(Bloomberg) — Gas is back as a risk to the global economy with potential strikes in major producer Australia threatening to shatter the fragile balance of global supplies — and send consumer bills rising once more.

Most Read from Bloomberg

Demand for the fuel in the northern hemisphere is still subdued, with a couple of months to go before the start of the heating season. But the prospect of prolonged plant closures has sent wholesale gas prices soaring, and comes on top of extreme weather events that have tested energy systems this summer, as well as setbacks among other large producers.

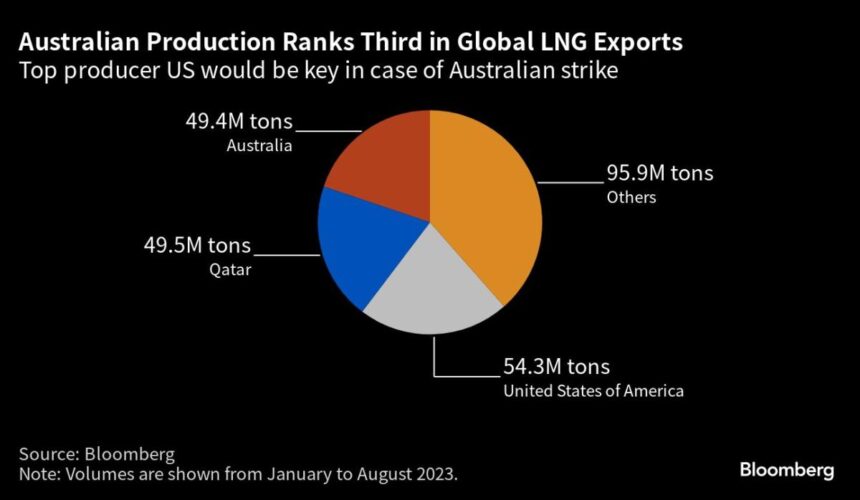

The latest escalation in supply fears was sparked by a dispute about pay and conditions at Australian plants belonging to Chevron Corp. and Woodside Energy Group Ltd., which account for over 10% of global liquefied natural gas supplies. While the facilities’ owners made billions of dollars from the turmoil that sent gas prices to record highs last summer, their workers have demanded to receive higher compensation, too, with labor unions set to continue negotiations on Tuesday.

“The potential strike comes at time when the gas market is in a precarious state even though prices have tumbled and are at relatively low levels compared to the recent past,” said Oystein Kalleklev, chief executive officer of shipowner Flex LNG Ltd. in Oslo, which owns and operates ocean-going gas tankers. The magnitude of the affected Australian annual capacity is a little more than two and a half times that of US Freeport LNG in Texas, where a months-long shutdown from an explosion and fire in June 2022 roiled markets.

While gas prices are still well off the highs seen about a year ago, volatility this winter could mean higher bills for household heating and residential power customers, as well as large-scale gas consumers that include steel, fertilizer and ceramic industries, which are still reeling from last year’s skyrocketing levels.

The strikes highlight the fragility of global gas flows more than a year after the market’s status quo was shattered by Russia’s war in Ukraine. Europe, which was hit hard by Russia’s decision to curb pipeline flows, is still in jeopardy, and executives of major energy companies have warned in recent weeks that a cold winter and unexpected outages could still put the region at risk of shortages.

Asia is even more directly exposed to Australian flows, and a bidding war with Europe risks driving consumer bills up in both regions.

If strike action at Australia’s Gorgon, Wheatstone and North West Shelf LNG plants lasts one month, three million tons of supply could be affected, removing about 44 cargoes of LNG from the market, said Claudio Steuer, Director of SyEnergy Consulting.

That could happen more imminently at facilities that supply the Woodside-operated North West Shelf as workers have already voted to approve strikes. Woodside is scheduled to meet Tuesday with labor unions, who must give seven days’ notice before laying down tools.

The impact could be significant, as Japan, Thailand and Taiwan have each received about a quarter of their supplies from those facilities this year, according to data from market intelligence firm Independent Commodity Intelligence Services. They’ve also provided 14% of China’s imports, and 28% of Singapore’s. Their usual buyers could be forced to look for fuel on spot markets instead, since the pool of LNG supply is still largely limited.

Supplies elsewhere are also under pressure. Russian LNG exports have been cut in recent weeks due to maintenance at two of its biggest facilities. Trinidad & Tobago has one plant down for planned work through most of August, and Egypt has stopped almost all exports while hot weather supports domestic demand. Nigerian supply has been underperforming amid long-lasting feed gas and security issues.

More scheduled maintenance is planned in the third quarter, including at Prelude, another LNG producing facility in Australia.

The US — the biggest and most flexible supplier of LNG — will likely receive a lot of attention from buyers looking for alternatives. The timing coincides with the ongoing Atlantic hurricane season, which so far has spared the US Gulf Coast, where US LNG exporters are concentrated. The odds of an unusually active Atlantic hurricane season are growing as ocean temperatures get hotter, according to US forecasters.

“US liquefaction terminals won’t be able to liquefy additional gas volumes in urgency,” said Andrei Belyi, CEO of Balesene OÜ, an energy consulting firm in Tallinn.

If the Australian supply outage extends into September, that would affect global supplies and prices in the run-up to the heating season. Prices in both Asia and Europe would need to rise to attract available LNG and keep homes warm. For some more price-sensitive buyers, such as India, LNG could become too expensive — the country already opted not to accept offers for supply it recently sought for 2024.

“In a tight LNG market, this could push both price indices up as the key regional markets compete for limited LNG supplies,” Steuer of SyEnergy Consulting said. “This will be traders’ Nirvana, as no one knows where the actual market price ceiling will be.”

–With assistance from Brian K Sullivan.

(Updates with details on negotiations in ninth paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.