Welcome back to Forrester’s blog series, 50/50, where we showcase two sides of a B2C marketing issue. This time, we explore how consumers feel about Capital One’s bid to acquire Discover — and how differentiated credit card brands are in the eyes of customers.

The main catalyst for this research is Capital One’s announced plan to acquire Discover. To better understand consumer sentiment around this proposed acquisition, we surveyed 504 panel members from Forrester’s ConsumerVoices Market Research Online Community (MROC) in early April.

When It Comes To Capital One Buying Discover, Most Consumers Respond With A Shrug

The feedback on the proposed acquisition is overwhelmingly apathetic: Just over three-fourths (76%) of panel members reported being “neutral” when asked how they feel about Capital One buying Discover. People who do have an opinion on the merger tend to view it favorably: 15% feel “positive” or “very positive,” while just 9% feel “negative” or “very negative.”

Respondents who are neutral on the acquisition say things like:

- “I don’t know what changes, if any, Capital One will make — hence, neutral.”

- “Takeovers happen all the time.”

- “I don’t know enough about it to comment.”

- “I would need to know how it will change or what they will offer.”

Respondents who view the acquisition positively say things like:

- “It will provide more opportunities and advantages for customers.”

- “Both companies have excellent customer service and reputations.”

- “It will lead to stronger companies and maintain their popularity.”

- “Both companies have good savings and innovative offerings.”

There were several negative comments directed specifically at one of the companies based on past interactions that the individual respondent had with the brand. Other respondents who view the acquisition negatively say things like:

- “I am sick and tired of large companies buying up others. It becomes impossible to do anything against them. They do whatever they want, and we pay the price.”

- “It will limit competition and screw over the consumer.”

As these quotes illustrate, the responses fell into the following themes:

- Pro: growth and innovation. Consumers are looking forward to new and innovative products that result from the acquisition, improvements on existing technology, and broader credit card acceptance and network reach.

- Pro: Many view both brands in high regard and expect that a combined entity would attract new customers based on their reputation. Existing customers would be willing to stay with the brand given their benefits and quality of service.

- Neutral: lack of information. Most neutral feelings from this announcement stem from a lack of information around what the acquisition would look like and what its impact on customers would be.

- Con: limited competition. Some worry that a reduction in competition could limit the product options available to them.

An Underlying Factor: Credit Card Brands Are Largely Undifferentiated

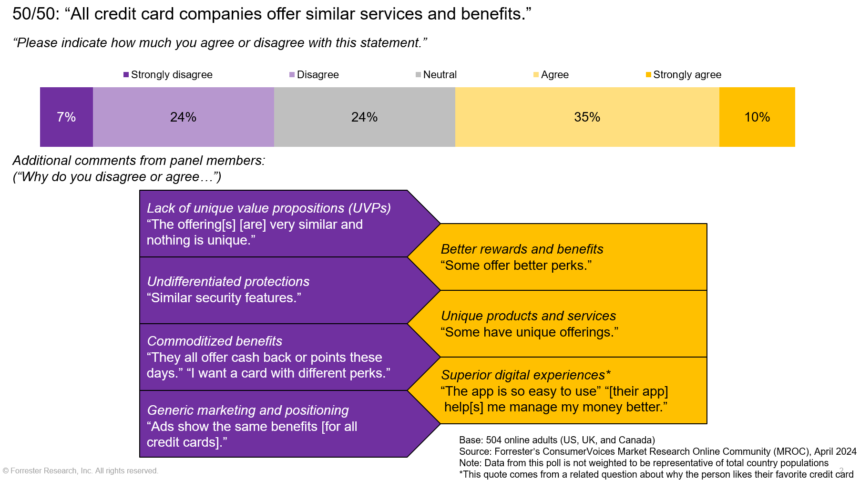

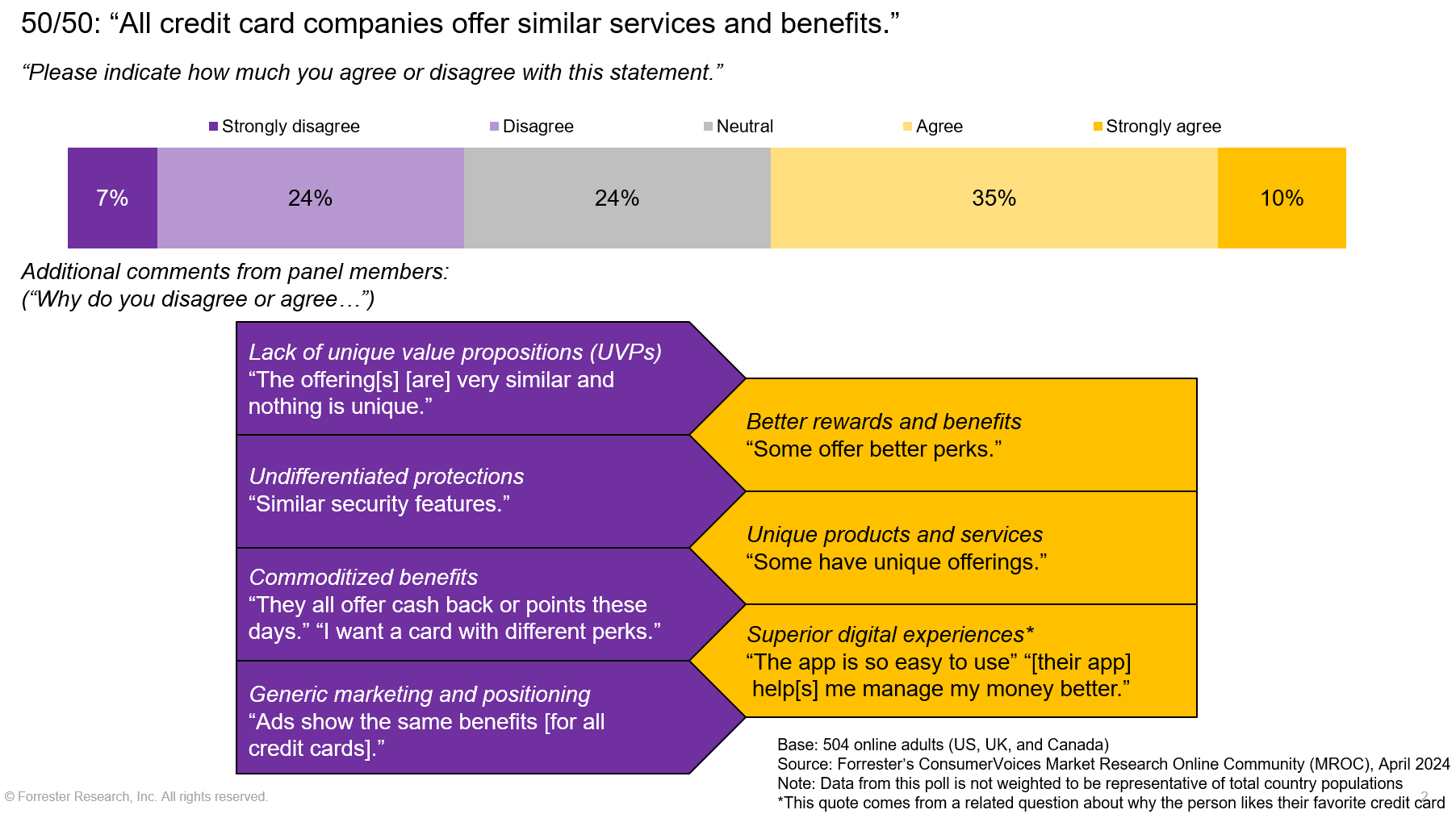

Some of the neutrality is, of course, because the acquisition hasn’t actually happened yet (and could still be scotched by regulators). But our research shows that a powerful factor is the broader lack of brand differentiation in the credit card market: When asked about the statement “All credit card companies offer similar services and benefits,” 45% of respondents say they agree with this view — including one in 10 who say that they “strongly” agree. Only 31% of respondents disagree (see chart below).

Respondents who felt that credit card brands lack differentiation say things like:

- “They all offer similar interest rates and benefits.”

- “From what I’ve seen, there isn’t much difference from one credit card to another.”

- “Most offer rewards programs and similar security features.”

- “They all pretty much offer the same thing … ”

Those who disagree that credit card brands tend to be similar say things like:

- “There are credit card companies that provide services that others don’t.”

- “They all have different benefit programs, fee structures, and rewards programs.”

- “Some credit cards have way better benefits than other cards.”

Differentiation in financial services (or a lack thereof) is a topic that Forrester has extensive research on, and being good enough to retain customers is no longer sufficient! Our research shows that banks cannot achieve sustained, profitable growth without differentiation.

Forrester will be publishing additional research on the Capital One + Discover merger, including further data on customers’ perceptions of each brand, what it means for digital experiences, and why the move illustrates how old-school business strategy can still be decisive in a digitally disrupted world.

For more info on this or any of that upcoming research, contact us!

Thank you,

Peter, Dipanjan, Sohm, and Michael