Earnings season has been…well…sloppy.

I know that’s not the most scientific of terms, so let me clarify.

Most of the major companies have reported now, with about 79% beating expectations. However, the fundamentals aren’t that great when you look under the hood.

The market is forward-looking.

It rewards companies with high growth potential. So even though earnings weren’t really bad, the growth rate seems to be slowing down.

In a weird turn of events, we are even seeing companies that beat earnings get their share prices hammered, while those that miss are being rewarded. This is crazytown…

The key to look at is the expected growth rates.

Stocks that aren’t showing a high rate of growth are being pummeled.

This market expects perfection, and nothing less will do.

It looks like we’re in for a lot of range-bound chop this week.

So what does this mean for trading?

?Numbers I Need:

In the email that went out to Bullseye Trades subscribers this morning (and in the FREE live session in the Alpha Chamber), I laid out the plan.

I’m looking for two types of stocks:

First, tickers that had massive bullish rallies after earnings, but have seen a significant pullback.

You know, stocks like GOOGL, META and AMZN.

Often once these stocks find some around a key moving average or mid-point of the Keltner channel, they’ll start moving back up.

Learn to recognize this cup-and-handle pattern.

And just like a couple of weeks ago, I’m really searching for stocks other than big tech companies.

Once a sector runs so far, institutional money starts to rotate into new sectors–for example, energy, which provided a nice trading opportunity on ERX back on July 24th.

Actually, there may be quite a bit more upside in these oil stocks so keep them on your radar.

I can show you how to …

Just ask me in my next live session, which is tomorrow, Tuesday Aug 8th 2pm EST.

So I definitely expect some volatility this week, particularly with the CPI release on Wednesday.

We have been getting a little “too comfortable” with declining inflation rates. I think we are near the bottom, and might actually start ticking higher soon.

But for the most part in the market, I see a lot of sideways action coming our way.

?Most Exciting Action:

I’m not too keen to risk a lot on big tech.

I think that may be played out for the moment, so I’m looking for some short squeeze opportunities.

The company I alerted for Bullseye Trades this week is one I’ve had on my watchlist for quite some time.

It has two things going for it.

After earnings, it shot up, sold off, and has formed a solid base of support. And it’s in the healthcare sector, which hasn’t seen much love recently.

With the institutional rotation going on there’s a really good chance for 5-10% bullish move.

And that’s just on the stock. The leverage of a call means potentially way more.

?Past Alert Update:

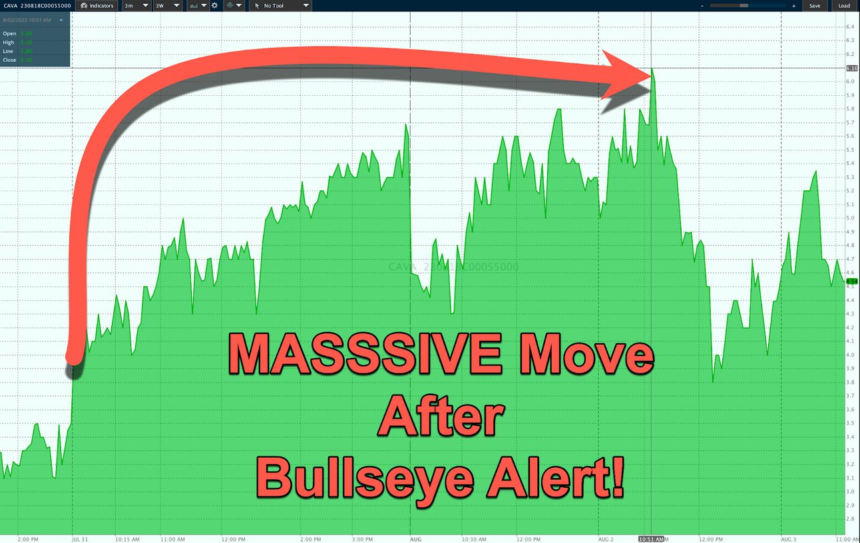

Hopefully, this week’s Bullseye idea will be another one like CAVA, which I alerted last Monday (before the market opened).

After I sent out the following trade plan to subscribers:

So what happened? It took off right after the bell.

*Trading is hard, results not guaranteed.

Again, I can’t promise you’ll make money on these trades. All I can do is teach you how I trade, and show you my very best ideas.

By the way, I gave out the trade idea of the week for FREE to everyone who joined in the live room this morning at 11:00 AM (did you join us??)

Don’t miss these opportunities!

When you join Bullseye Trades, you can look forward to my complete trading gameplan every Monday morning, covering my TOP TRADE IDEA for the week.

You’ll also have unlimited access to our training library, trading ebook “How to Become an Alpha Hunter,” and alerts on trades I make sent directly to your Raging Bull app.

Bullseye Trades isn’t just an alert service. It’s a full educational system to hone your trading skills.

Just so you know, we were running a sale last week to join Bullseye Trades for only $199 $9.

That sale was supposed to end today, but I extended it one more day because a lot of people couldn’t use the link from this weekend (bad tech guy!)

There was a small glitch in the order form, and we were flooded with emails asking how to get in.

Well here’s your second chance. But it closes at MIDNIGHT ON TUESDAY.

Get access to my top trade idea each week along with my full game plan for how I want to trade it with my own real-money trading account.

Be sure to check back in later this week, and I’ll give you a full update on how this week’s Bullseye trade has worked out.

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.