Rmcarvalho

REITs fell this week as major indices suffered the impact of negative reactions from the market, arising from the recent downgrade by Fitch Ratings, jobs data and other macro factors.

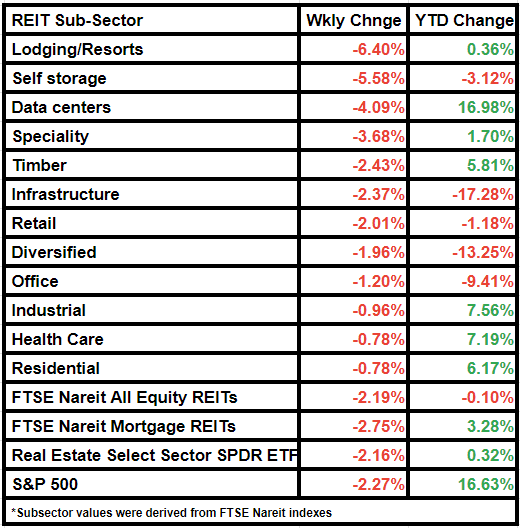

FTSE Nareit All Equity REITs declined 2.19% from last week, compared to the S&P 500 index that fell by 2.27%.

Dow Jones Equity All REIT Total Return Index was down by 2.18% on a weekly basis.

The broader Real Estate Select Sector SPDR ETF index decreased by 2.16%.

Meanwhile, mortgage REITs declined by 2.75% from last week.

The decline comes as Fitch downgraded the U.S.’s long-term rating to AA+ from AAA, reflecting expected fiscal deterioration, a growing debt burden and the erosion of governance related to its peers.

Also, the Job Openings and Labor Turnover Survey (JOLTS) report for June showed a fall in job openings to 9.582M from 9.616M in the prior month, vs. 9.650M consensus.

Notably, hotel REITs were a major laggard, having decreased by 6.40% W/W.

Self storage REITs declined 5.58% and data centers were down by 4.09%.

Health care and residential subsectors saw a comparatively smaller fall of 0.78%.

Here is a look at the subsector performance:

More on REITs: