shih-wei/E+ via Getty Images

One of the prevailing themes in the retail sector is that consumer discretionary spending headwinds will hold back share price returns for the remainder of 2023 and early part of 2024. However, quant analysis can be useful in determining stocks that are set up to outperform during a harsher economic backdrop, even if consumers will be put to the test.

UBS’ quant team picked a macro outlook based on GDP growth, inflation, Fed fund rates, and balance sheet forecasts. The firm believes the next three months will be characterized by a macro environment wherein U.S. GDP is slowing, inflation is easing, interest rates are rising, and the Federal Reserve is tightening its balance sheet. Based on the historical record, UBS thinks the strongest factors to consider in the current macroeconomic environment are Highest Sales growth next 12 months, Highest EPS growth next 12 months, and High EV to Sales.

U.S. softlines retail names On Holdings (ONON), Decker Outdoor (DECK), Ralph Lauren (RL), and Skechers (SKX) made the short list of Buy-rated stocks that also score very high on a quant basis.

ONON: “We view On as one of the world’s fastest growing athletic wear brands and worthy of a premium multiple. We forecast On delivering a 44% 5-year EPS CAGR and think its growth will surprise the market, driving stock outperformance.”

DECK: “Hoka is one of the world’s fastest growing footwear brands. We forecast it delivering a 19% 5-yr. sales CAGR and this is the main driver of our 17% 5-yr. EPS CAGR forecast for DECK. We believe this growth will drive stock outperformance.”

RL: “We think the market doesn’t appreciate the transformational changes RL has made to its brand image, distribution model, and cost structure. We forecast a 12% 5-yr. EPS CAGR.”

SKX: “Skechers is an underappreciated global growth stock, in our view. We expect SKX’s P/E to expand as the market recognizes its ability to deliver strong growth. We forecast a 24% 5-yr. EPS CAGR.”

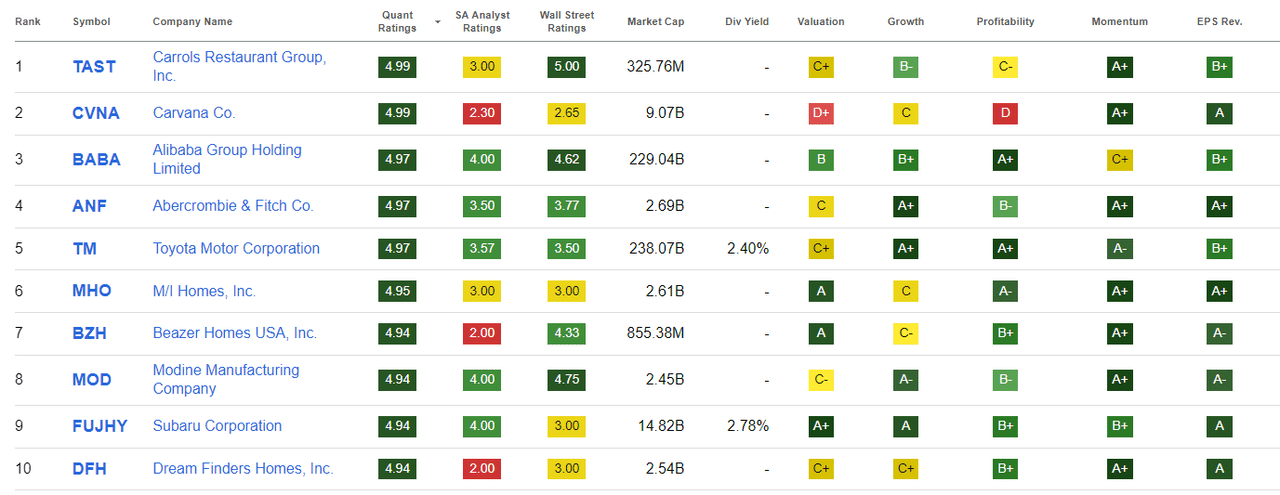

Meanwhile, Seeking Alpha’s Quant Ratings are an objective, unemotional evaluation of each stock based on data, such as the company’s financial statements, the stock’s price performance, and analysts’ estimates of the company’s future revenue and earnings. Over 100 metrics for each stock are compared to the same metrics for the other stocks in its sector. The stock is then assigned a rating (Strong Sell, Sell, Hold, Buy or Strong Buy). Some of the retail sector stocks that have flashing Strong Buy Quant Ratings on them include Abercrombie & Fitch (ANF), Vera Bradley (VRA), Urban Outfitters (URBN), Guess? (GES), and PVH Corp. (PVH). Across all consumer discretionary stocks, Carrols Restaurant Group (TAST), Carvana (CVNA), and Alibaba (BABA) top the list of highest quant ratings.