(Bloomberg) — China’s economy is showing little sign of a rebound, with fresh stress in the property market and deflation threatening the growth outlook.

Most Read from Bloomberg

Official data on Tuesday will likely show modest gains in industrial output, retail sales and fixed-assets investment in July from a year ago, although growth rates are still well below pre-pandemic levels.

Real estate investment probably shrank further, with confidence shaken by a possible default by a major developer and housing sales continuing to fall as well.

Adding to the gloom, heavy rain and deadly floods last month in the southwest and more recently in the north of China likely hindered construction and infrastructure projects, curbing economic activity.

The numbers follow economic news in the past week that showed deflation arriving in July as manufacturers and retailers cut prices in a bid to lure buyers and move excess stock. Exports and imports also plunged more than expected, while borrowing by consumers and businesses slumped.

Beijing has made several pledges and announced incremental measures to support growth, but has avoided the kind of monetary and fiscal stimulus implemented during previous downturns. A weaker yuan and high debt levels have prompted more caution.

The government also set a fairly conservative growth target of about 5% for the year, which remains on track even without major stimulus. The People’s Bank of China is likely to keep a key policy interest rate unchanged at 2.65% on Tuesday, according to economists surveyed by Bloomberg.

China’s State Council this weekend released a plan to further attract foreign investment and improve the business environment, including tax and visa measures.

What Bloomberg Economics Says:

“The economy needs more support. We see the central bank delivering it in the third quarter by freeing up more cash for banks to lend and trimming borrowing costs further.”

—For full analysis, click here

Elsewhere, US data may show resilient consumer demand, UK wage and inflation numbers will guide investors betting on future Bank of England rate hikes, and Japanese growth statistics will also be released.

Click here for what happened last week, and below is our wrap of what’s coming up in the global economy.

US and Canada

Following reports in the past week showing inflation is moderating, fresh snapshots of retail demand, home construction and factory output will set the tone for the economy at the start of the third quarter.

In addition, the Federal Reserve on Wednesday will serve up minutes of its July policy meeting, at which officials boosted rates a quarter of a percentage point to a 22-year high. Investors will gauge the account for clues on the appetite for further hikes, though odds favor a pause in September.

On Tuesday, a report is forecast to show retail sales picked up in July. Resilience in consumer demand, augmented by a still-healthy labor market, would underscore views that the economy has scope to avoid a recession.

The following day, separate data may show an increase in July new-home construction as builders respond to lean inventories in the resale market. An increase in starts of single-family homes would be the fifth in the last six months.

While housing is showing signs of stabilizing, manufacturing is struggling for momentum. A Fed report is projected to show factory production little changed last month after two months of declines.

Turning north, Statistics Canada will release inflation data for July, after the consumer price index slowed to 2.8% in June. That was the first time in two years that it fell within the Bank of Canada’s control range.

Asia

Away from China, Indian data on Monday will reveal if inflation accelerated in July.

Japanese numbers on Tuesday are expected to show the economic expansion continued in the second quarter, while price data Friday are forecast to show inflation remained well above the Bank of Japan’s target in July.

Also on Tuesday, the Reserve Bank of Australia will release minutes from its August meeting, where it held rates steady, ahead of fresh labor statistics on Thursday that may show employment growth slowing.

In neighboring New Zealand, which just saw its first monthly drop in food prices since early 2022, the central bank is expected to hold rates steady on Wednesday, while its counterpart in the Philippines is forecast to stand pat on Thursday.

Malaysia unveils second-quarter gross domestic product statistics on Friday.

Europe, Middle East, Africa

After news of the UK economy’s resilience in the second quarter, fresh data will help determine the Bank of England’s resolve in enacting further rate hikes, with the first of two months of key reports due before the Sept. 20 decision.

Wage numbers on Tuesday will show the extent that higher prices are feeding through into self-reinforcing pay pressures. Then, July inflation data on Wednesday are likely to reveal a significant slowdown, though an underlying gauge stripping out energy and other volatile elements is seen barely budging.

In the euro zone, the week will be interrupted in many countries – including France and Italy – by holidays on Tuesday.

Aside from German investor confidence that day, traders may focus on potentially revised readings of euro-area GDP and inflation, on Wednesday and Friday respectively, which will show whether recent data — for example, Germany’s industrial production drop — recast the overall picture for the economy.

In the Nordics, Sweden’s consumer-price report on Tuesday will draw attention, at a time when the Riksbank remains committed to tightening even as evidence of its impact on the economy becomes increasingly clear.

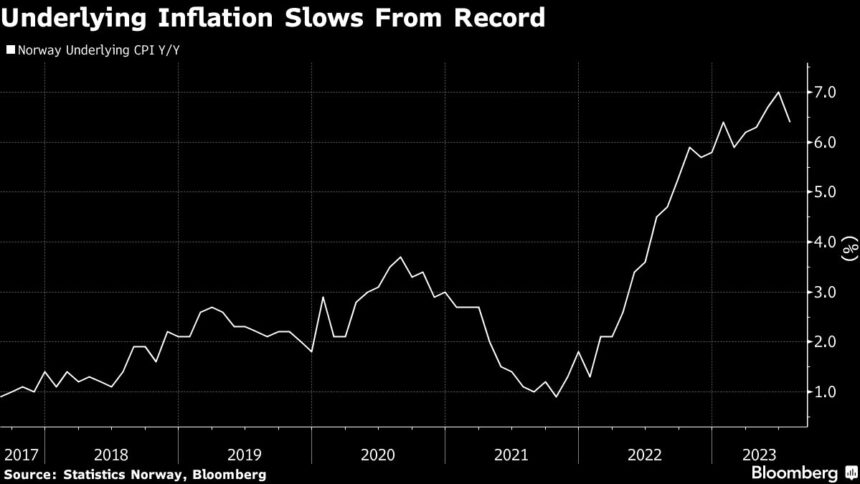

On Thursday, Norges Bank may deliver a quarter-point rate hike flagged at its last decision, after slowing core consumer-price growth eased pressure on policymakers to go for a bigger move.

Turning south, investors on Tuesday will find out if inflation in Israel decelerated for a third month in July. That could make the Bank of Israel — which recently said it might not be done with rate hiking — less inclined to further tighten policy.

The same day, Nigerian data will likely show inflation surged beyond June’s 22.8% level, stoked by the removal of fuel subsidies and the devaluation of the naira.

In Uganda, monetary officials are expected to stand pat for a fifth meeting after the inflation rate fell below the central bank’s 5% target in the past two months. Two days later, on Thursday, Rwanda is also likely to keep rates on hold.

Latin America

Manufacturing, industrial output and retail sales data for June published this week should underscore a dramatic slowdown in Colombia’s economy

Quarter-on-quarter output likely declined for the first time since 2021 in the three months through June, while the year-on-year result and June’s GDP-proxy reading stalled.

Chile’s central bank, led by chief Rosanna Costa, turned heads by kicking off its easing cycle with a bigger-than-expected 100 basis-point rate cut last month, so the minutes of that meeting, due on Monday, will be a must-read for Chile watchers.

Banco Central de Chile will also post its survey of traders along with its second-quarter output report, which is widely expected to show a mild contraction as first-half mining activity disappointed.

Data posted in Peru this week may show that unemployment in Lima declined for a fourth month in July.

GDP-proxy data are likely to show output fell in June, Finance Minister Alex Contreras said this month, which would mean the economy posted consecutive quarter-on-quarter contractions in the first half of 2023.

In Argentina, the July consumer price report will likely show an 18th straight year-on-year rise from June’s 115.6% reading.

The central bank, which raised its key rate to 97% in May, often follows up on inflation data with monetary policy announcements.

–With assistance from Nasreen Seria, Vince Golle, Paul Jackson, Monique Vanek, Paul Wallace and Robert Jameson.

(Updates with plan to attract foreign investment in eighth paragraph)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.