Are investors on the brink of losing a hard-fought recovery for the stock market this year? September is about to deliver the S&P 500’s

worst monthly performance of 2023 — a 5.1% drop (December 2022 saw a 5.8% tumble.) Thanks for nothing, bond yields and King Dollar.

If the index can hang onto the 11% return earned so far this year, that’s better than 2022, but maybe not the rebound many hoped for. And rising fear among investors could make the next three months tough, especially as bad news is now bad news.

Over to our call of the day, where a team at HSBC led by chief multi-asset strategist Max Kettner, says things are so gloomy, an upside surprise shouldn’t be ruled out.

“Our recent conversations have not been short of pushbacks on potential downside

catalysts — from a post-Taylor Swift/Beyoncé consumer spending hangover and numerous others,” say Kettner and the team, who draw upon Swift’s work to headline the note, “Shake it off.”

And while the catalyst for the latest pullback in risk assets is mirroring those of 2022 — higher yields and higher-for-longer restrictive monetary policy, they see one big distinction.

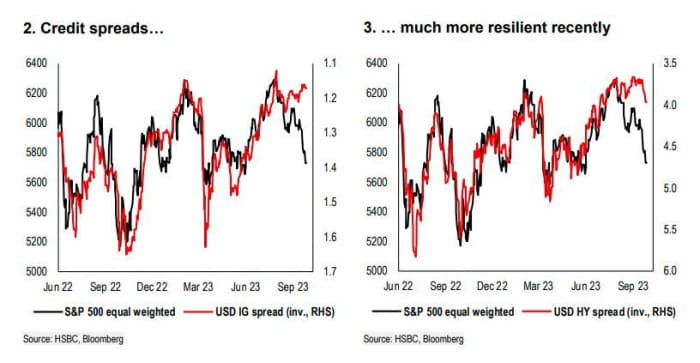

“The key difference to last year’s rates-driven selloffs is that it hasn’t happened in anticipation of a significant slowdown in growth, but instead due to growth still being too resilient, in particular in the U.S,” said the HSBC strategists in a note to clients. “As a result, credit spreads have also remained much more stable compared with equities.”

Credit spreads offer a looking glass into the health of businesses and their access to capital. Here’s the HSBC chart that lays out what’s been happening:

HSBC

How to play this? HSBC is sticking to an overweight on U.S. equities, and has lifted their exposure to energy due to “attractive carry” (potential profit to be earned from just owning an asset), with a nudge toward the U.K. due to its exposure to that sector.

Apart from faith in U.S. stocks, they broadly prefer U.S. over European risk assets headed into the fourth quarter. “The reason is simple: near-term consensus growth expectations for the U.S. are still very low – similar to the last couple of quarters. So the bar for positive surprises remains pretty low.”

For example, Kettner and Co. say it’s really hard to see any negative surprises in the next three to six months, and their own economists predict higher fourth-quarter and first-quarter U.S. growth and also fewer rate cuts in 2024 and 2025 than consensus. Inflation will head higher in the fourth quarter.

The big changes to sentiment that has put the S&P 500 on a slippery slope have been U.S. rates pricing, a dollar comeback and higher energy prices. Here, HSBC pushes back on a few more concerns among investors:

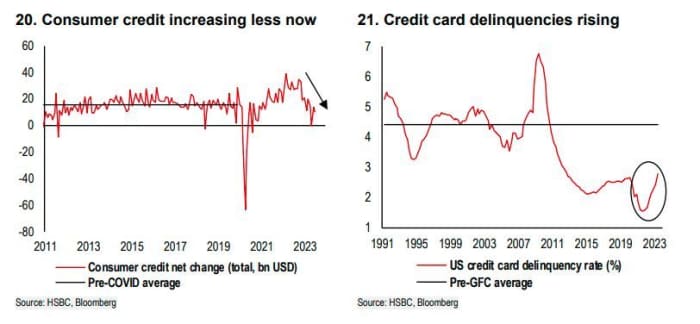

HSBC says markets are worrying too much about consumer credit and delinquencies.

- Excess savings running low among U.S. consumers. HSBC argues that real wage growth has been positive for some time, and low-income consumers have not been left out of that. Also, rising risk assets have like led to a “positive wealth effect for U.S. households.”

- Rising consumer credit. They point out that consumer credit is rising at a slower pace than 2021 and 2022. “In any case, it’s often a variable that is used as a bearish argument, regardless of the direction.”

- Increased credit card delinquencies. While delinquencies have been rising since late 2022, the level is “barely” where it was before COVID-19 and “nowhere near the pre-GFC [Global Financial Crisis] average yet.”

- Student loan debt moratorium expiration. As HSBC explains, those repayments have temporarily spiked higher since early July, but have since reverted down, and some fear this will restrain spending. “We wouldn’t be that negative though: the fact that debtors repaid student debt ahead of the expiration of the moratorium shows that indeed consumers still have money left to spend.”

- Wobbly job market. The strategists point out that a year ago, overwhelming consensus was for a first-half recession, Fed pivot and second-half recovery. Nonfarm payrolls, they note, grew 190,000 in August, initial jobless claims are less than 20,000 away from a record low seen a year ago and job openings remain about 1.5 million above their pre-COVID 19 peak. “This hardly qualifies as weaker.”

Also read: Investors should shun stocks and bonds as U.S. economy shows shades of 2008, top JPMorgan strategist warns

The markets

Stock futures

ES00

NQ00

are flat as crude

CL

briefly tapped $95 a barrel — the first time in a year. The 10-year Treasury yield

is up, to around 4.63%. The Hang Seng

fell 1.3% with shares of deep-in-debt property group Evergrande

HK:3333

halted amid reports its chairman is in police custody.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Fed Chairman Jerome Powell will speak at a town hall with teachers at 4 p.m. Weekly jobless claims and a revision to second-quarter GDP are due at 8:30 a.m., and pending home sales at 10 a.m. Federal Reserve Gov. Lisa Cook will speak at 1 p.m.

Meme-stock favorite GameStop

GME

is up 9% in premarket trading after the consumer electronics retailer named Ryan Cohen president and CEO.

Accenture

ACN

and CarMax

KMX

results are ahead, with recently downgraded Nike

NKE

coming after the close.

Peloton Interactive

PTON

is up 13% after the exercise bike maker and yoga-wear giant Lululemon Athletica

LULU

announced a five-year partnership.

Micron Technology

MU

is off 4% after the memory-chip maker forecast more negative margins. Its CEO sees “several hundreds of millions of dollars” in AI-fueled 2024 data center sales, but not for a while.

Best of the web

How Cathie Wood’s ARK plans to crack Europe

One investor’s battle to turn rewilding into a multibillion-dollar industry

The iPhone 15 is overheating for some users, and the fix may not be ideal.

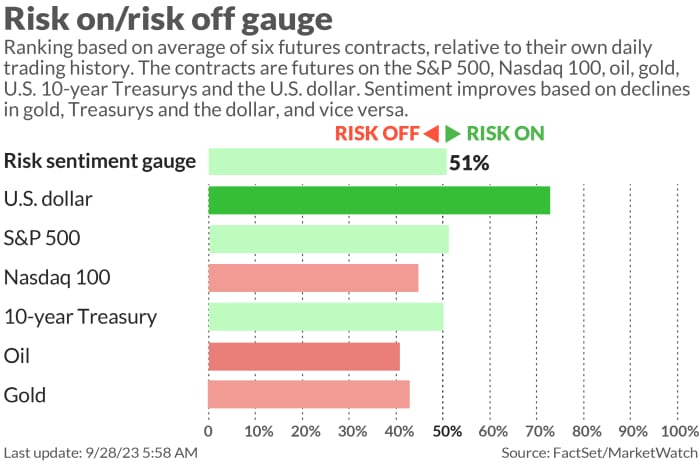

The chart

This chart sees a line in the sand for markets right now, from a trader and chartist known as Heisenberg on X:

@Mr_Dervatives

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m.:

Random reads

China is mad, and recalling its pandas.

When a bear comes to your birthday party, let him eat tacos.

Meet Grimpoteuthis, the adorable dumbo Octopus.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.