golfcphoto/iStock via Getty Images

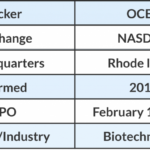

Cambium Networks (NASDAQ:CMBM) stock dipped 20% to $6.35 during after hours on Wednesday as the company gave out preliminary Q3 numbers, with revenues expected between $40M-$45M compared to the previous outlook of $62M-$70M provided during Q2 results.

The decrease in revenues is primarily due to a delay in government defense orders due to U.S. federal budgetary timing issues.

Net income/loss and income/loss per share are expected to be below the low end of the previous GAAP and non-GAAP ranges. (Previous guidance: GAAP net income: $2.3M-$7.6M, or between $0.08 and $0.27 per share; and non-GAAP net income: $16.7M-$21.9M, or between $0.59 and $0.78 per share.)

Cash is expected to be ~$27M; the company has an unused $45M revolving credit line available.

Cambium Networks (CMBM) also suspended its guidance for the full year 2023.

A day after the Q2 results, the stock fell ~35% after J.P. Morgan Securities downgraded the stock to underweight from neutral, and the company cut its outlook, appointed a new CEO, and missed Q2 estimates.