fcafotodigital

Chocolate sellers such as Hershey (NYSE:HSY), Mondelez (MDLZ), Barry Callebaut (OTCPK:BYCBF), and Nestle (OTCPK:NSRGY) may have hit the wall on pricing as consumers start to push back. While the industry has seen strong profits over the past couple of years as demand for chocolate held up despite price hikes, the trend may be breaking, per data cited by Reuters.

While prices for cocoa recently hit 46-year-highs and sugar prices are also near their highest level in more than a decade, consumers in Europe and North America have already lapped up price increases of about 20% over the past two years and are starting to cut back on the amount of chocolate they consume or trade down to cheaper products. “We are seeing consumers starting to react more than before, I’d be very cautious with price increases,” warned IRI analyst Dan Sadler. “We’re seeing consumers starting to trade down,” he added.

Mondelez International CEO Dirk Van de Put discussed the trend on the company’s earnings call (Mondelez International, Inc. (MDLZ) Q2 2023 Earnings Call Transcript). He said MDLZ does see consumers shopping around more, hoping to find deals. “The quantity bag per shopping trip is the same, but they tend to shop a little bit less frequently, but nothing really that preoccupies us,” he noted. During Hershey’s (HSY) recent earnings call (The Hershey Company (HSY) Q2 2023 Earnings Call Transcript), executives laid out how the company is using hedges to offset some of the cocoa inflation.

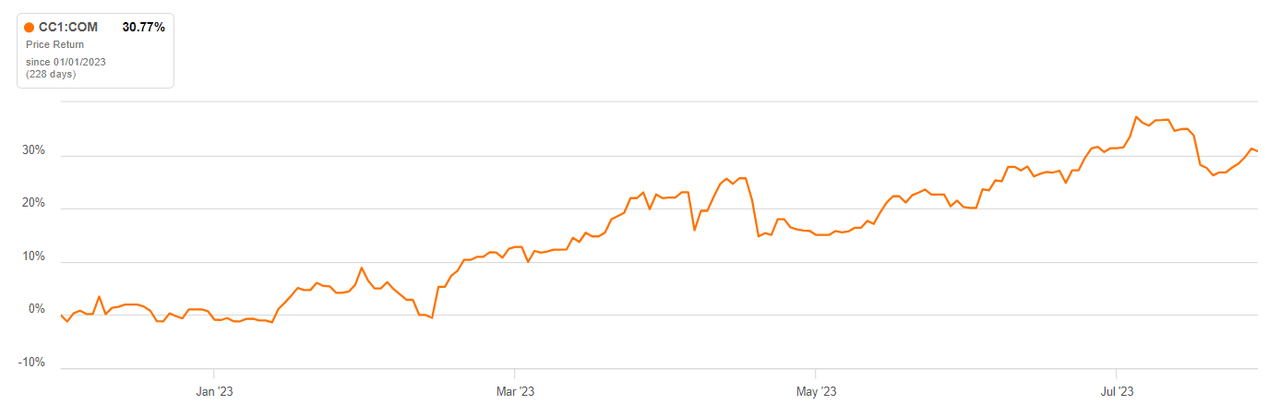

Cocoa prices have been pressured by unfavorable weather in key harvest regions. Heavy rain in West Africa accelerated the spread of black pod disease and could impact cocoa crop quality through the 2023/2024 season. Last week, New York cocoa rallied to a 12-year high for the nearest futures contract as concerns over tighter supply led to more buying. Tighter future cocoa supplies has prompted fund buying of cocoa. Coca futures (CC1:COM) are up more than 30% on a year-to-date basis.