The US was stripped of its top-tier sovereign credit rating by Fitch Ratings, echoing a move made more than a decade ago by S&P.

The credit assessor downgraded the US from AAA, a ranking the nation has held at Fitch since at least 1994, according to data compiled by Bloomberg. The move comes in the wake of major political battles over the nation’s borrowing and repeated standoffs over raising the debt limit. While the most recent legislative impasse was resolved, it remains a potential issue of concern going forward.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions,” Fitch said in a statement.

Fitch had warned on May 24 that there was a risk of a downgrade. The US is now rated AA+ by Fitch, one step below AAA, and the assessor has a stable outlook on the country.

Moody’s Investors Service currently rates the US sovereign Aaa, its top rating. S&P Global Ratings has it at a score of AA+, one notch below the top tier, having removed its top score back in 2011 on the heels of an earlier debt-ceiling crisis.

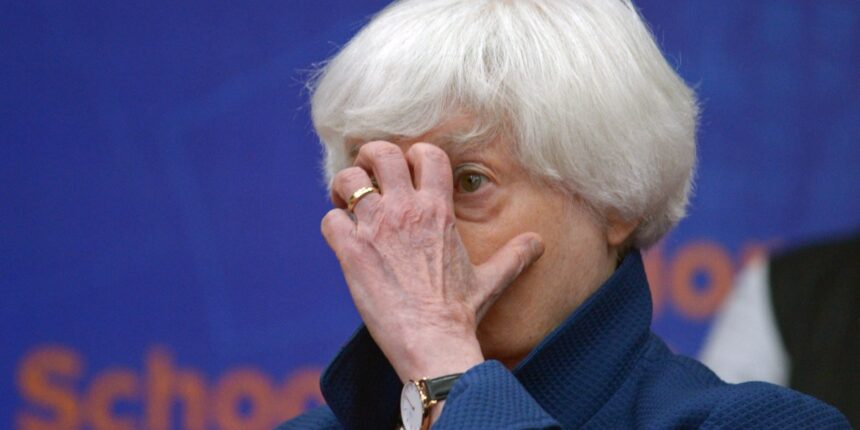

Treasury Secretary Janet Yellen responded to the downgrade, calling it “arbitrary” and “outdated.”

Treasury markets were closed at the time of the announcement.