In FMCG, Private Labels are key in providing a differentiated offering and richer customer experience for the retailer. Shopper loyalty is directly dependent on which retailer is providing what that person wants, when they need it, and at the right value. With increasing inflation, private labels are in the perfect position to meet today’s challenging shopper demands.

Growth of private label FMCG in 2023

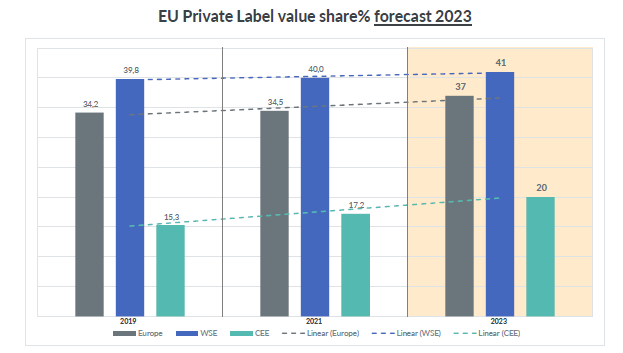

Our analysts forecast that private label FMCG market share in Europe will grow by around +2 percentage points this year, as household budgets remain tight and shoppers continue to down trade from previous buying habits. This will be led by slightly stronger value growth in Central and Eastern Europe, although Western and Southern Europe dominates in terms of value share.

Source: GfK Consumer Panels

Private label FMCG opportunities for retailers and manufacturers

1. Innovation

Innovation is crucial for retailers and manufacturers to maintain growth and differentiation. During times of upheaval, brands that continue to innovate across different facets of their business are far more likely to sustain market share and emerge stronger than those that don’t.

It’s a lesson learned from previous crises, such as the 2008 economic crash, and is already being seen in brands emerging from the pandemic. Brands that invested more in innovation during 2020 saw a +9 point growth in indexed market share in 2021, while those that didn’t saw a -10 point drop.

For A-brands the major way to differentiate is by price and promotion, or by short-term exclusivity during new product launches. Differentiation with private labels serves a broader perspective aside from price, such as range, quality, targeted ingredients, positioning against specific audience needs, and packaging.

As a result, today’s challenging market conditions present greater opportunities for private label manufacturers to grow, while, for the retailer, a private label strategy enables differentiation from their competition.

2. Sustainability

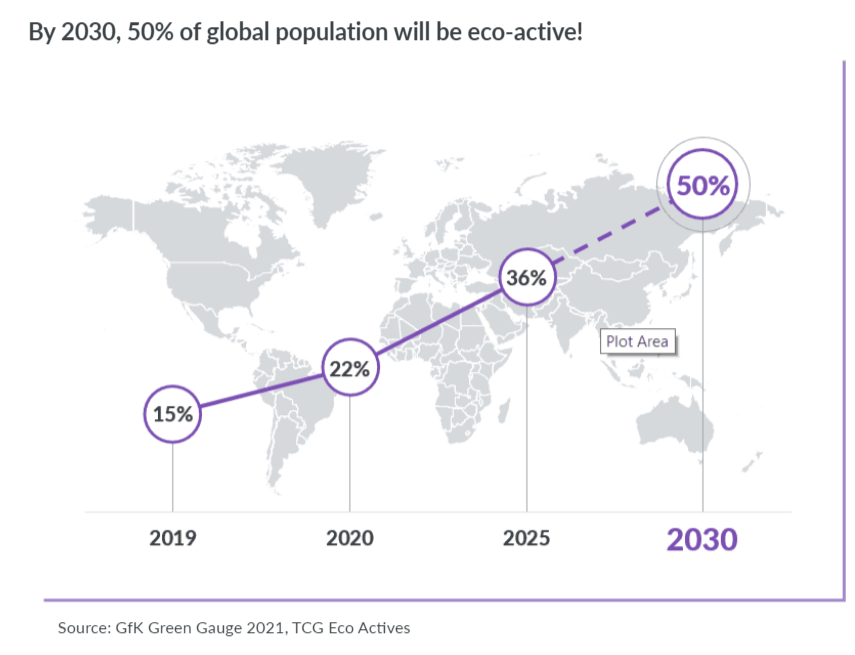

This is a prime opportunity for private labels. Sustainability is a consistently growing shopper demand, but not at any price.

By 2030, half of the world’s population will be “eco-actives” in their personal behavior and shopping decisions. They will account for a potential revenue of $1,000 billion revenue for FMCG, and $700 billion for consumer tech and durables.

Despite this potential, 59% of shoppers today say they are held back in their desire to buy green because eco products are harder to find or more expensive than the traditional products. For these people, purchasing will follow if environmentally friendly choices are ‘put where the shoppers are’ and without a major premium.

Private label FMCG brands are in a prime position to fill this fill space. The race to ‘own’ sustainability in terms of consumer perception is still wide open. Only 19% of shoppers globally can name a brand that is eco-friendly, and just 25% trust the claims companies make about their environmental practices. Private labels are better positioned than major brands to deliver the clear, uncluttered and credible brand narrative around an on-going commitment to sustainability that is needed to win the trust and spending power of eco-actives.

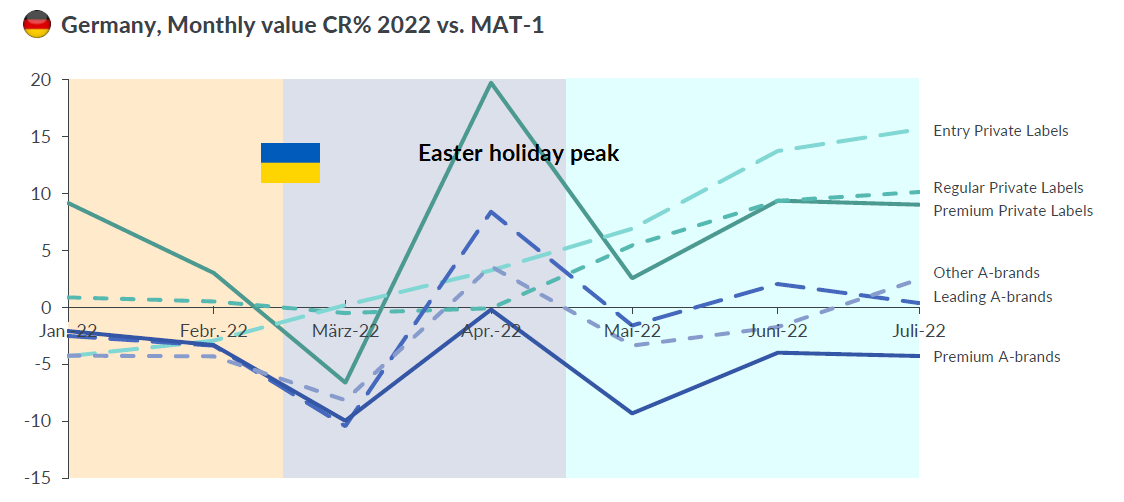

3. Pricing: private labels showing strongest value growth

Despite the cost of living crisis, 42% of global shoppers still agree that it’s important to indulge or pamper themselves on a regular basis (GfK Consumer Life). However, shoppers are balancing this against their strong focus on value for money. This creates a need for retailers to prioritize a balanced portfolio, leveraging premium products to sustain margins, while securing volume through more affordable ranges.

Private labels offer consumers a means to save money compared to buying A brands, without giving up their purchases in a certain area.

Taking Germany as an example. During 2022, the German market saw consistent strong value growth of entry-level and regular private label, while premium private labels held stable. While there is some skew in comparing value growth figures, due to inflation leading to a relatively higher percentage price increase on private labels compared to A-brands, due to private label margins being thinner, there remains clear signs of consumers generally trending away from spend on premium and leading A-brands and towards private labels in this country.

Key take-aways for retailers and private label manufacturers

Cooperation between retailers and private label manufacturers crucial; differentiate with sustainable private labels

To maximize the potential value of private label FMCG in the current economic landscape, strategic cooperation between retailers and private label manufacturers is crucial. Differentiation within sustainable private labels is growing, as is the number of shoppers that care for sustainability – even in the face of strained wallets. Retailers should respond by offering more ‘bio/ organic’ private label products to differentiate from competitor retailers and meet shopper demands, while keeping pricing strategy in mind.

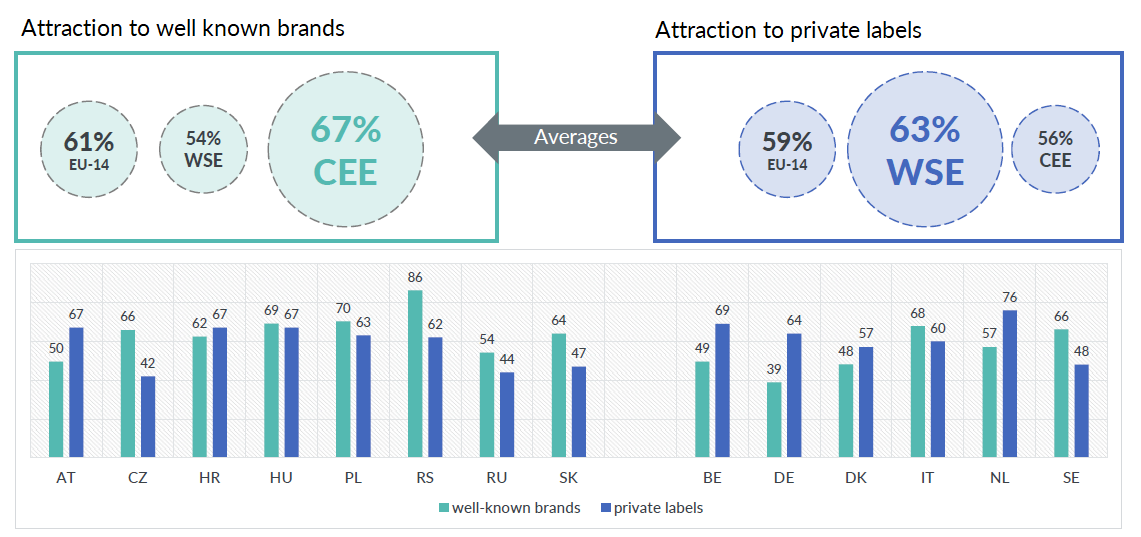

Eastern European countries saw high private label growth potential in 2023

Currently, private label is seeing it’s highest share of market in Western European countries such as the UK, Netherlands, Belgium and Germany. However, with the economic downturn ongoing for some time still, there is momentum for private label to grow, especially in the Central and Eastern European countries.

Innovation and availability

Drive availability on-shelf and provide value for money to maximize Private Label choice, especially for shopper must-have categories. Continue to invest in advertising and innovation.

—

Discover 5 ways to increase your chances of making it into consumers’ baskets in 2023 – view our infographic “European retail trends impacting 2023″

![]()