Worried about the Market? ?

Join me LIVE today @ 1pm EST for a Special

I’ll Show you EXACTLY What I am Looking at

Trading Ideas I’m Looking to BUY Right Now!

Happy Thursday, everyone!

Yesterday was a sea of red, and today isn’t looking much better (at least yet).

I warned you last week about the SPY death line at $445. I knew if that didn’t hold, we’d see quite a bit more downside.

(Remember this chart I shared with you a couple of days ago?)

Well, that broke on Tuesday, and what happened?

Another big drop on the index, exactly like I said.

Folks, I’m giving you this advice for FREE–insights from over 20 years of market experience.

Bullseye Trades subscribers get much more, so join the community right now.

The selling started, and it hasn’t stopped. Any hopes of a rally yesterday ended when the Fed released the FOMC meeting minutes.

Looks like rate cuts are off the table, more hikes are on the way, and commercial real estate is in trouble.

As I write this, I’m looking at a bounce I discussed in my Bullseye Unlimited subscriber email this morning.

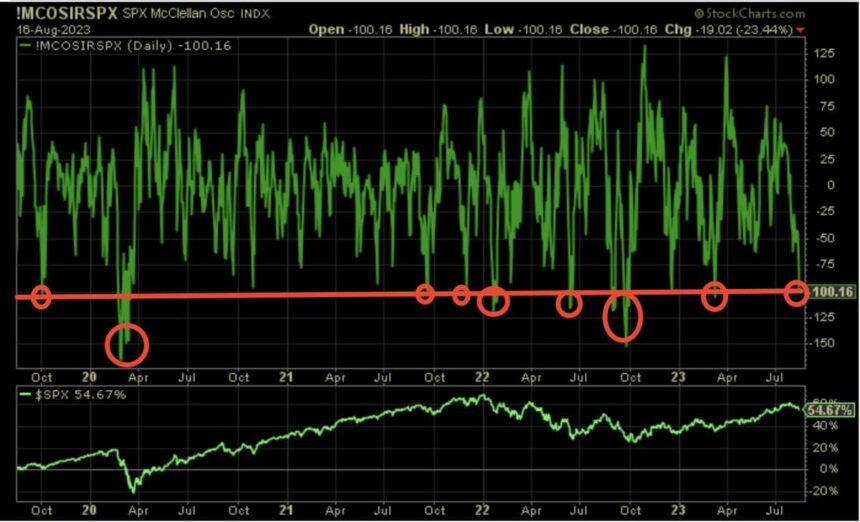

You won’t find hardly anyone else talking about this, but we’re sitting at -100 on the following chart, and I am sure you’re asking yourself, “So what?”

This is one of those weird osciallators I follow pretty closely. When it speaks, you need to listen.

You see, every time (but once) in the past four years we’ve hit this level, we’ve seen a 4% rally in SPY over the next 30 days.

Plus SPY and QQQ are heavily oversold and sitting just at the 50-day EMA. It’s been a key level of support since late March.

We got a pop this morning so let’s see if this plays out.

So it’s time for our end-of-week trade review.

Here’s how my Bullseye Trades worked out that I laid out for my members on Monday this week (before the market opened).

? Here Was the Plan

META crushed earnings, then fell.

It’s a powerhouse stock with lots of big money interest. Unless the whole market falls (which is always possible), it was oversold and ready for a bounce.

So I sent out the following alert to my Bullseye Trades subscribers outlining my outlook on the stock.

Included was the complete gameplan for how I would trade it, including the SPECIFIC OPTION I was looking at.

So what happened with this trade?

? Here’s What Happened

I got filled at my target price on Tuesday and sent out the following alert to Bullseye Trades subscribers.

Seeing META dip a bit more, I decided to add to the position as per my plan.

Subscribers know immediately when I place or close trades.

Ok, here’s where the plan changed.

My stop was a close below $295, and yesterday’s close was at $294.29. However, the market drop yesterday was on news, not technicals.

META was only slightly below my stop loss and sitting just above its 50-day EMA. This is a major level of support and institutional buying.

So I opted to stay in the trade.

I’m looking for a continuation of this morning’s bounce to push the trade into profit.

We’ll see how that works out. I’m optimistic.

But if things get too bearish, I’ll just take a small loss. No worries at all, it’s just part of trading.

I’ve had so many winners recently, this won’t make a dent. And another opportunity is coming MONDAY next week!

? Critical Lessons

Have a plan, but be flexible. Like the old military quote says:

“No plan survives first contact with the enemy”

Always leave open the possibility of modifying your plan based on new developments.

I’m NOT saying to trade emotionally – that’s suicide. However, I’ve been for so many years I’m comfortable making adjustments.

And you’ll get there too.

Join Bullseye Trades now and start getting the options education that will take you to the next level.

You’ll get my complete game plan every Monday, unlimited access to our training library, the trading ebook “How to Become an Alpha Hunter,” and alerts on trades I make sent directly to your Raging Bull app.

?Tomorrow, let’s dig into how exactly how I set up a trading game plan.

Before I ever buy a stock, I always have a game plan in place for what I’ll do if it doesn’t work out.

It’s a crucial part of being a successful trader, and I have learned a lot about who to do this so I don’t panic when trades don’t go my way.

?You can even join on your mobile phone… no download needed!

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.