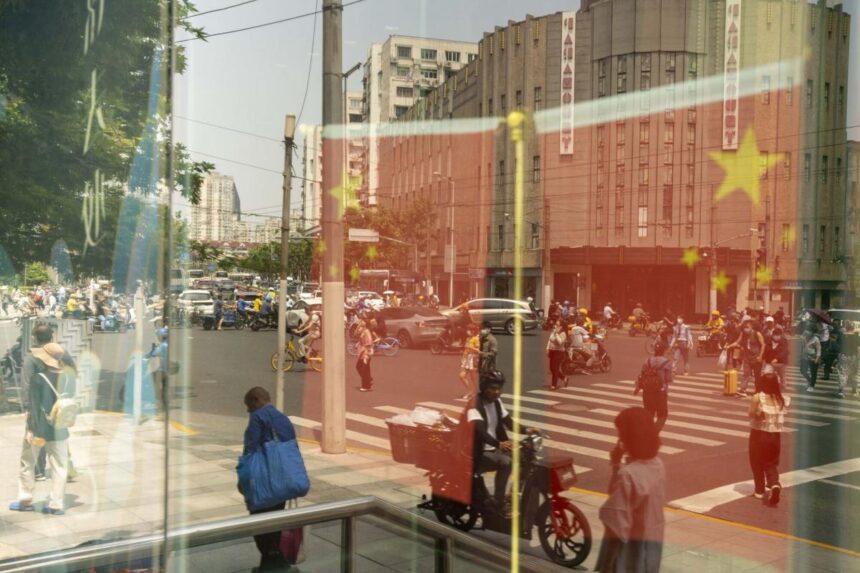

(Bloomberg) — Stocks in Asia were under pressure after the rally in Chinese equities hit a wall on disappointing services activity, which raised further concerns on the nation’s economic malaise.

Most Read from Bloomberg

Hong Kong shares fell more than 1%, underperforming the region, with shares in mainland China shares also slipping. A private survey of China’s services sector showed activity expanded at the slowest rate this year in August, a signal that economic recovery is losing traction.

Property stocks were among the worst performers and developer Country Garden Holdings Co.’s woes added to the negative sentiment as it entered the final hours of a grace period to pay interest on dollar bonds. The company is also reported to plan payment extensions of seven yuan bonds.

There’s “some profit taking as PMI data was somewhat disappointing and Country Garden’s US dollar bond grace period deadline is looming,” said Marvin Chen, an analyst with Bloomberg Intelligence.

Stocks traded lower in South Korea, where inflation accelerated much faster than estimates in August on the back of higher energy costs, reinforcing the case for the central bank to keep the door open to further policy tightening to rein in prices.

Equities also declined in Japan and Australia, where the Reserve Bank of Australia is set to keep rate unchanged for the third straight month in a meeting later Tuesday. The regional stocks move drove the MSCI Asia Pacific Index toward its first decline in seven days.

The dollar edged up, while Treasuries were slightly lower across tenors as cash trading resumed. Australian bonds also fell ahead of the central bank’s meeting, with yield on the three-year rising three basis points and that on the 10-year up four basis points.

The offshore yuan weakened following the PMI data.

Oil continued to trade near the highest level since mid-November after a surge driven by supply cuts from OPEC+ that have tightened the market. Crude has rallied by about a quarter since late June as a result of supply reductions, which have been led by Saudi Arabia and Russia.

Meanwhile, Goldman Sachs Group Inc. lowered its estimate of US recession probability. “Continued positive inflation and labor market news has led us to cut our estimated 12-month US recession probability further to 15%, down 5pp from our prior estimate,” Jan Hatzius, its chief economist, wrote in a note. “We are also substantially more optimistic than most other forecasters in terms of our baseline GDP growth forecast, which averages 2% through the end of 2024.”

Key events this week:

-

Australia rate decision, Tuesday

-

Eurozone S&P Global Eurozone Services PMI, PPI, Tuesday

-

US factory orders, Tuesday

-

ECB President Christine Lagarde chairs panel focused on central banks and international sanctions at ECB Legal Conference, Tuesday

-

Australia GDP, Wednesday

-

Eurozone retail sales, Wednesday

-

Germany factory orders, Wednesday

-

US trade, Wednesday

-

Canada rate decision, Wednesday

-

Bank of England Governor Andrew Bailey testifies to the UK parliament’s Treasury Select Committee, Wednesday

-

Federal Reserve issues Beige Book economic survey, Wednesday

-

Boston Fed President Susan Collins speaks on the economy at New England Council, Wednesday

-

China trade, forex reserves, Thursday

-

Eurozone GDP, Thursday

-

US initial jobless claims, Thursday

-

Bank of Canada Governor Tiff Macklem to speak on the Economic Progress Report, Thursday

-

New York Fed President John Williams participates in moderated discussion at the Bloomberg Market Forum, Thursday

-

Atlanta Fed President Raphael Bostic speaks on economic outlook at Broward College, Thursday

-

Japan GDP, Friday

-

France industrial production, Friday

-

Germany CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 11:45 a.m. Tokyo time

-

Nasdaq 100 futures fell 0.1%

-

Japan’s Topix fell 0.4%

-

Australia’s S&P/ASX 200 fell 0.6%

-

Hong Kong’s Hang Seng fell 1.4%

-

The Shanghai Composite fell 0.6%

-

Euro Stoxx 50 futures fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.1% to $1.0785

-

The Japanese yen fell 0.2% to 146.70 per dollar

-

The offshore yuan fell 0.2% to 7.2922 per dollar

-

The Australian dollar fell 0.5% to $0.6427

Cryptocurrencies

-

Bitcoin fell 0.5% to $25,695.4

-

Ether fell 0.6% to $1,617.77

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.21%

-

Japan’s 10-year yield advanced 1.5 basis points to 0.655%

-

Australia’s 10-year yield advanced five basis points to 4.14%

Commodities

-

West Texas Intermediate crude rose 0.2% to $85.74 a barrel

-

Spot gold fell 0.3% to $1,936.35 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Zhu Lin.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.