A pair of classic American brands had opposite days Friday as shares of one logged their best day ever on reports of a possible sale, while the other’s stock struck a record poor performance after a report of a pending bankruptcy.

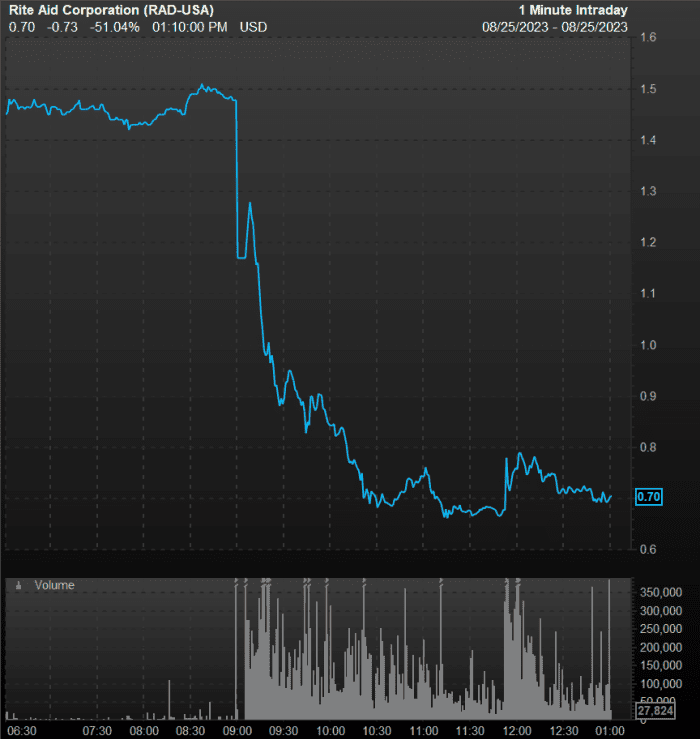

Earlier Friday, shares of Rite Aid Corp.

RAD,

plummeted after the Wall Street Journal reported the drugstore chain was filing for Chapter 11 bankruptcy protection as it has more than $3.3 billion in debt and faced multiple lawsuits alleging its pharmacists overprescribed opioid painkillers, citing people known to be familiar with the plans.

Following the report, Rite Aid shares sunk as low as 66 cents a share, and finished Friday down 51% at 71 cents a share. Previously, the stock’s worst one-day performance was a 39% drop on March 12, 1999, to close at $451.25, according to FactSet data. Rite Aid’s highest closing price was $1,018.75, back on Jan. 8, 1999, according to FactSet.

Rite Aid shares are down 78.9% to date in 2023, compared with a 14.8% gain in the S&P 500 index

SPX.

Back in June, shares came under pressure amid reports that the company was looking to restructure $2.9 billion in debt.

FactSet

Read: Rite Aid’s stock drops more than 50% on report of pending Chapter 11 bankruptcy

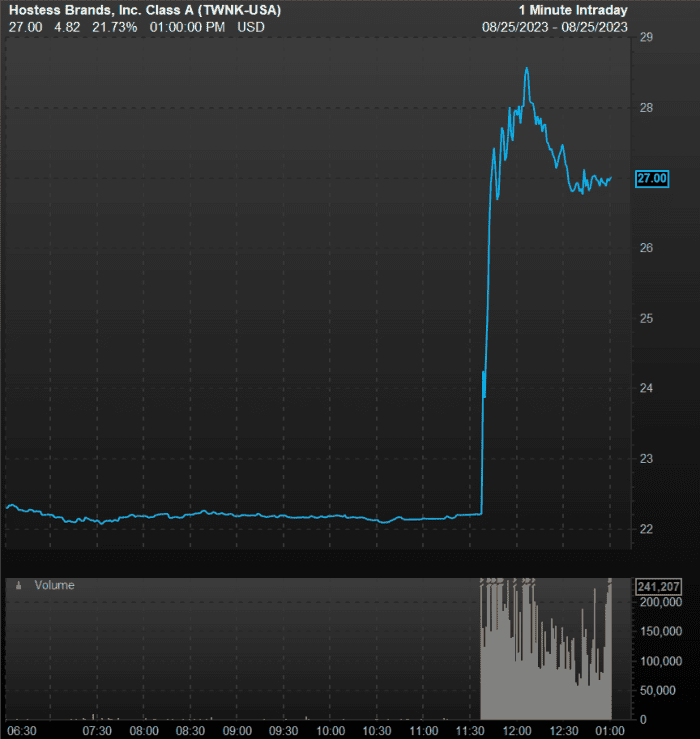

Meanwhile Friday, Reuters reported that Hostess Brands Inc.

TWNK,

known for its Twinkies and Snoballs snack cakes, was contemplating a sale to more than a few interested parties such as General Mills Inc.

GIS,

Mondelez International Inc.

MDLZ,

PepsiCo Inc.

PEP,

and Hershey Co.

HSY,

and being advised by Morgan Stanley. Reuters cited sources close to the matter who wished not to be identified.

Hostess shares surged as much as 30% to an intraday high of $28.84, and closed up 21.8% at $27, to top their previous best day of a 15.4% gain on March 1, 2018, according to FactSet.

FactSet

Read: Hostess’s stock shoots toward best day ever on report of Twinkies maker’s possible sale