Millennials can’t afford homes, but somehow, their younger siblings, Gen Z, can. Even with over a decade more work experience than Gen Z, Millennials still feel priced out of the housing market. So how can the younger generation, only twenty-seven years at the oldest, already be on track to beat Millennials in the homebuying race, all while mortgage rates and prices are high, inventory is low, and inflation is eating away at Americans’ disposable income? We’ve got Redfin’s Chen Zhao back on the show to explain.

Today, we’re trying to answer one question: Who is buying all the houses? With younger generations struggling to buy and more Baby Boomers aging in place, real estate investors want to know their competition and who they may be selling their homes to. In this episode, Chen breaks down the data behind age trends in homebuying, plus shares why Millennials fell behind past generations.

But that’s not all. We’re getting into the changing landscape of the “buy vs. rent” debate and whether more renters now will mean fewer homebuyers in the future. Plus, with an aging Baby Boomer generation, will we finally see the “Silver Tsunami” of housing inventory hit the market as boomers “age in place,” especially with their large share of family-sized houses? Could our housing supply problems reverse if a sizable amount of inventory hits the market? We’re answering it all coming up!

Dave:

This challenging and confusing housing market. Who is actually buying all the homes as a flipper or real estate investor? What buyers are you trying to attract? Are Gen Z and millennials priced out of the game? We’re going to explore some generational home buying patterns on today’s show.

Hey everyone, and welcome to On The Market. I’m your host, Dave Meyer, and on today’s episode, we’re bringing back a fan favorite guest. It’s Chen Zhao from the economics team at Redfin. And with her we’re going to discuss Gen Z and millennial home buying patterns, how they’re funding their down payments and getting into this market and some rental trends you’re definitely going to want to pay attention to because the question of whether it’s cheaper to rent or buy doesn’t just impact home buyers. It also impacts landlords and real estate investors. So with that, let’s bring on Chen. Jen, welcome back to the show. Thanks for being here again. Thanks

Chen:

For having me.

Dave:

So my first question surrounds this idea or this narrative online or in social media that Gen Z and millennials are priced out of the housing market currently. How would you react to that narrative?

Chen:

Well, I would say housing is very unaffordable right now, so I’m very sympathetic to that narrative. I mean, it is definitely the case right now that home prices are really high. And then not only that, but also mortgage rates are really high too. So for anyone who’s trying to get into the housing market for the first time, it is a tough situation. That being said, I think the big picture right now is that for younger millennials and Gen Z home buyers, a lot of ’em are still having success even though it is a tough market. So millennials, when we look at the data, are a little bit behind their parents and their grandparents when they were at the same age, but Gen Z is actually keeping up pretty well. That being said, I think that’s kind of like a top line picture. When you look deeper into the data, there is going to be a lot of heterogeneity in the sense that I think those who are doing well, who are able to get into a home right now are those who are getting help from families, and then there’s going to be a lot of others who are getting left behind.

Dave:

All right. Well, I do want to get into in a bit more about who’s actually having success right now, but maybe you can help us paint a picture of normal times or compared to previous generations, what percentage of the housing market would you expect to be Gen Z and millennials as young adults? Essentially?

Chen:

I think the way that this typically plays out is that people buy their first homes when they’re getting married, they’re starting to have kids. That’s kind of the American ideal and how people picture their lives playing out. So the average age of a first time home buyer is usually in their mid thirties. I think right now it’s about 36 years old. So a lot of times people are getting married in their late twenties or early thirties, so by their mid thirties they, they’ve saved up some money from having been working for a while and they’re ready to get into their first home. So that is kind of typically how things play out, and I think that what we have seen with millennials and we’re starting to see with Gen Z is a lot of the same picture right now. So millennials are these folks who are basically in their late twenties to early forties at this point, and more than half of millennials already own their own homes. Gen Z is just starting to get into that time of their lives. So the oldest Gen Z adults are starting to be in their late twenties right now, so they’re just starting to enter into that first home buying age.

Dave:

Okay, got it. Yeah. I hear a lot about how Gen Z isn’t able to afford homes, and I often think that you have to sort of benchmark that compared to their age right now, a lot of people who are in their early twenties or mid twenties are not typically able to afford to buy a home, especially in this type of market. Now you said that millennials are far behind. Is that still because of what happened in 2008? Because I am a millennial. I graduated college in 2009, and I constantly hear about how millennials sort of got hit with this financial crisis and have never really caught up. Is that why millennials lag behind other generations in home ownership benchmarks?

Chen:

Yeah, yeah. There is no really kind of in some sense a typical story, right? Because if you kind of zoom out and you look at the housing market as a whole over the last few decades, so the first thing you would want to look at is probably mortgage rates. So what has happened to mortgage rates? Mortgage rates got really high in the late 1970s and early 1980s up to 15, 18%. And then over the next 40 years, they basically just sort of declined and all the way up until 2020. And then 2022 is when they started really rising again. Of course there was some small fluctuations in between there, but really by and large, they just kind of declined. And if you look at what happened at home prices, they basically kind of just increased with the exception of the financial crisis. So for millennials, you are exactly right.

What happened was that I’m also a millennial. I think of myself as an elder millennial, I guess I graduated in 2007 and basically walked right into the financial. So a lot of our generation in our earliest career years were dealing with this massive recession. It was a very deep recession and affected a lot of the economy, and it lasted for a really long time. People in our generation had a lot of setback in our early career years, but what was unique about the financial crisis is not just how deep it was, but also how slow the recovery was. So that 10 year time period after the financial crisis from about 2008, 2009 to 20 18, 20 19, right before the pandemic, we never really saw the economy just take off. Instead, what we saw was that it sort of very slowly but surely recovered, and it wasn’t until we got to 20 18, 20 19 that we started saying, Hey, actually it looks like we’re back now, but that means that for this generation in that time when you were supposed to be working, saving up for a down payment and buying your first home, you were not accumulating wealth as quickly as you otherwise would have.

And also you were walking into a time where a lot of people were starred from the financial crisis. So a lot of people might’ve said, I’m not really so sure about home ownership. People say home prices only go up, and that was true, but then we had this massive downturn in the housing market.

Dave:

Well, that sort of matches my lived experience at least. So I think a lot of people of similar age would resonate with that. We have to take a quick break, but we’ll have more from Redfin’s Chen out when we return. Welcome back to On the Market podcast. What about Gen Z because they came of age, became young adults during a very strange economic time. It’s obviously very different from what happened in 2008, but it sounds like they are not facing the same challenges that millennials have in terms of home ownership. Is that right?

Chen:

What I would say overall is that it’s too early to tell for Gen Z, right? This is a generation right now that’s age 12 to 27, so most of them are, or many of them are not even adults yet. But for those who are adults, they’re people who have just entered the workforce at this point. And it is true that for the elder Gen Z, you’ve graduated into a kind of strange time period because you had the pandemic and then you had this inflationary period where the Fed is trying to fight inflation and therefore mortgage rates are really high. So what we’ve seen in the data is that so far, if you look at just the adult portion of the Gen Z population, about a quarter of them are homeowners, and this is according to 2023 data.

Dave:

And Chen, what do you consider an adult? At what age?

Chen:

19 plus. Okay. Yeah, so this is not after college. It’s for those who are in Gen Z who are age 19 or above, about a quarter of ’em are homeowners. And if you take a look at that population and you compare it to the previous generations at the same time period in their lives, what we do see is that Gen Z is, some of them are tracking slightly ahead, but some of them are slightly behind, but by and large are basically keeping up with the previous generations, whereas the millennials that we just talked about are slightly behind the previous generations. But what’s probably happening is that for a lot of these young people who are buying homes in their mid to late twenties, they’re probably getting help from their parents either in the form of a down payment or maybe they were living rent free at home, so therefore they were able to save up money for a down payment.

Dave:

How do you quantify that? It makes sense logically that people would get help from their parents, but is there a way you’re able to measure that?

Chen:

So we have done some surveys, so in one of our surveys, what we found is that one third, so actually more than a third, 36% of Gen Zs, this also includes younger millennials. So 36% of them who plan to buy a home soon expect to receive a cash gift from family to help fund their down payment.

Dave:

Is that, I mean, it’s probably hard to get that data right back in time to know if millennials or Gen X or boomers got similar assistance.

Chen:

Yeah, we’re actually unable to go back historically for a lot of our survey data. Unfortunately, I wish we did have that data. But in addition to that, we also found that 16% of them say they’re going to get an inheritance to help with their down payment, and about 13% of ’em live with their parents or other family members. At the same time though, it is also true that the most common way, even among these young home buyers to fund their down payment is still to basically save money out of their own paychecks. So you do hear the story out there a lot that a lot of people are getting help from family members, but more are still saving up on their own.

Dave:

Great. Thank you for explaining that, and I wish you had that data too. That would be really nice if we all got to look at it. So tell me a little bit about any other trends and sentiment that you’re seeing among millennials and Gen Z have the back-to-back strange economic periods. We’ve respectively come to adulthood in changed people’s desire to own a home or just their ability to afford it.

Chen:

What we’re seeing is that a lot of people, I think are worried about affordability, so they’re not sure if they are going to be able to afford a home in the future. And then of course, you do naturally see that when people are younger, they do tend to rent first, right? So right now the main housing story for Gen Z is still one about renters, but that’s just because they’re young. So as they kind of slowly age into their thirties, it will become more of a home buying story. And I do think that there is, you hear about this trend where people are questioning doesn’t make sense to buy a home at all, right? Because home prices are really high right now, mortgage rates are really high. It is the American dream, but is there an alternative path? For example, could you just keep renting and maybe just invest your money in the stock market or through other investment assets? Do you always have to invest through your home? And there are a lot of advantages to investing in a home, obviously through the tax code, but that doesn’t mean that that’s the only way. That being said, what I would still expect is that the pattern that you see through the generations I think will still hold where people still do entrance through their thirties, they’re getting married, they’re having kids, so they’re buying homes. And that is probably by and large what you’ll see for Gen Z as well.

Dave:

A lot of this gen makes me wonder if demand for rental housing may shift a little bit, not the total aggregate amount of it, but the type of rental housing that is desired. Because you look at media across the board, talk about all the different ways you can measure whether it’s better to rent or buy. For the majority of US cities right now, it makes more sense for most people to rent than to buy. And so it makes me wonder people who have families, are we going to start to see demand for bigger rentals or more single family rentals than we have in the past? Not sure if you have any data on that or any thoughts on that hypothesis.

Chen:

Yeah, absolutely. So you’re touching upon a couple of really interesting things, one of which is yes, absolutely. Right now it is much harder to make the case for home ownership than in any previous recent time with how unaffordable housing has gotten rental renting makes a lot of sense in a lot of places probably right now for the near term at least. I think that is definitely the case. It is also the case that a lot of people are probably renting because they can’t find anything to buy right now. And that is especially true, as you noted, there’s kind of a need for larger apartments right now, and you actually see that where single family rents are growing faster than apartment rents are right now. And that’s one of the things that’s actually this kind of a little bit of a digression, but it’s one of the things that’s fueling the inflation statistics because housing inflation is such a large part of our overall inflation statistics, and that is largely right now single family rents because it’s kind of an approximation for home ownership. So that is a big, I think, macroeconomic story for sure. And we do have a shortage of larger apartments or single family homes for rent. So it makes sense that there should be an incentive to build more in this category, or maybe there should be more of an incentive for investors who are looking into this area because there’s a lot more demand for that right now.

Dave:

Yeah, this really reminds me of something, a question I get often, which is that there’s sort of these kind of confusing two trends happening. One is there’s this long-term housing shortage in the United States that’s been going back 15 years right now, and that’s led to a lot of the appreciation that we’ve seen over that time period. At the same time, we’re also seeing in our world of investing a glut of multifamily supply coming online right now. And so I think for a lot of us, it’s hard to square those two things, like how are there too many apartments but too few houses. But I think this conversation really shed some light on this idea that there’s just a mismatch in demand. The type of apartments that we’re creating a building might not necessarily be what renters need and want right now.

Chen:

Yeah, I think you’re absolutely right. There’s a little bit of a mismatch. There’s also, I think people often talk about there’s this big lot of apartments right now, therefore the rental market is soft. The rental market is soft right now, but rents are not by and large declining. Things are still holding up, and we need to remember that rents accelerated very quickly during the pandemic. So the fact that didn’t reverse and turn negative, I think is actually remarkable that we’re actually holding onto those high levels. Just trying to bring a little bit of perspective, I guess, to the rental market. But yes, I think you’re right that there is definitely a mismatch in housing where builders, especially multifamily, tend to build smaller units and there’s a lot more demand right now it seems like for single family homes and then also for larger apartments. But we do have to take kind of a step back and think about when we’re talking about the housing shortage, it’s important to think about longer term demographic trends as well, and not just what’s happening right now.

So right now what we’re experiencing is that millennials are aging into basically the prime home buying years. So millennials are generally folks who are in their late twenties, early forties right now. And within the millennial population, if you looked at a chart of by year how big the population is right now, the biggest part of that cohort is really in their mid thirties right now. So if you imagine a snake that was swallowing an animal we’re at that point or that passing through, and it’s that big lump that’s passing through, but once that lump passes through, gen Z is smaller than the millennial population. And if you look at birth trends, future generations are going to be only smaller than that, right? So yes, there is a housing shortage right now, but if you were to look beyond kind of the medium term, I think a lot of these trends would actually reverse.

Dave:

That’s super interesting, and the question I get quite a lot is what happens after this big generational and demographic tailwind that the housing market has had ends? And it makes you wonder, does the shortage just get absorbed over time as demographics even out, or is it possible that we’ll see that we’ve overbuilt at some point if the generations continue to shrink more and more?

Chen:

Yeah, I mean, I would definitely, I mean, I want to make it clear I’m not advocating for less building right now because right now we are definitely in a period, at least for now and the short term in a housing shortage, and we desperately need more housing. But yes, I think that if we look a little bit further out, we may find that we’re not only no longer in a housing shortage. We might kind of see the reverse pattern. And you have to also keep the other end of the demographic spectrum in mine too, which is the baby boomers. Baby boomers. Were a huge generation. Baby boomers own I think almost 40% of the homes in the US even though they only make up, I think about fifth of the US population. So these are folks who are in their sixties and seventies right now, and as they sort of age out or pass away, essentially these are homes that are going to be freed up and that’s not something that’s going to happen all of a sudden. There’s no cliff that’s happening, just like what I talked about with the other end of the spectrum with smaller generations coming up, these are all slow moving trends. And so if you are kind of an investor or you’re a builder, you’ll have time to react to this as it comes through in the data. But it is definitely the case that these homes baby boomers own will slowly free up over time and add back into the supply at the same time that we have smaller, younger generations coming through.

Dave:

We have to take one final break, but stick with us more from on the market when we come back. While we’re away, make sure to go to your favorite podcast app, search for on the market and give us a follow-up This way you’ll never miss an episode.

Welcome back to the show. You read my mind. That is something I was going to ask you about is this concept, I think it’s sometimes called a silver tsunami where people anticipate that boomers are going to all fire sale their properties all at one time and we’ll have this huge spike in inventory. It sounds like you think that this will take place over a longer period of time. I’m curious though, because one of the trends that I’ve noticed is that more are opting to age in place, and that may mean that boomers, especially with longer life expectancy, it may not happen as soon as a lot of people are anticipating. Do you give any credit to that theory or have any data to shed some light on this idea?

Chen:

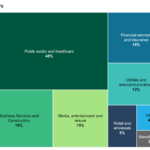

Absolutely. So first of all, I think it’s important to set the scene. Baby boomers own an outsized proportion of the homes in this country. What we have seen is that empty nester baby boomers, so those who don’t have kids living with them actually own twice as many of the large homes in this country as millennials who have kids. So baby boomers who don’t have kids are owning about 28% of the three bedroom plus homes in this country, whereas the millennials who have kids only own 14%, and that is very different than if you look back historically comparing similar generations where those fractions would’ve been more equal. So there’s this kind of expectation though that baby boomers are going to give up their homes all of a sudden in the silver tsunami. I don’t think there’s any tsunami coming because when you look at demographic trends, it’s always a slow moving force.

So if you wanted to use some sort of water related analogy, it might be more like the tide going out or something like that because when we’ve surveyed baby boomers, the vast majority want to age in place. They want to stay in their community where they have friends, they know the bus routes, their doctors are there, et cetera. But I think aging in places more than just wanting to stay in your community. It’s also about a lack of housing supply that’s appropriate for baby boomers. So many of them don’t necessarily want the four or five bedroom, two story house that they raise their kids in, but they would probably want a one story smaller home, but that might not exist in their community. At the same time, house prices have gone up so much. Mortgage rates are so high now that financially it might not even make sense for them to trade homes. So there’s a lot of forces keeping them in place for sure. But it is definitely the case that I think over time a lot of them will be forced out either because they’re passing away or because they just find it really untenable to stay in their home and they actually do need to move to an assisted living facility, but that’s not going to happen all of a sudden no one’s flipping a switch, right? It’s going to be the slow trend that happens over time where those homes are added back to the housing supply.

Dave:

What are the math conundrum here? As you said that something like 20% of the US population is made up from baby boomers, but they own about 40% of homes. Is that because their ownership rate is just super high among baby boomers, or does that also mean that they have a sort of disproportionate amount of second homes and vacation homes as well?

Chen:

Both of those. So the home ownership rate among baby boomers is going to be, it is always the case that the home ownership rate amongst those who are older is going to be much, much higher than those who are younger just because they’ve had more time to build up kind of this wealth. And if you think about the lifecycle for baby boomers, they kind of came of age in a time where actually mortgage rates were really high, home prices were low, but over the last 40 years, like I said, mortgage rates only went down. So even if they bought, when mortgage rates were 18%, they had many decades to refinance down to a 3% mortgage rate. So they really have really benefited from this cycle. And a lot of them also because mortgages were cheap and they had time to build up wealth, a lot of them also own second homes and vacation homes.

Dave:

That may be one source of supply just to think of, because obviously there’s many personal factors, societal factors, keeping people in place for their primary residence, but I can imagine as this generation ages maybe willing or wanting to get rid of a second home or a vacation home and markets that are dense in that type of housing stock may experience some increase in supply.

Chen:

Yeah, that’s definitely a possibility. I think what might play a role in that decision is just kind of how much retirement savings do you have? Do you need to take out the money from a second home, for example, if you’re not adequately prepared for retirement, or would you rather pass this home down to your kids or whatever. And a lot of policies may kind of play a role in that decision as well. If you live in California, you’re going to have Prop 13 and all these sort tax and considerations in mind as well. So it’s going to be a kind of different calculus, I think, for each person.

Dave:

Well, Chan, this has been a really helpful and enlightening demographics and housing market lesson here. Is there anything else from your work or research you think our audience of real estate investors should know?

Chen:

I think the only other thing I would add is that if you look at the most recent data, so in 2023, the HAMDA data from that year, what you are seeing is that about 40% of the mortgages did go to Gen Z and the younger millennials, so that’s almost half and 27% went to buyers who were aged 35 to 44, so just slightly older than that group. So it is still definitely the case that younger people who are kind of aging into their prime home buying years are fueling home buying for the most part. Just something else to keep in mind as you’re thinking about what’s going on in the housing market right now.

Dave:

Great. Well, thank you so much for sharing your research and work here, Chen, for anyone who wants to read Redfin’s most recent reports, all the work that Chen and her team does over there, we’ll make sure to link to all that in the show description below. Chen, thanks for joining us again, we appreciate your time.

Chen:

Of course. Thanks so much for having me

Dave:

On. The market was created by me, Dave Meyer and Kaylin Bennett. The show is produced by Kaylin Bennett, with editing by Exodus Media. Copywriting is by Calico content, and we want to extend a big thank you to everyone at BiggerPockets for making this show possible.

https://www.youtube.com/watch?v=DYCQ_GDqeDI

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.