Sam Bankman-Fried’s tweets have come back to haunt him.

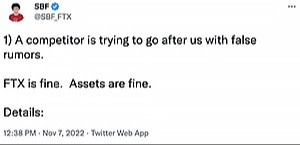

As customers raced to withdraw their money from his embattled FTX cryptocurrency exchange nearly one year ago, Bankman-Fried tried to stop the run on the bank with a message to his more than 1mn followers: “FTX is fine. Assets are fine.”

In testimony on Friday, FTX co-founder Gary Wang, one of Bankman-Fried’s closest friends, said the message was a lie: “No . . . FTX was not fine,” he told jurors. “Assets were not fine.”

Prosecutors have seized on this and other posts from the fallen billionaire’s prolific Twitter account as they try to convince a New York jury that Bankman-Fried lied to the public, his customers, lenders and investors, about secret dealings that let his own trading firm, Alameda, raid billions in FTX customer money.

As Bankman-Fried’s trial got under way this week, prosecutors again and again showed the jury screenshots of his posts on Twitter, since renamed X, and contrasted the public statements with insider testimony from Bankman-Fried’s closest associates.

Wang, who has pleaded guilty and is co-operating with the government, described how the night before he had helped Bankman-Fried to pin down exactly how much money Alameda owed to FTX customers. “The exchange was short $8bn,” he said.

Presented with a second tweet, where Bankman-Fried reassured customers that “FTX has enough to cover all client holdings”, Wang again said that his friend had lied.

“FTX did not in fact have enough assets to cover all client holdings,” Wang told the jury.

The panel of 12 jurors and six alternates includes a retired investment banker at Salomon Brothers, two Metro North train conductors, and a trained accountant who is the office manager for her husband’s landscaping business.

They will have to decide whether the pallid 31-year-old Bankman-Fried, sitting a few feet from them at the defence table, is really a master criminal, or just a spectacularly failed entrepreneur.

Bankman-Fried, who faces a lifetime in prison, has pleaded not guilty and maintains his innocence. His lawyers said in opening arguments he had made mistakes in the rush to build FTX into a $40bn company at the forefront of the crypto industry, but that Bankman-Fried had acted in “good faith” without the intent to defraud anyone.

The trial, which has become a test case for efforts by the US government to stamp out the freewheeling offshore cryptocurrency industry, will hinge on the personal relationships and intimate conversations of a handful of Bankman-Fried’s oldest friends and closest business associates.

The mood in the 26th floor courtroom in lower Manhattan was tense as Wang — who first met Bankman-Fried at a high school summer programme for gifted maths students and lived with him in college at MIT — walked swiftly past the defence table to take his seat on the witness stand.

When the prosecutors asked him to identify Bankman-Fried in the courtroom, Wang strained out of his seat to see his former friend among the sea of lawyers.

Bankman-Fried was impassive throughout the week’s testimony, tapping intensely on a laptop and avoiding eye contact with the witnesses. Wang will be cross-examined on Tuesday. One of the most awaited witnesses, Caroline Ellison, his one-time girlfriend and Alameda’s CEO, will take the stand early next week, prosecutors said.

“That is absolutely devastating testimony,” said Daniel Silva, a former federal prosecutor at law firm Buchalter. “The government has a compelling case . . . This is a great story. It’s a movie script in an indictment.”

Juxtaposing this testimony with Bankman-Fried’s tweets has become a powerful tool for the government. The jury saw a tweet from July 2019 where Bankman-Fried said Alameda’s account on FTX was “just like everyone else’s”.

But Wang testified that on the same day, FTX had implemented changes in the bowels of its computer code that gave Alameda unlimited rights to borrow from FTX — one of several unique privileges he helped hardwire into the exchange.

The jury also heard from an FTX customer, a London-based cocoa trader, who said Bankman-Fried’s assurance in the November tweets led him to leave his funds on the exchange until it was too late.

Matt Huang, an investor at VC firm Paradigm, which put $278mn into FTX, testified that his firm had asked about the exchange’s relationship with Alameda before investing and was told that Alameda received no special treatment.

Prosecutors have also tried to establish that Bankman-Fried knew about and orchestrated Alameda’s secret access to customer money for years before the exchange collapsed.

Wang testified to conversations about Alameda’s borrowing as far back as 2019. He described how the crash in crypto prices in spring 2022 prompted several third-party crypto lenders to demand repayment of loans from Alameda.

He walked the jury through a spreadsheet where he had calculated Alameda’s debts to FTX in June 2022 at $11bn, and described a meeting at the exchange’s Bahamas office where Bankman-Fried asked about the calculations before instructing Ellison to repay the third-party loans.

“The money ultimately came from FTX customers,” Wang said. “We said publicly that we would not use customer funds like this.”

Asked who he meant by “we”, Wang said simply: “Sam”.