Receive free US equities updates

We’ll send you a myFT Daily Digest email rounding up the latest US equities news every morning.

US stocks have recorded their longest monthly winning streak in two years, as optimism about falling inflation and resilient growth encourages increasingly broad market gains.

The S&P 500 rose 3.1 per cent in July, including a 0.2 per cent gain during the final session of the month on Monday. The increase marked the fifth consecutive month higher for the blue-chip index and the longest such run since the summer of 2021.

The tech-dominated Nasdaq Composite closed up 0.2 per cent on Monday, bringing its gain since the end of June to 4 per cent.

“The market rally has really reminded people why it’s just so hard to walk away from equities,” said Alex Chaloff, chief investment officer at Bernstein Private Wealth Management. “This has been one of the weirdest rallies we’ve ever had . . . [but] equities are still ripping higher.”

For the first five months of 2023, the increase in benchmark indices was driven entirely by the so-called magnificent seven megacap groups — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Stock price gains have begun to broaden over the past two months amid signs the US Federal Reserve is nearing the end of its cycle of rate increases, and may succeed in bringing down inflation without causing a recession.

“The opportunity going forward is in the forgotten 493,” Chaloff predicted, referring to stocks in the S&P 500 that were not among the “magnificent seven”. In the year to date, the S&P 500 is up more than 19 per cent, while the Nasdaq has soared by 37 per cent.

A version of the S&P 500 in which the components are equally weighted within the index has risen almost 11 per cent since the start of June, compared with a 1 per cent decline in the preceding five months.

The Fed last week raised the federal funds rate to a 22-year high and left the door open to further increases, but many economists expect the most recent move will be the last rate increase in the current cycle.

Optimism about the likelihood of an economic “soft landing” has also been reflected in debt markets, with the premium that risky corporate borrowers have to pay to issue new debt shrinking rapidly. The gap between yields on US junk bonds and equivalent Treasury notes has tightened by almost 0.9 percentage points since the start of June, one of the biggest two-month drops since 2020.

Yields on longer-dated Treasuries climbed in July, although those on their shorter-dated counterparts have been roughly unchanged.

European stocks also enjoyed a decent month, with the continent-wide Stoxx 600 adding 1.9 per cent for its second consecutive monthly gain. That included a 0.2 per cent increase on Monday following better than expected economic growth data.

France’s Cac 40 rose 0.3 per cent and Germany’s Dax traded flat, having touched a record high earlier in the session.

Figures showed the eurozone economy grew a higher than expected 0.3 per cent in the three months to July after stagnating in the previous quarter. Separate figures showed that annual inflation in the 20-country currency bloc slowed to 5.3 per cent in July.

European Central Bank president Christine Lagarde last week suggested it may also be at the end of its rate-rising cycle after lifting interest rates in the currency bloc to 3.75 per cent, the highest level since 2001.

Meanwhile, investors prepared for more big US tech companies, including Apple and Amazon, to report earnings this week, offering more insight into the health of Wall Street’s high-flying tech sector.

“Apple is not only the market’s most valuable company, it’s also a litmus test for consumer spending, which so far has been keeping the economy afloat,” said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management.

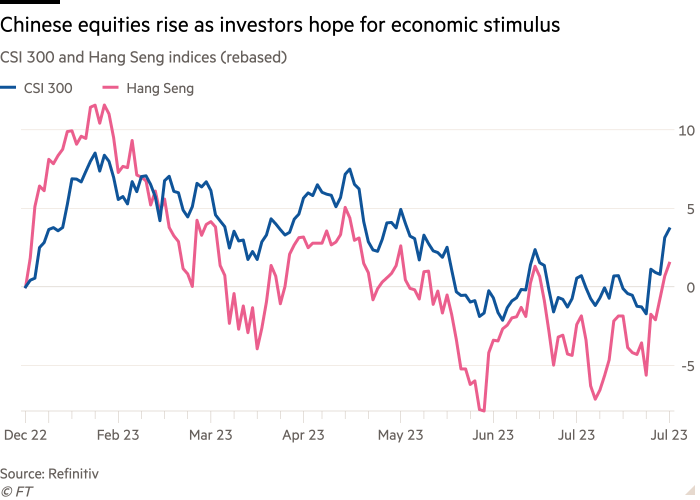

In Asia, Chinese stocks notched their biggest monthly gain since January as a series of weak data points spurred hopes officials and policymakers could announce economic stimulus in an effort to boost growth and avoid the possibility of succumbing to a bout of deflation.

Japan’s broad Topix index rose 1.5 per cent in July, a seventh straight month of gains for its longest winning streak in a decade. Yields on benchmark 10-year government bonds have surged to their highest level since mid-2014 after the Bank of Japan last week took the unexpected step of easing controls on the JGB market.

Hong Kong’s Hang Seng index gained 0.8 per cent on Monday, while the benchmark CSI 300 rose 0.6 per cent, as both reached their highest levels since early May. Japan’s Topix rose 1.4 per cent.