Thomas Faull

The latest food scanner data from Evercore ISI showed consumption trends were weaker for the last 4-week period. The 4-week total U.S. measured channel food sales growth was up 2% year-over-year for the period that ended on August 13 vs. a +3.5% rise for the 4-week period that ended on July 30.

Notable gainers in the most recent scanner data were BellRing Brands (BRBR) +34% sales growth year-over-year, Simply Good Foods (SMPL) +7.9%, J.M. Smucker (SJM) +7.6%, and Mondelez International (MDLZ) +7.4%.

Notable decliners for the four-week tracking period were B&G Foods (BGS) -3.7% year-over-year, Hain Celestial (HAIN) -3.7%, Kraft Heinz (KHC) -2.9%, and Conagra Brands (CAG) -2.8%.

Analyst David Palmer’s food breakdown: “Our Evercore ISI consumer staples survey continues to indicate normalized pricing power (see Figure 3) and food price elasticity has returned to a pre-COVID norm of about 1x. Meal-oriented center store continues to be the largest drag on growth – with average 4-week growth of -2% YoY. Rising price elasticity of demand (now above 1x L4wk) is likely to remain a Food overhang. The average relative Food P/E trades ~10% below the S&P 500 and at a slight discount to the 5-year average of – 5% and below its 10-year average of a 10% premium.”

Evercore ISI’s top picks in the food sector are Mondelez International (MDLZ), Post Holdings (POST), Hostess Brands (TWNK),and BellRing Brands (BRBR).

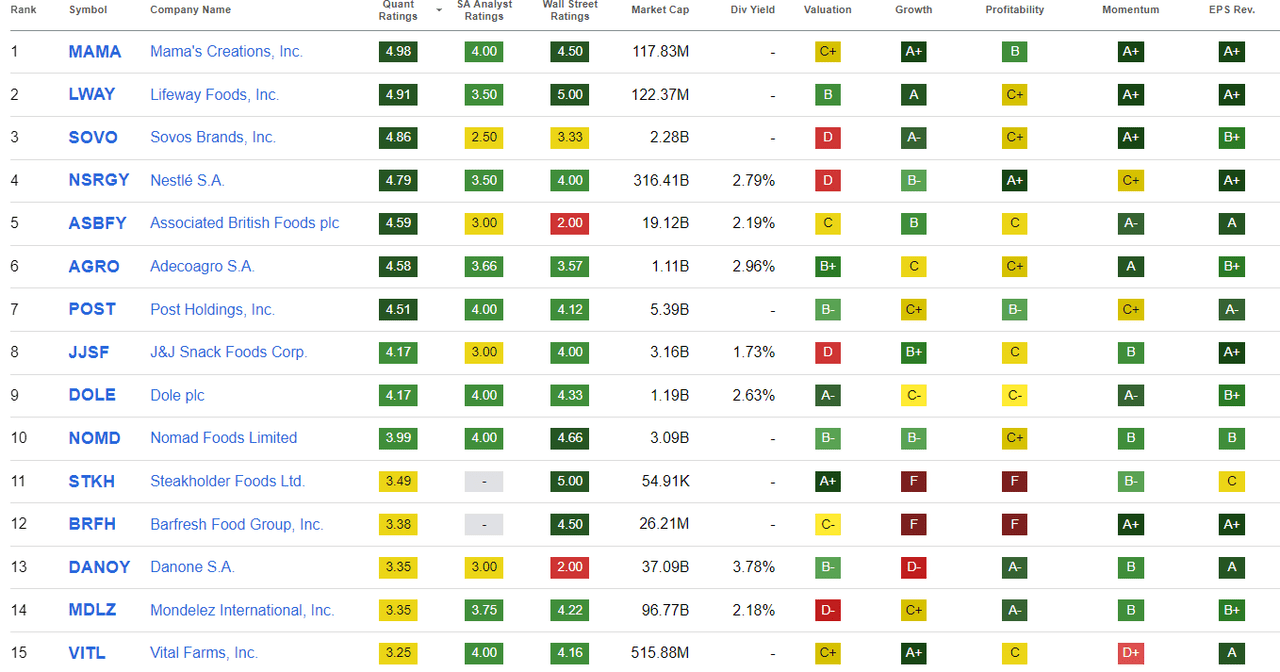

The Seeking Alpha Quant Ratings for the food sector show Mama’s Creations (MAMA), Lifeway Foods (LWAY), and Sovos Brands (SOVO) as the top picks.