Leon Neal

Defense stocks were among the top five gainers, while airline stocks dipped following Hamas’ attack on Israel last weekend.

The Industrial Select Sector (XLI) rose +0.96% for the week ending Oct. 13, while the SPDR S&P 500 Trust ETF (SPY) ticked +0.46% higher. Year-to-date, or YTD, XLI has gained +3.60%, while SPY has climbed +12.83%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +11% each this week. YTD, 3 out of these 5 stocks are in the green.

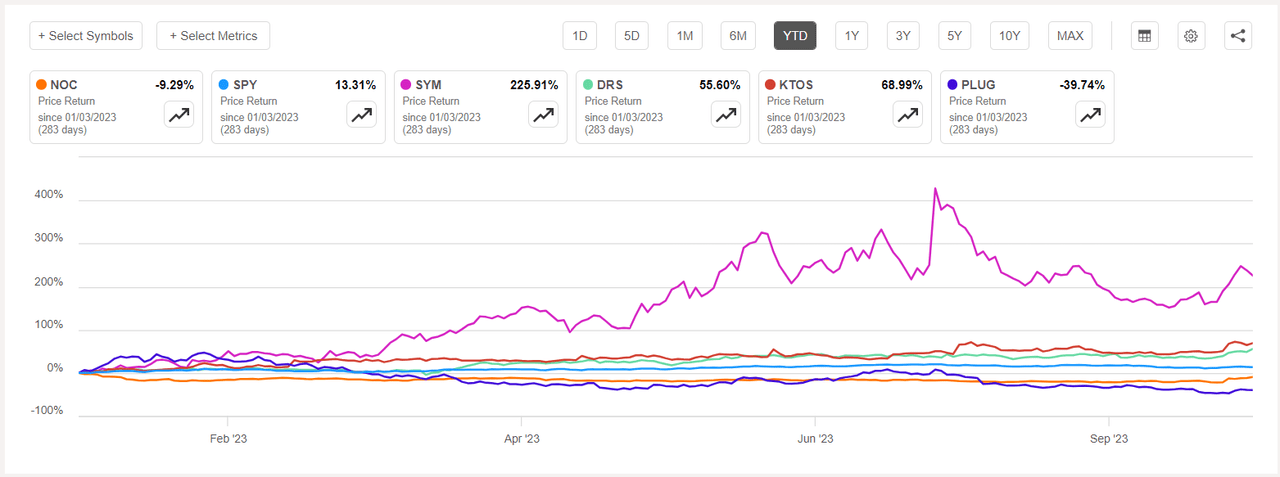

Northrop Grumman (NYSE:NOC) +15.81%. The Falls Church, Va.-based drone maker’s stock jumped +11.43% on Monday to lead gains in aerospace and defense companies following Hamas’ attack on Israel on Oct. 7.

Northrop has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade A for Profitability but F for Growth. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 8 out of 23 analysts tag the stock as Strong Buy. YTD, -10.16%.

Symbotic (SYM) +12.53%. The company, which offers warehouse automation systems, has been seeing gains again in the past few weeks after having witnessed slowdown in the earlier weeks of September and August. YTD, the shares have soared +228.64%, the most among this week’s top five gainers for this period.

The SA Quant Rating on SYM is Hold with score of A+ for Momentum and F for Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 8 out of 13 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Leonardo DRS (DRS) +12.04%. The Arlington, Va.-based defense electronic system maker’s stock also rose on Monday (+5.63%). YTD, the shares have gained +47.81%. DRS has an average Wall Street Analysts’ Rating of Strong Buy, wherein 4 out of 5 analysts view the stock as such.

Kratos Defense & Security Solutions (KTOS) +12.03%. The San Diego-based company was another defense stock which made it to the top five gainers after having surged on Monday (+11.10%). YTD, the shares have risen +64.24%.

The SA Quant Rating on KTOS is Hold, while the average Wall Street Analysts’ Rating is Buy.

Plug Power (PLUG) +11.04%. Shares of the company got a boost on Tuesday (+11.70%) after noting in an investor presentation that it expects to generate ~$6B in revenues by 2027 and $20B by 2030. PLUG has an SA Quant Rating of Sell, which in contrast to the average Wall Street Analysts’ Rating of Buy. YTD, the stock has tumbled -40.66%, themost among this week’ top five gainers for this period.

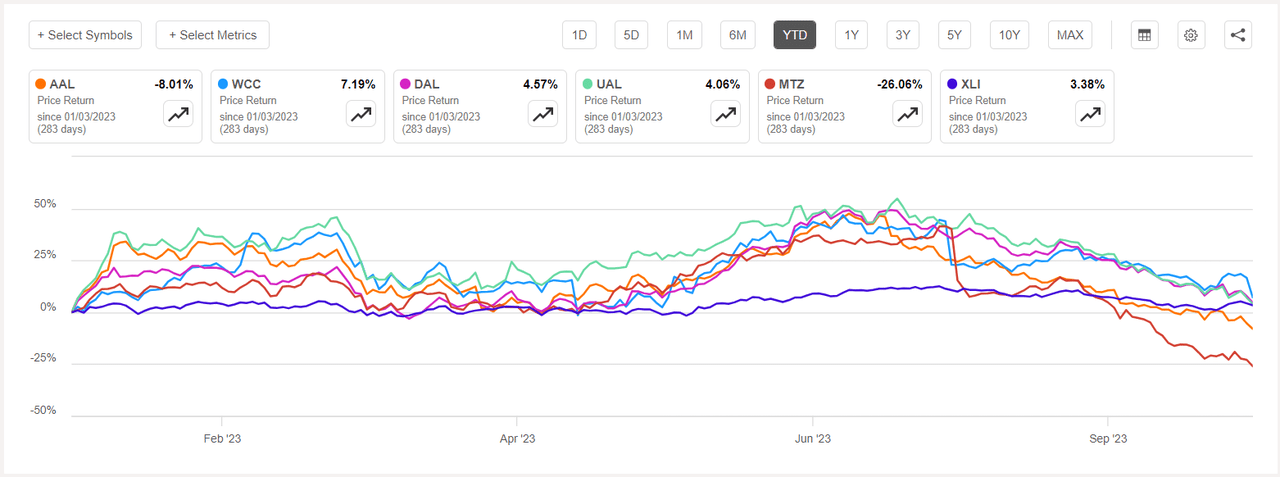

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -7% each. YTD, 2 out of these 5 stocks are in the red.

American Airlines (NASDAQ:AAL) -8.15%. Fort Worth, Texas-based company was among the airlines which suspended direct flights to Israel following the advisories from the U.S. and Israel. The company, reportedly, has suspended flights to the countrry through Dec. 4. Airline tracking data indicated that international flights to Israel were down about 90% from the level it were the previous week. YTD, -7.86%.

The SA Quant Rating on AAL is Hold with a factor grade of A for Profitability and D for Momentum. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 14 out of 21 analysts view the stock as such.

WESCO International (WCC) -8.15%. The business-to-business distribution and logistics services’ provider saw its stock fall the most on Friday -8.06%. The SA Quant Rating on WCC is Hold with score of A+ for Growth and B- for Valuation. The average Wall Street Analysts’ Rating has a completely different view with a Strong Buy rating, wherein 8 out of 12 analysts tag the stock as such. YTD, +6.79%.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Delta Air Lines (DAL) -7.84%. The shares dipped the most on Monday (-4.65%) amid the war in Israel. The company noted that it would not fly to Israel through the end of October. Delta also reported its Q3 results beating estimates.

The SA Quant Rating on DAL is Buy with score of A+ for Profitability and A for Growth. The average Wall Street Analysts’ Rating is more positive with a Strong Buy rating, wherein 14 out of 20 analysts tag the stock as such. YTD, +3.77%.

United Airlines (UAL) -7.41%. The Chicago-based airline, which saw its stock fell -4.88% on Monday, reportedly, has indefinitely suspended flights to Israel. YTD, +2.71%. The SA Quant Rating on UAL is Hold, while the average Wall Street Analysts’ Rating is Buy.

MasTec (MTZ) -7.40%. The infrastructure construction company was upgraded to Buy at Craig-Hallum Capital but it did not help boost the stock. YTD, the shares have declined -25.24%, the most among this week’s worst five performers for this period.

The SA Quant Rating on MTZ is Sell. More on MTZ – Warning: MTZ is at high risk of performing badly. The average Wall Street Analysts’ Rating differs completely with a Strong Buy rating.

Dear Readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.