workers worked mostly or solely from home, and just under a quarter of employed Canadian adults worked in a hybrid work arrangement. This is unlikely to change in the near future. Over three-quarters of Brazilian workers consider hybrid work ideal due to its productivity benefits, and just under half of UK workers say they would only consider applying to hybrid roles in the future. The future of work traditionally office-based work is very much home-based.

These insights into consumers’ working lives might seem slightly incongruous in an article about the sportswear industry, but the fact is, work and wardrobe are inextricably linked. The expansion of flexible and home working arrangements seen in recent years has not only drastically changed the approach to day-to-day working life for many people, but also their fashion choices.

In the past, consumers may have easily separated clothing for work, and clothing for home. But now, with many homes becoming offices, and the inherent formality of the workplace diminishing, Mintel’s consumer research in the US found that men are now more likely to favour comfortable clothing for the workplace, with the proviso that the items are versatile and can still look presentable. Versatility is key, however for some consumers that goes further than comfort and style, functionality also plays a role.

Home workouts are on the rise. In the UK, over half of active adults exercised at home as of February 2023, and a similar trend was observed in the US. A significant 60% of active US adults exercised at home without home equipment in 2023. Consumers fit workouts and exercise around work schedules, so activewear that can seamlessly transition between workplace and work-outs is highly sought after by consumers. This is a global trend, over a third of Chinese consumers say versatility is important when purchasing sports and leisure wear. Brands have already responded with items that are not only functional for workouts but also stylish enough for the workplace. Case in point: US fashion retailer Athleta and their city pants, which are marketed as being “made for work, play, and everything in between”. Directly addressing the growing consumer demand for adaptability and versatility is vital for brands and retailers to grow, as consumers continue blurring the lines between fashion and sportswear.

Sportswear and Wellness

In the United States, two-thirds of adults have expressed a desire to live in activewear daily, highlighting that activewear has become a lifestyle choice rather than just a fashion trend. Activewear holds a strong emotional appeal, particularly among women in the US, who express a desire to live in it due to its comfort. As mental health awareness increases, so does the need for holistic self-care, and seeking comfort, through food, beauty routines, or fashion choices, is a big part of that. However, the desire for comfort is not the only wellness trend impacting the sportswear market.

Explore Mintel’s Extensive Fashion Market Research

In Germany, there is a growing emphasis on mental health and wellbeing, which is driving consumer interest in sportswear designed for activities that are linked to wellness practices, such as yoga, running, and hiking. Sportswear brands have the opportunity to support consumers’ commitment to holistic wellness and healthier lifestyles, by offering advice on how to lead a healthy lifestyle beyond their fashion choices. Brands can look to the industry’s key players for inspiration, such as Nike’s Training Club, which provides videos and apps to consumers that promote mental health besides physical goals through guided meditation.

Sustainability is becoming an increasingly important aspect of the wellness trend. In China, a high percentage of consumers are willing to pay more for sportswear made from environmentally-friendly fabrics. Furthermore, a quarter of Germans are interested in sustainable sportswear, and this number is higher among Gen Zs. Sportswear brands should be putting sustainability high on their list of priorities to align with consumer demand. Encouraging the use of the second-hand market and circular shopping, partnering with sustainability specialists and introducing rental and repair services are initiatives that have seen success in the German sportswear industry, and are likely to be successful in other markets due to the growing consumer focus on sustainability.

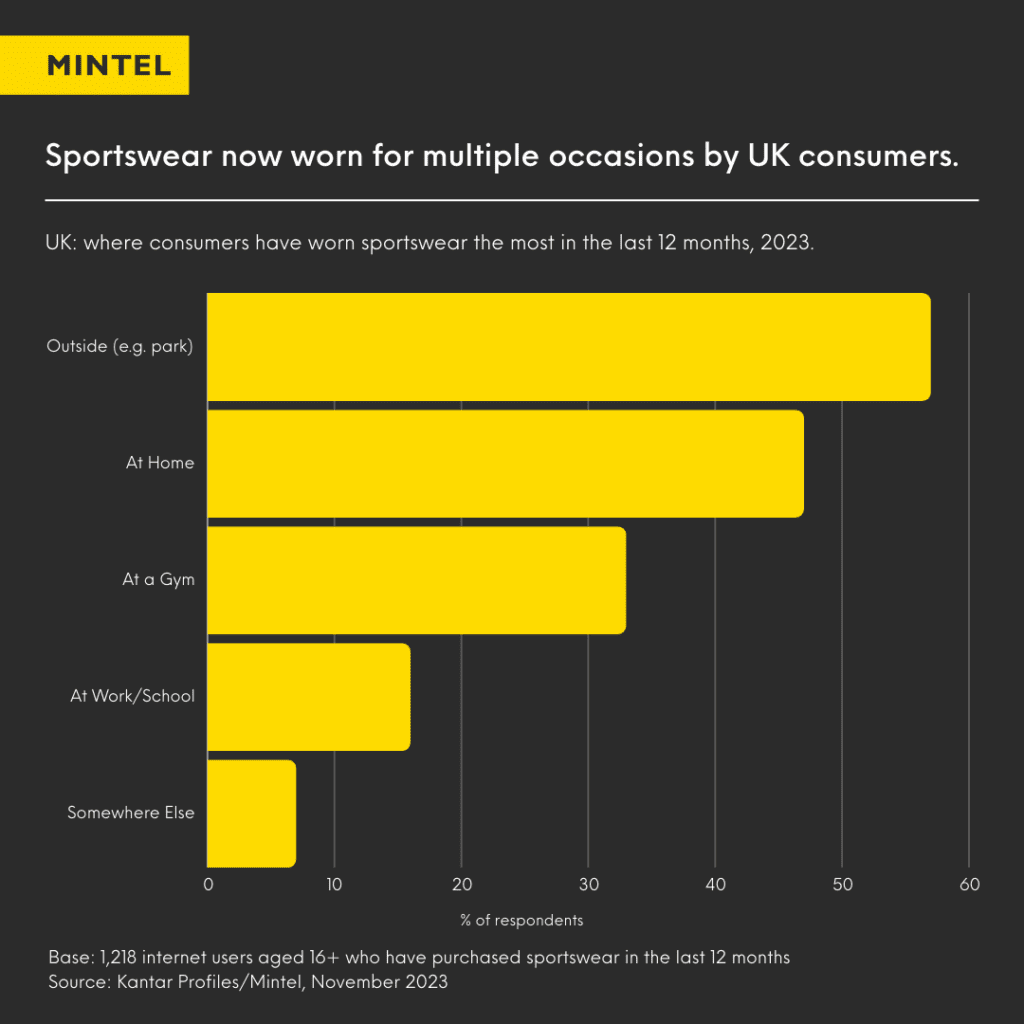

Luxury Leisurewear

Before the rise of the athleisure industry, wearing sportswear around the house was exclusively reserved for sick days for many people. But that has changed, the days when sweatpants were saved for trips to the gym are long gone. Mintel’s recent consumer research found that almost half of UK consumers surveyed have worn sportswear around the home, but it’s not just the casual fashion market that has been influenced by sportswear, luxury fashion brands have also begun to introduce sports and leisure wear elements in their collections, highlighting sportswear’s near omnipotence in the clothing industry.

Global luxury brands are increasingly adapting to the athleisure market trends by launching their own lines of sportswear-inspired items and collaborating with traditional sports brands to merge fashion and functionality. In 2022, luxury brands Fendi and Versace released their own lines of athleisure items, in response to the consumer demand for the combination of comfort and style. Elsewhere, luxury brands are collaborating with sports brands to break the boundaries between sports and fashion. For instance, in Germany, luxury fashion brand Gucci collaborated with traditional sportswear brand Adidas to launch an activewear collection. By offering products that are both functional and fashionable, luxury fashion brands can become more accessible, and increase their appeal to everyday consumers. The luxury athleisure trend has also been seen in China, Gucci even went as far as organising a lake-hiking camp in Beijing, suggesting that sports and leisure wear is now an integral part of the luxury fashion industry.

Step into the Future of Fitness Fashion with Mintel

Global sportswear market trends have changed in recent years, and they reflect how consumer lifestyles have changed. Work routines have changed, and the traditionally formal environments of the office have become more informal. A focus on health and wellness has made function and comfort more sought after in consumers’ wardrobes. Self-care is increasingly important, and for many consumers, that means being comfortable.

The fact that sportswear has become an integral part of the wider fashion industry suggests that consumers’ love of casual fashion isn’t going anywhere soon. Following the Paris Olympics, which has already had an impact on the beauty industry, consumer interest in sports and, as a result, sportswear is likely to rise. Even without a post-Olympics surge, there are opportunities for traditional sportswear and luxury fashion brands alike, who can fuse function with fashion to meet this consumer demand.

Subscribe to Mintel’s free newsletter, Spotlight, to get exclusive content and insights delivered directly to your inbox.

Sign up to Spotlight