Earlier this summer, MBW reported that Concord had over USD $550 million in fresh capital to spend on acquisitions. The company’s CEO, Bob Valentine, told us with confidence: “There are still opportunities in the marketplace for sizeable acquisitions.”

Well, today (September 8), Concord has confirmed that it’s on the verge of pulling one heck of a sizeable transaction.

Alchemy Copyrights, LLC, trading as Concord, has agreed terms on a deal whereby it will acquire the entirety of Round Hill Music Royalty Fund (RHM) – the UK-listed fund operated by Round Hill Music.

The deal values the entire issued and to-be-issued share capital of RHM – which currently trades on the London Stock Exchange – at approximately USD $468.8 million, the two companies said in an announcement today.

Under the terms of the acquisition, Round Hill’s scheme shareholders will receive USD $1.15 per share in cash.

Since 2015, Concord has deployed more than USD $2.0 billion of capital and completed more than 100 transactions across recorded music, music publishing and theatricals. Its biggest acquisitions to date include its $550 million-plus acquisition of Imagem in 2017, and last year’s acquisition ~$300m acquisition of music rights from Phil Collins and members of Genesis.

A statement issued by RHM to the markets today reads: “Concord and its management have followed the progression of RHM since IPO and believe that RHM’s assets complement Concord’s long-standing objective to acquire high quality and long-term music assets.

“Concord believes that the quality of RHM’s assets are consistent with Concord’s existing holdings, and creators connected to the rights acquired will benefit from the services of Concord’s existing creative and administrative support teams globally.”

Round Hill Music Royalty Fund floated in November 2020. Having largely acquired catalogs from Round Hill’s private company in New York, today the UK-listed fund owns 51 catalogs and over 150,000 songs.

Catalogs owned by the UK-listed fund include 446 compositions in the GIL/GPS catalog, which includes early Beatles classics (She Loves You, I Saw Here Standing There and more), plus songs recorded by The Rolling Stones, Otis Redding, John Lee Hooker, Pat Boone, and Ricky Nelson.

Round Hill’s UK-listed fund also owns a stake in the Carlin catalog, which includes hits made famous by artists including Johnny Cash, Aretha Franklin, Ella Fitzgerald, Meatloaf, Air Supply, Bonnie Tyler, Elvis Presley, Peggy Lee and George Harrison.

In its statement to the market today, the company said: “RHM has experienced a significant de-rating over the last year driven by the inflationary and higher interest rate environment, which has impacted most listed alternative investment companies.

“The RHM Board believes that the Acquisition is in the best interests of RHM Shareholders by providing RHM Shareholders with an opportunity to realise the value of their RHM Shares for cash at a significant premium, and a value greater than the highest price at which the RHM Shares have traded since the Company’s IPO in November 2020.

“As such, the RHM Board intends to recommend unanimously that Scheme Shareholders vote in favour of the Scheme at the Court Meeting and that RHM Shareholders vote in favour of the Resolution at the General Meeting.”

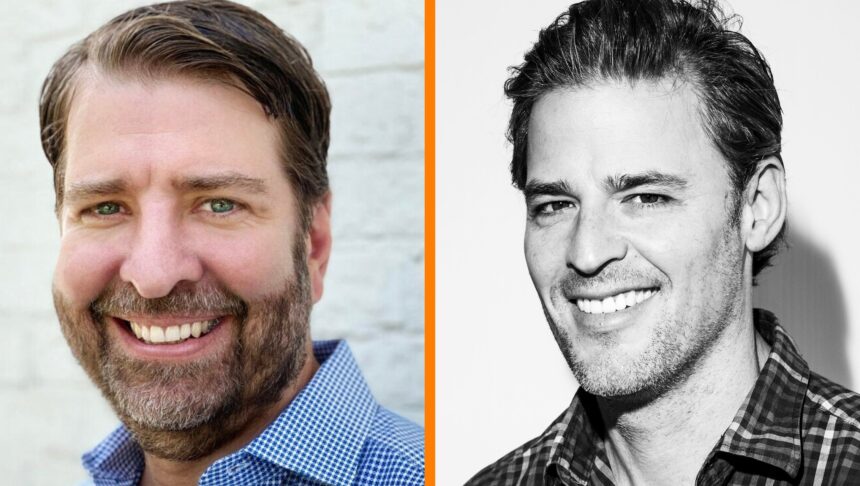

Commenting on the Acquisition, Robert Naylor, Chairman of RHM said: “The Board is pleased to present this opportunity for liquidity at a premium to both the share price and the IPO price, as well as at a narrow discount to economic net asset value per share. The recommended offer represents excellent value for shareholders.”

Commenting on the Acquisition, Bob Valentine, CEO of Concord said: “Since its IPO, RHM has built an impressive portfolio of music rights which generate revenue across a variety of income streams and have demonstrated their ability to stand the test of time. As one of the world’s leading music companies with a proven track record of strategic catalogue expansion, Concord has a global team of sync, licensing, marketing, copyright and royalty experts well positioned to maximise the value of this portfolio for all of the songwriters and artists within it.

“This offer enables RHM shareholders to realise their investment in the business at an attractive premium to the undisturbed share price, while the transaction provides an opportunity to create value for all stakeholders.”Music Business Worldwide