The beauty and personal care industry, and more specifically the fragrance sector, is impacted by the high cost of living as consumers are trying to scale back ‘unnecessary’ spending.

What’s Been in the Air of the Fragrance Market in Recent Years?

In recent years, the fragrance market has seen a number of innovations across the globe as a response to COVID-19 and the economic climate – both of which have been dominating consumer behaviour. These innovations included the positioning of fragrance as a tool for escapism or as an extension of self expression, and increasing the value perception of fragrance through added functions.

Current macroeconomic difficulties will help to position fragrances as a sensorial escape, and value perceptions can be driven by communicating quality and by innovating in alternatives, for example, texture.

In five years and beyond, the fragrance industry will need to adapt to challenges created by global warming and the increasing consumer demand for sustainable products. A combination of science and technology will help the category tackle these challenges and thrive in the future.

Read on to learn about the industry, fragrance trends, and market opportunities for your business in more detail.

How the Cost of Living Crisis Impacts Fragrance Market Trends

In the light of rising living costs, fragrances are not among consumers’ spending priorities. Many are developing more cautious spending behaviours and are focussing on experiences rather than products. But there is opportunity for premium beauty products to fit within these spending priorities by tapping into the category’s emotive nature, e.g. by communicating fragrance as part of life’s key moments.

Fragrances can be positioned as part of daily at-home experiences, e.g. when getting ready before a dinner with friends or having a lazy weekend. Moreover, collaborating through ads, hit TV shows, or influencers and famous faces appeals to those spending more time watching TV than going out.

Consumers are Trading Down

Price-sensitive shopping habits are becoming more apparent as the economic climate worsens. As explored in Mintel’s report The Future of Fragrance, Latin American buyers are trading down to cheaper alternatives, such as, from eau de parfum to body spray and from branded scents to cheaper non-branded alternatives.

To avoid losing their customers to cheaper off-brand fragrances, buyers need to understand the tangible and measurable benefits of branded products, or brands need to offer smaller pack sizes and refills to align with consumers’ savvy shopping behaviours.

Use Fragrances to Improve Consumers’ Mood During the Cost of Living Crisis

81% of UK BPC buyers express high interest in feel-good BPC products.

Brands can build on consumers’ association of fragrances with mood. It’s not surprising that stress relief, mood or energy boost, and mental clarity can indeed be a deciding purchase factor in the current economic climate; especially for consumers in the EMEA region. Brands need to communicate those beneficial effects through their on-pack messaging, comprehensive online content, or through vibrant marketing campaigns.

Source: Time To Relax by Krudivat

One example of MoodScience technology/feel-good ingredients is Kruidvat’s Time to Relax fragrance that advertises its usage of specific ‘feel-good’ natural ingredients, such as relaxing bergamot and calming ylang ylang.

Escape the Dreary Present Through Scent

Amidst inflation induced anxiety, consumers will look for escapism. Due to its emotive nature, the fragrance industry is well placed to tap into escapist themes. The most common fragrance component groups are associated with escapist and imaginative themes, such as fantasy, nature, or floral.

As people spend less time travelling due to strained budgets, consumers travel through their senses, and less common scents are among emerging fragrance industry trends.

Source: spice market by Natio

For example, Natio’s ‘spice market’ takes users along on a narrative journey based around a fragrant spice market, containing natural aromas: cardamon, basil, clove, and pepper.

Emphasise Durability & Value

Durability and product value are especially important to consumers as the cost of living goes up. As fragrances are not considered ‘essential’, consumers might need some persuasion to invest in perfumes and scents. However, value need not always be about low price. Value can also be related to long-lasting benefits and multifunctional products.

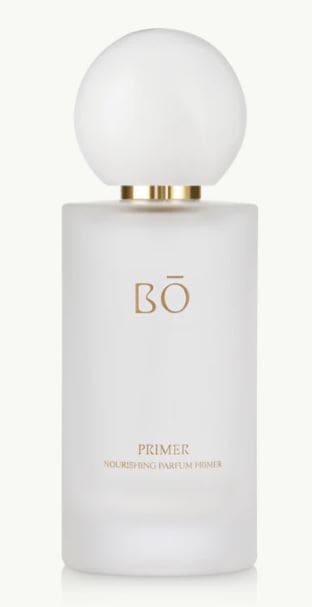

39% of US fragrance users would buy fragrance products they haven’t smelled in person if it was long-lasting. Brands can link long-lasting claims to value for money and offer their customers new ways of extending scent, which present opportunities to attract money-conscious consumers, e.g. by using primers – a niche emerging fragrance market trend. Such primers, applied before the regular scented product, enhance the durability of scent and can add an extra, more experiential step to the perfume application ritual.

Another way for brands to prove their worth is by promoting the more potent and durable benefits of extrait de parfum. Despite its higher price tag, brands can stress how only a few drops are needed per application since pure perfume contains a high concentration of perfume oil, thus making a bottle last longer, which aligns with consumers’ value for money perceptions.

Source: Bo Nourishing Parfum Primer.

The Scented Self: Fragrance as an Extension of the Wearer’s Personality

Fragrance, while functioning as a tool to escape reality during financially strained times, can also be positioned as an extension of the wearer’s personality. Turning fragrance into an expression of one’s own identity can ensure repeat purchase.

While older consumers have a clearer idea of which scents suit them, younger consumers are still trying to navigate the fragrance world. Brands can target their younger audience with education and tailored fragrance messages that address their individuality, thus encouraging brand loyalty at the point of market entry.

Over the past two years, fragrance launches carrying the word ‘spiritual’ have increased by 58%, showing that astrology and spiritual messaging associated with fragrances are a major emerging fragrance market trend and can help consumers make sense of their own personalities. This creates opportunities in the fragrance market to link astrology and zodiac signs to fragrances to reflect consumers’ personalities, as well as helping them search for specific scents.

Visit our Mintel Store for our most up to date market research

The Fragrance Industry & Sustainability

Global warming and its impact on the fragrance industry is bringing about new fragrance trends. There has already been a notable increase in eco-ethical claims within the sector over the past few years. This poses challenges for fragrance brands as many consumers, especially in the EMEA region, perceive fragrances as less eco-friendly than other BPC categories.

To counteract that, brands must be more transparent about their sustainability claims and communicate more openly, as in spite of more eco-friendly claims, consumers’ remain sceptical. In addition to transparent communication, brands can:

- Innovate around fragrances and sustainability.

- Tap into consumer interest around how fragrances are made and the ingredients used.

While on-pack space may be limited on fragrance bottles, and a minimalist design often prevails in the category, there are still opportunities for brands to cater to consumers, who are most likely to check packaging for ethical claims. One way to best present eco-ethical information on-pack, despite limited space, is through QR codes that take consumers to informative online content, e.g. ingredient sourcing, the production journey, INCI list details.

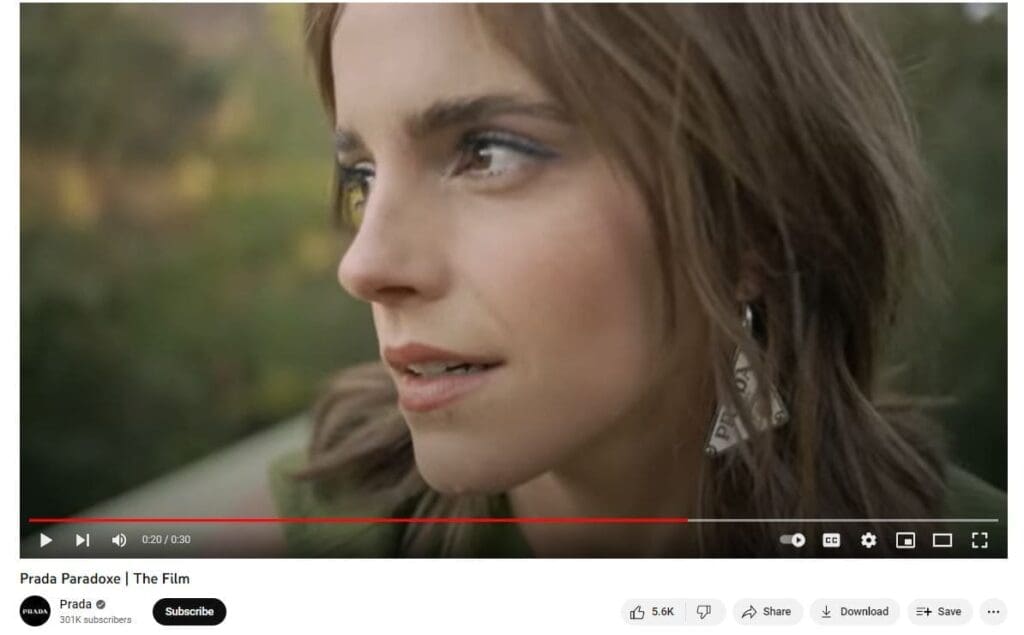

Celebrity ambassadors are another way to help raise the eco profile of brands. Brands like Prada are already doing this in their advert featuring actress Emma Watson, promoting the refillable merits of their product Prada Paradoxe Eau de Parfum. The refillable spray bottle has been designed to limit its weight and use of glass, ensuring a more sustainable impact.

Source: Prada Advert featuring Emma Watson.

Fragrance Market Opportunities: How to Bottle Innovation

50% of Chinese female BPC product users aged 18 to 24 are interested in novel formats and textures.

Unlock New Possibilities with Innovative Textures

Fragrance industry trends show that young women in Asian countries, such as China, show interest in BPC products with innovative textures and prefer them over established perfume sprays. As explored in Mintel’s fragrance market research, consumers are eager to explore, play, and embrace novel experiences following years of restriction due to COVID-19.

Currently, the fragrances market is dominated by sprays, mists, and spritzers with 65% of launches following these traditional formats. By evoking a sense of playfulness through texture and novel formats, brands can differentiate themselves and may broaden their audience. Solids, roll-ons, or gels inject a sense of play into product application and can engage consumers who would not normally buy fragrances.

Lead Innovation with Secondary Elements & Multifunctionality

While consumers in APAC are interested in innovative formats, one of the most sought after fragrance trends in the American market are additional functions that can help premiumise certain products over others.

While exclusivity is a strong purchase driver for some consumers, for younger generations, price is not always an indicator of scarcity. Instead, premiumisation by emphasising secondary elements, such as skincare, can elevate brands in their perception. Multifunctional fragrance products can be advertised by brands, promoting several benefits in one product:

- Two-in-one concepts are cost-saving during the cost of living crisis and increase a product’s value, thus benefiting consumers with strained budgets.

- Multifunctional formulas that blur fragrance with skincare or makeup are convenient for users by eliminating extra steps.

Source: Balsam Noon Flower Fragrance (Barrio White Dream series), is a solid scent and functions as fragrance and highlighter in one.

Brands can build on the self-care benefits of scent and look beyond aromatherapy claims by blurring their products with skincare, such as include soothing skincare ingredients or promote suitability for use on the body/linen/rooms to help create a more peaceful home environment.

Virtual Reality: An Emerging Fragrance Industry Trend

Going forward, the fragrance industry can take inspiration from the travel sector, which uses virtual reality to immerse potential tourists to a remote location from the comfort of their homes.

Similarly, fragrance brands can virtually transport consumers to the places of origin of the ingredients they use. For example, Dior created a virtual experience for their customers – the Immersive Journey- in which users can tour its fragrance house under a chosen avatar. More such opportunities for consumers to escape their daily lives – through scent coupled with VR – and learn about brand stories will become available through the advancement of the metaverse and VR technology.

Prepare for Future Fragrance Industry Trends with Mintel

Moving forward, consumers demand value for money, efficiency, and innovation that helps ensure the latter, while also bringing something new to the table – or the bottle.

How can your business respond to emerging and evolving fragrance trends and changing consumer attitudes as well as preferences? With Mintel’s leading independent market and consumer research, you can focus your strategies to align with what consumers want from the fragrance sector in the UK and globally.

Picked up the scent? Follow the trail for more industry insights.