The S&P 500 (SP500) on Friday gained 0.69% for the week to close at 4,536.32 points, posting gains in four out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) added 0.65% for the week.

After posting its best weekly performance since early June last Friday, the benchmark index was unable to replicate a similar advance. Quarterly earnings largely dominated the spotlight.

Perhaps the most eagerly anticipated results were from Netflix (NFLX) and Tesla (TSLA), with both household names turning in a disappointing showing. The streaming giant missed on revenue expectations and issued underwhelming guidance, while the electric vehicle leader slumped on profitability and margin concerns. Technology stocks were hit hard on Thursday as traders reacted to the results, wiping out gains from earlier in the week that was powered by Microsoft’s pricing of its artificial intelligence tool, Copilot.

The S&P 500 (SP500) had gained steadily over the first three days of the week, culminating in a yearly closing high on Wednesday. Sentiment had been buoyed by better-than-expected earnings from major banks, with most lenders benefiting from high interest rates.

Next week will see the earnings season move into a higher gear. Heavyweight companies such as Microsoft (MSFT), Google-parent Alphabet (GOOG) (GOOGL), Facebook owner Meta (META) and chip giant Intel (INTC) are scheduled to announce their earnings.

Despite the Federal Reserve’s blackout period this week, central bank policy was still very much in focus after inflation data came out of the UK and Japan. UK’s consumer price index decreased to 7.9% in June from 8.7% in May, marking the lowest level since March last year. Additionally, Japan’s core consumer inflation stayed well above the central bank’s 2% target for the fifteenth consecutive month, putting pressure on the Bank of Japan’s policy of ultra-low interest rates.

The European Central Bank and the Fed’s monetary policy committee meetings will take place next week. Both central banks are expected to hike interest rates by 25 basis points each.

“We believe next week’s FOMC meeting should be straightforward. We expect a 25bp hike, as generally hinted at by various Fed speakers over the intermeeting period,” JPMorgan’s Michael Feroli said.

“The curious outcome of the June FOMC meeting—no hike but dots revised up to show a strong majority for at least two hikes over the remaining four meetings of the year—already made a hike at the July meeting seem likely. The data over the intermeeting period haven’t been that surprising. While the June CPI was certainly welcome it will probably take a few more favorable outturns to influence the FOMC’s thinking,” Feroli added.

Turning to the weekly performance of the S&P 500 (SP500) sectors, seven ended in the green, led by Energy and Health Care. Communication Services and Consumer Discretionary topped the losers. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from July 14 close to July 21 close:

#1: Energy +3.53%, and the Energy Select Sector SPDR ETF (XLE) +3.50%.

#2: Health Care +3.46%, and the Health Care Select Sector SPDR ETF (XLV) +3.49%.

#3: Financials +2.96%, and the Financial Select Sector SPDR ETF (XLF) +2.95%.

#4: Utilities +2.40%, and the Utilities Select Sector SPDR ETF (XLU) +2.41%.

#5: Consumer Staples +1.64%, and the Consumer Staples Select Sector SPDR ETF (XLP) +1.82%.

#6: Industrials +0.88%, and the Industrial Select Sector SPDR ETF (XLI) +0.87%.

#7: Materials +0.58%, and the Materials Select Sector SPDR ETF (XLB) +0.59%.

#8: Information Technology -0.08%, and the Technology Select Sector SPDR ETF (XLK) +0.08%.

#9: Real Estate -0.51%, and the Real Estate Select Sector SPDR ETF (XLRE) -0.49%.

#10: Consumer Discretionary -2.28%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) -2.25%.

#11: Communication Services -3.01%, and the Communication Services Select Sector SPDR Fund (XLC) -2.37%.

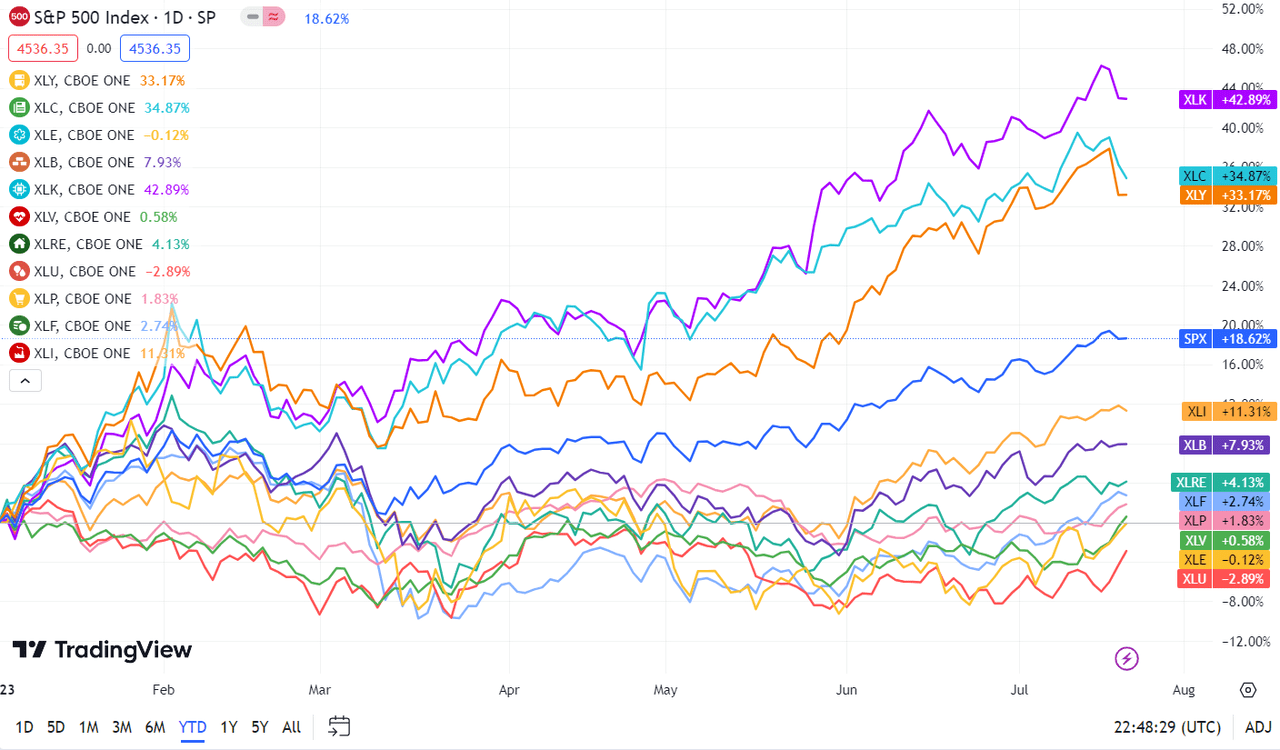

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.