The Rolls-Royce (LSE:RR) share price continues to surge in late summer trading. At 219.9p per share, the FTSE 100 stock has gained a whopping 44% in value over the past two months alone. It’s also more than 130% more expensive than it was at the start of the year.

Yet amazingly the engineer still looks dirt cheap according to current profits estimates. City analysts have upgraded their forecasts following recent strong half-year results, and earnings are now tipped to soar 329% year on year in 2023.

This means that Rolls-Royce shares trade on a forward price-to-earnings growth (PEG) ratio of 0.1. As a reminder, any reading below 1 indicates that a stock is being sold below value.

Brokers think yearly earnings in 2024 and 2025 will rise another 24% and 21% respectively, too. So the PEG reading remains below this bargain benchmark long into the future.

Is Rolls a FTSE value stock I can’t afford to miss?

Sunny skies

Rolls has been flying thanks to the civil aviation sector’s sustained recovery. In fact, a better-than-expected rebound prompted the company to upgrade its profit and free cash flow forecasts for this year.

The business makes a terrific amount of money from servicing the large engines used on commercial aircraft. Its Civil Aerospace division is responsible for just under half (47%) of group revenues.

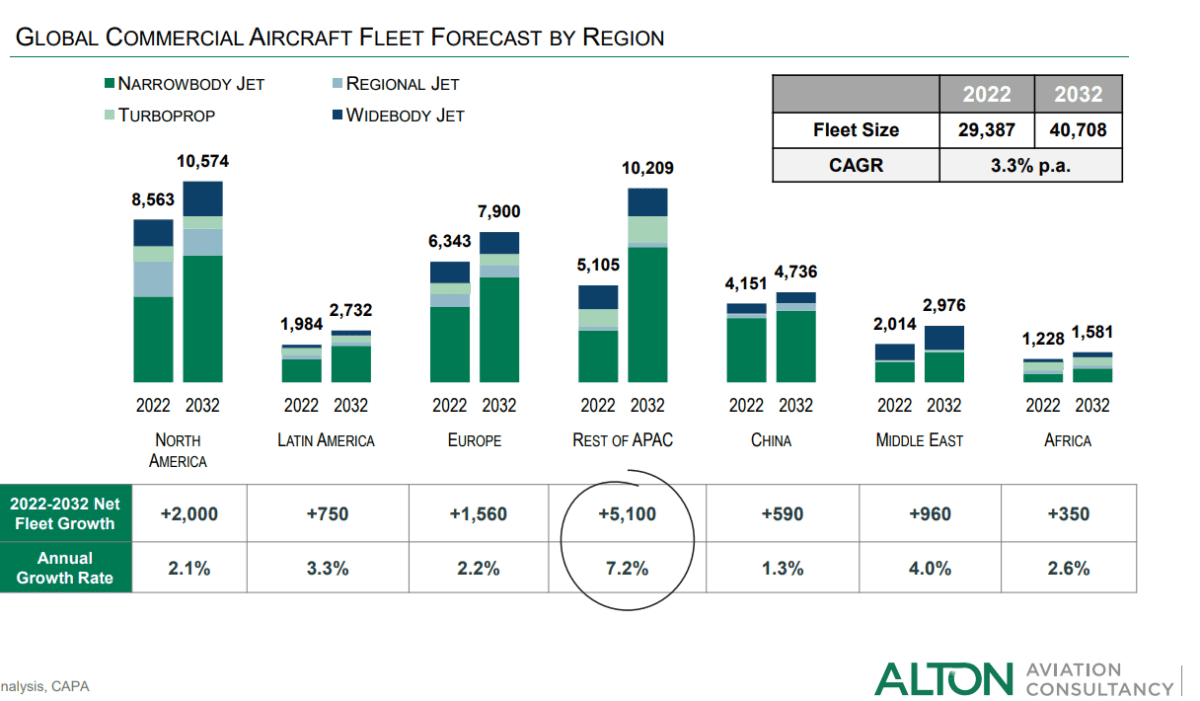

Things are looking sunny for its core unit over the long term too. As the graphic below shows, aircraft numbers are — thanks in large part to robust sales in Asia Pacific — tipped to rise strongly over the next decade. This gives aerospace companies an excellent opportunity to sell and service their product.

As a potential investor, I’ve been keeping a close eye on speculation that Rolls could re-enter the narrow-body aircraft market too.

New chief executive Tufan Erginbilgic hasn’t suggested an imminent return to this segment as part of his transformation strategy. But he has touted the possibility of entering “into partnership” with another company when the next round of development projects begin, Reuters has reported.

Why I’m not buying Rolls shares

Things are looking tasty for the civil aerospace market, then. And the defence sector — another major source of company profits — also looks set for steady growth as geopolitical tensions grow.

However, I’m not tempted to buy Rolls-Royce shares today. I’ve long worried about a bubble forming around the FTSE share. And the fresh upswing in its price during recent weeks has increased my fears.

The company’s major £2.8bn net debt pile, a large chunk of which needs to be repaid by the end of 2025, is one problem that overshadows it. Should the travel sector begin to slow as the economy splutters, concerns over Rolls’ balance sheet will inevitably rise.

I’m also mindful of the huge competition the business faces to sell its commercial engines. According to Statista, Rolls-Royce has a market share of just 12%. A debt-heavy balance sheet could see it fall even further in the pecking order if development budgets are affected.

Despite the cheapness of its shares, I’d still rather buy other FTSE value stocks.