A number of leading banks are slated to report their third quarter 2023 earnings results over the coming days. The interest rate environment and its impact on the banks’ key metrics is a prime area of focus. Here’s a look at what to expect from the earnings reports:

JPMorgan

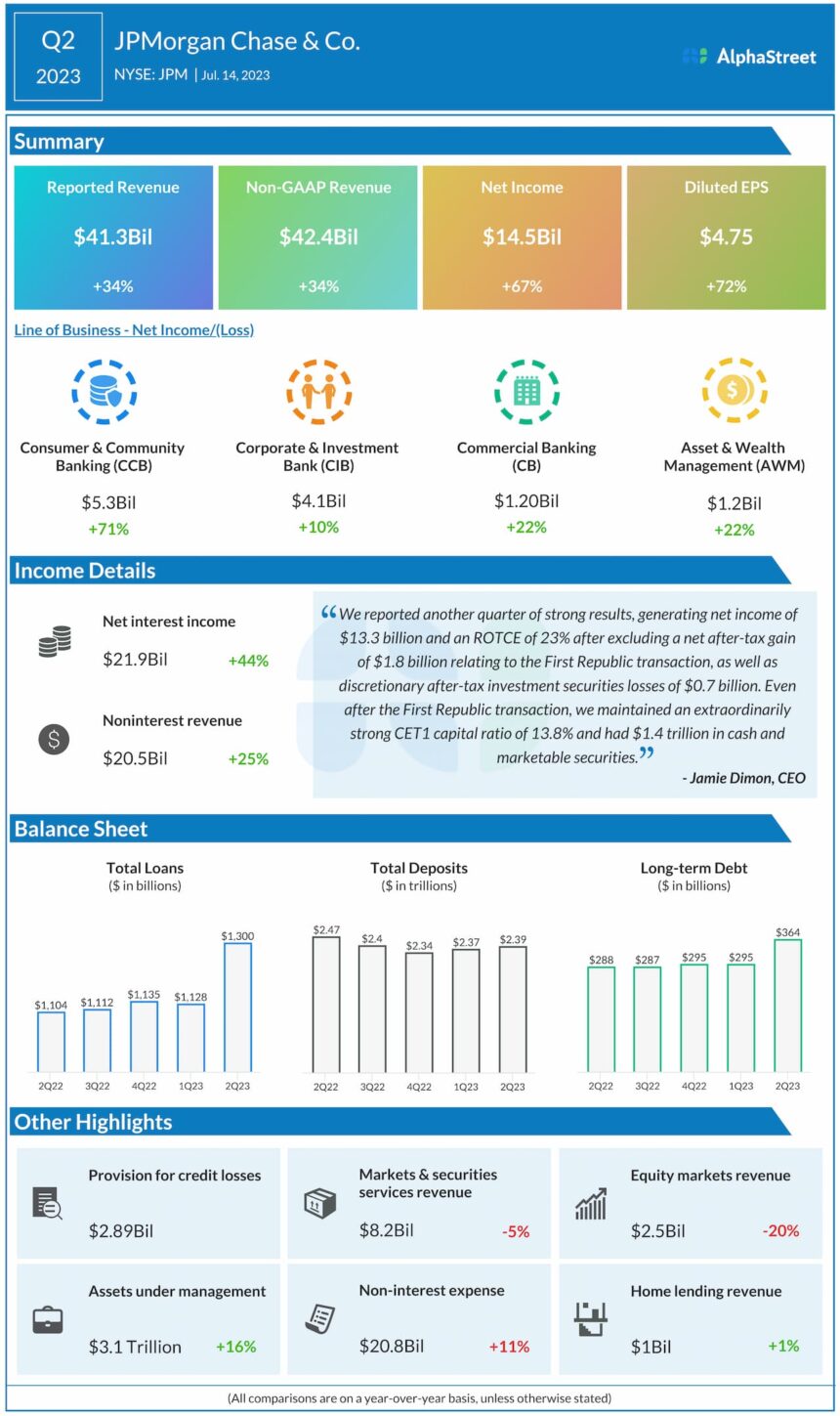

JPMorgan Chase & Company (NYSE: JPM) is scheduled to report its third quarter 2023 earnings results on Friday, October 13, before market open. Analysts expect the bank to report revenue of $39.6 billion for the period, which would represent a growth of over 23% from the year-ago quarter. The consensus estimate for EPS is $3.87 which compares to $3.12 reported in the prior-year period.

Citigroup

Citigroup Inc. (NYSE: C) is slated to report Q3 2023 earnings results on Friday as well. Analysts are projecting revenue of $19.2 billion which would reflect a year-over-year growth of over 5%. EPS is expected to be $1.19 which is lower than the $1.63 reported a year ago.

Wells Fargo

Wells Fargo & Company (NYSE: WFC) will also report its third quarter 2023 earnings results on Friday, before market open. Analysts are estimating revenue of $20.1 billion, which would represent an increase of 7% from the prior-year period. The consensus target for EPS is $1.22 which compares to EPS of $0.85 reported last year.

Goldman Sachs

Goldman Sachs (NYSE: GS) is scheduled to report its third quarter 2023 earnings results on Tuesday, October 17, before market open. Analysts are estimating revenues of $11.4 billion, which would represent a decrease of 4% year-over-year. EPS is projected to be $5.96, which is below the $8.25 reported last year.

Bank of America

Bank of America (NYSE: BAC) will also report its Q3 results on Tuesday, before market open. Analysts are projecting revenue of $25.2 billion, which would reflect an increase of 7% over the prior-year period. EPS is expected to be $0.80 which compares to $0.81 in the year-ago quarter.

Morgan Stanley

Morgan Stanley (NYSE: MS) is scheduled to report its third quarter 2023 earnings results on Wednesday, October 18, before market open. Analysts expect revenues to be $13.3 billion, which represents a slight increase from the $13.2 billion reported in the same period a year ago. EPS is estimated to be $1.35, which compares to $1.47 reported last year.