Knowing your audience is the backbone of success whether you’re a small business or a household name. And to know your audience, you need to do some all-important market research. But what’s the best way to go about doing that? Well, the easy answer is to use GWI to get on-demand insights into your existing audience and your potential customers.

But, if you want to take the long route, you could conduct a good old fashioned market research survey yourself.

What is a market research survey?

We’re glad you asked. A market research survey is a way of gaining information, insights, and attributes about your target consumers, so you can better understand them and what makes them tick. More information means more knowledge, which leads to more understanding – helping drive more successful campaigns.

But market research surveys don’t just help you improve your targeting and create campaigns that have impact. They provide valuable insight into the feelings, attitudes, and preferences of your audience – guiding everything from concept testing and launching new products, to brand positioning and customer satisfaction.

But what does it really take to conduct a market survey that works? Let’s get into it.

How to conduct a market survey that works

1. Set a clear goal

2. Know who to survey

3. Get help from survey-savvy people

4. Figure out the best way to get answers

5. Focus on the execution

6. Understand analysis is the answer

7. Uncover the bigger picture

1. Set a clear goal

Start by setting a clear objective of what you want from your market research. This will be determined by your marketing goals. If you’re launching a new product, for example, you’ll want to know what the demand is, how aware people are of your existing products/brand, if they currently use a competitor, and how frequently they buy.

Be precise about the outcome you’re looking for so you can get the answers you need to nail your future marketing campaigns.

- Why are you doing the survey?

- What do you want to find out from your research?

- Is it for product improvements with an existing audience?

- Are you looking to launch a new product into the marketplace and therefore need to know if there’s sufficient demand?

- Are you looking to improve your customer experience?

Knowing what you want to find out will help you identify what information you need. And it’ll help you determine whether a qualitative or quantitative approach works best.

The aim is to find out what your customers are looking for and improve satisfaction with your brand.

Uncovering consumer attitudes could reveal some invaluable insights that will guide your strategy with the customer at the heart.

2. Know who to survey

Market research starts with identifying which market you’re targeting. Who’s your audience? Are you looking at existing customers? Or are you looking to find out more about potential customers?

Think back to your goal here. Keeping in mind what you’re looking to achieve from your market research can help guide who you survey. For example, if you want to build on your customer offering by introducing a priority service, you may just want to gather information from people living in a certain area or earning over a certain amount.

Use regional data to attain precise information about the target customer whose data you need, and narrow it down to support your ultimate goal.

Determine key demographics of your target audience like where they live, their age, gender, or income bracket. You’ll also need to establish the market size of your target market in order to calculate your sample size.

3. Get help from some survey-savvy people

Who knows about surveys? We do.

We teased this at the start, but turning to an existing, ongoing survey (or multiple) could save you a helluva lot of time – and money. So if you need a faster way to understand digital consumers, we give you an on-demand window into their worlds. All in a few quick clicks, in one reliable audience insights platform. See for yourself.

GWI data spans 52 markets and represents over 2 billion internet users, making it the world’s leading market survey on digital consumers.

We provide a level of detail you can’t find elsewhere. Survey research is tricky. So why not leave it to the market research experts? And if you want something super bespoke for your business needs, our Custom research offering might be just the thing.

4. Figure out the best way to get answers

Cast your mind back to steps 1 and 2. Thinking about who you’re looking to survey and what you’re looking to gain will help determine how you get those answers from the right target market.

Knowing the difference between primary research and secondary research, as well as qualitative and quantitative, can go a long way to helping you figure out the best approach.

For example, primary market research is where you gather data that hasn’t been collected before – it’s new, essentially. You can gather primary research via surveys or observations. On the other hand, secondary market research is where you gather data that’s already been collected or conducted before by other people. You can find secondary research in published reports or studies.

Surveys can be carried out in a number of ways, no longer exclusive to telephone surveys and focus groups. The online survey is another option that allows you to take a step away from the time-consuming paper survey. You can also conduct market research in groups or on an individual basis.

Once again, the optimum approach for your brand will depend on your goals and the information you’re trying to capture, as well as your target audience, market share potential, and overall preferences.

If you want to gather in-depth information from Gen Z, for example, you might want to head over to Instagram. With 28% of Gen Zs saying that Instagram is their favorite social media platform, you’re most likely to find them scrolling here where you can try out polls to get answers, and ask follow-up questions that dig a little deeper.

Using quantitative panel data to back this up, market researchers can come away with powerful insights and market analysis they can trust.

5. Focus on the execution

Once you’re clear about your goals, the data you want, the people you need to talk to, and the best way to gather your survey data, it’s important to maximize the sample size.

This means reaching people at the right time, checking out where they’re likely to be, and setting a realistic timeframe for them to share their thoughts.

You’ve got to really keep your target audience in mind here. If you’re physically interacting with people, think about the places they’re likely to visit, and at what times they’ll be there. There’s no use setting up camp at the mall on a weekday if you’re looking to talk to corporate big fish.

If it’s an online survey, understanding which social media platforms or websites they are likely to hang out on, and at what times they tend to be online is vital to getting those survey form completion numbers to hit the high notes.

Conducting some data analysis ahead of the survey can go a long way in helping make the survey easier to reach the right audiences. Take the guesswork out of your marketing research.

6. Analysis is the answer

Once you’ve gathered your market survey responses, they need to be analyzed thoroughly to pull out key trends and findings to allow you to gain some tasty, actionable insights from the data. So, what do you need to be looking at?

- Examine qualitative answers for stand-out quotes and detailed feedback about attitudes and behaviors

- Calculate averages from your quantitative answers

- Compare your results against global and local secondary market research

There are plenty of ways to cross-examine and analyze your market research data based on the type of data you’ve collected and what you’re looking for.

7. Uncover the bigger picture

Conducting a single market research survey is invaluable to brands, but when carried out in isolation, market research can lack real-world relevance.

To get more from your analysis, large-scale market survey data allows you to compare your findings across multiple data points. You can cross-reference it with local subgroups and compare against global averages to clearly see where the value truly lies.

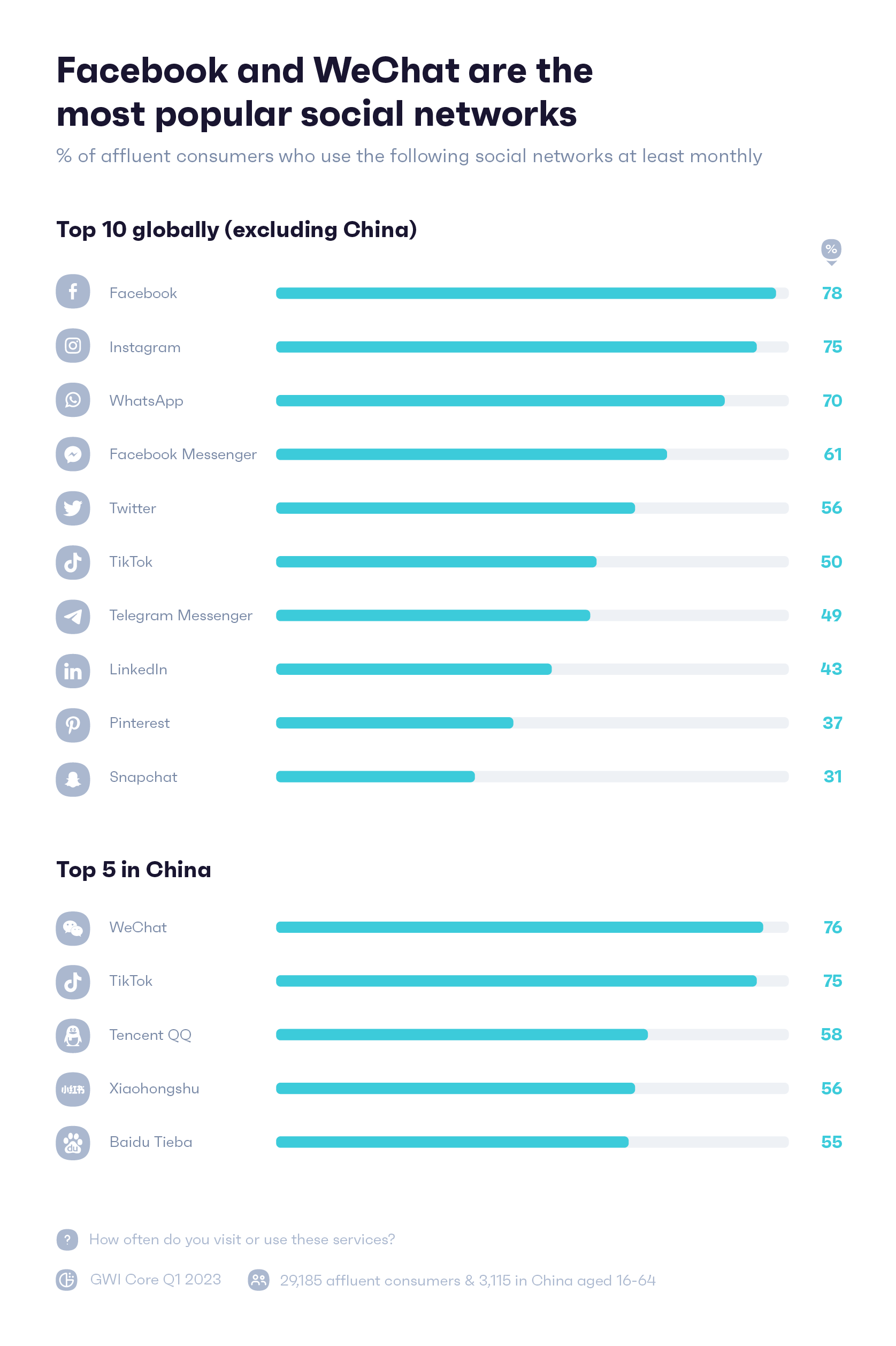

Use case: Identifying affluent consumer behaviors on social media

Here’s a hypothetical example. Let’s say you sell a luxury product. You’ve identified from your own survey results and analytics that social media is prominent in your customers’ lives.

But you need more detail to target high-earners on the channels where they’re most active.

By using a deep data set to dig down into their activity on social media, you can uncover exactly where they spend their time:

Combining this with questions designed to reveal their motivations for using social media takes your understanding to the next level:

Here, 30% of affluent consumers follow/subscribe to companies and brands they purchase from, so we’re more inclined to say they can be targeted with a good social media strategy from brands to be enticed into buying from them.

Uncovering insights like this is key to delivering a well-positioned message that sticks.

Now, you can create a campaign specifically targeted to hit your ideal target market, where they hang out and in a way that speaks to their interests.

Market research surveys are pivotal to success

Market surveys can be used in a variety of ways to help a brand focus more on its target audience and take a more people-based approach.

You can use it to get a better understanding of the perceptions around your brand, test the appetite for a new product, and find customer demographics to accurately pitch an ad campaign. A marketing research survey enables you to gather information about your audience and help to build a buyer persona for each sector of your target audience for more personalized, effective marketing strategies.

Data holds the answers you need to achieve almost every business goal.

But data is powerless without effective analysis. And without effective analysis, no insights can be drawn. So it pays to have third-party survey data sets at your disposal to contextualize your findings. A skillfully-planned market survey that catches customer feedback and experience will deliver findings that could spell the difference between success and failure in a marketing strategy. Leveraging GWI’s data platform means getting clued up on your audience fast, and making decisions you can stand behind.