Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

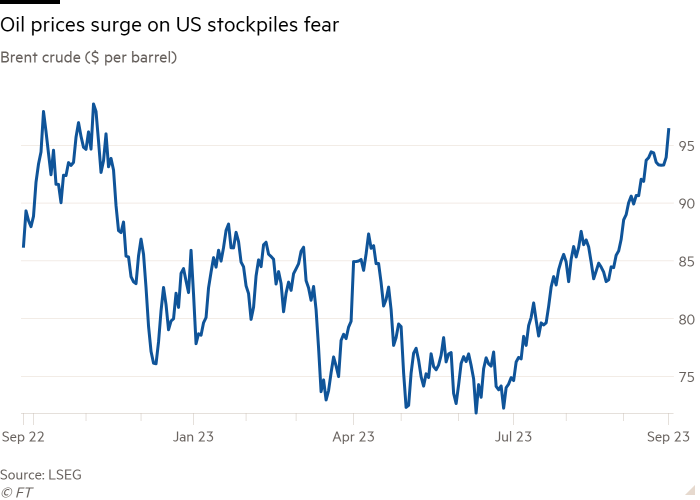

Oil prices surged nearly 3 per cent to a fresh 10-month high on Wednesday, approaching $100 a barrel, as lower than expected US stockpiles added to concerns about the impact of tighter global supplies of crude.

International benchmark Brent crude climbed as high as $97.06 a barrel, its highest intraday level since November 2022, before paring that gain slightly to settle at $96.55. The US equivalent, West Texas Intermediate, rose 3.6 per cent to $93.68 a barrel, as stockpiles at a critical delivery hub fell further, according to weekly government data.

The latest report from the Energy Information Administration showed that US commercial crude oil inventories fell by 2.2mn barrels from the previous week, further tightening supply, while the delivery point for WTI saw inventories fall to the lowest point in more than a year.

“The price correction we saw last week has run out of steam and market momentum is pointing to higher prices,” said Ole Hansen, head of commodity strategy at Saxo Bank.

Oil prices have risen 30 per cent since June after some of the world’s biggest producers announced a series of supply cuts to last until the end of this year, adding to investors’ concerns over persistent inflation in the US and Europe.

The benchmark US S&P 500 closed marginally higher, after hitting a three-month low in the previous session. The Nasdaq Composite rose 0.2 per cent.

Energy stocks rose on higher oil prices, with supermajors ConocoPhillips and ExxonMobil up 3 per cent and 3.3 per cent, respectively.

In Europe, the region-wide Stoxx Europe 600 index ended the day 0.2 per cent lower, notching its fifth successive day of losses.

US government bonds extended their sharp sell-off from earlier in the week, prompted by the Fed’s hawkish guidance that interest rates were likely to remain higher for longer because of persistent inflation.

Yields on the benchmark 10-year Treasury rose 0.05 percentage points to 4.61 per cent on Wednesday, hitting a fresh post-2007 high. Yields on the 30-year note advanced 0.03 percentage points to 4.72 per cent.

The dollar, which tends to strengthen when investors expect higher rates, rose 0.4 per cent against a basket of six peer currencies, hitting a fresh 10-month high.

“For most of this year, equities were able to rally despite rising rates because growth and earnings expectations were revised up too,” said Emmanuel Cau, head of European equity strategy at Barclays.

But the appeal of equities had declined as investors accepted that rates would stay higher for longer, threatening economic growth, he said. “Amid peak central banks’ hawkishness and downside risks to the economy, bonds are looking increasingly attractive versus equities.”

Meanwhile, US durable goods orders — a closely watched gauge of manufacturing activity — rose 0.2 per cent month on month in August, a sharp improvement from the 5.6 per cent contraction in the previous month, and above economists’ estimates for a 0.5 per cent decline.

New orders for non-defence capital goods excluding aircraft — considered a proxy for business investment — rose by 0.9 per cent in August, also beating forecasts.

Attention turned to US and eurozone inflation data due later in the week, as investors hoped to gain further insight into central banks’ plans for upcoming monetary policy.

Separate data on Wednesday showed that profits in China’s industrial sector fell 11.7 per cent year on year in the first eight months of 2023, compared with a larger 15.5 per cent contraction in the first seven months of the year, in a sign that recent support measures may be helping to stabilise the world’s second-largest economy.

Hong Kong’s Hang Seng index rose 0.8 per cent and China’s CSI advanced 0.2 per cent following a two-day losing streak.