Two months ago, I announced Forrester’s Revenue Growth Framework. We reviewed academic research, evaluated practitioner models, spoken with CMOs, and studied best practices among companies to distill a framework to help our clients develop a structured approach to growing revenue. I’ve applied this lens to Apple’s latest earnings release to analyze the company’s growth strategy.

Apple’s third-quarter earnings describe a mixed growth story.

Apple’s third-quarter earnings and tepid growth rates for its devices (iPhone revenue went down 2% YOY, although some of the damage was inflicted by adverse foreign exchange) caused a slump in its stock price after months of ascendancy. The climate in which the world’s largest company operates is one that many technology companies are struggling with. Macroeconomic headwinds persist as talk of recession is fading but not entirely gone, and Apple’s largest category (smartphones) is softening in developed markets where the company has a significant market share.

How can a large, established company like Apple that’s deeply invested in mature low-growth markets find new revenue growth? Here are three ways:

-

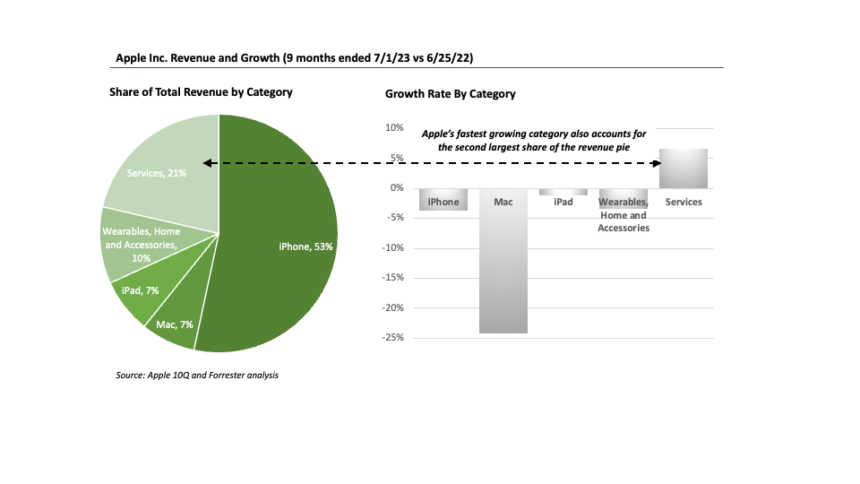

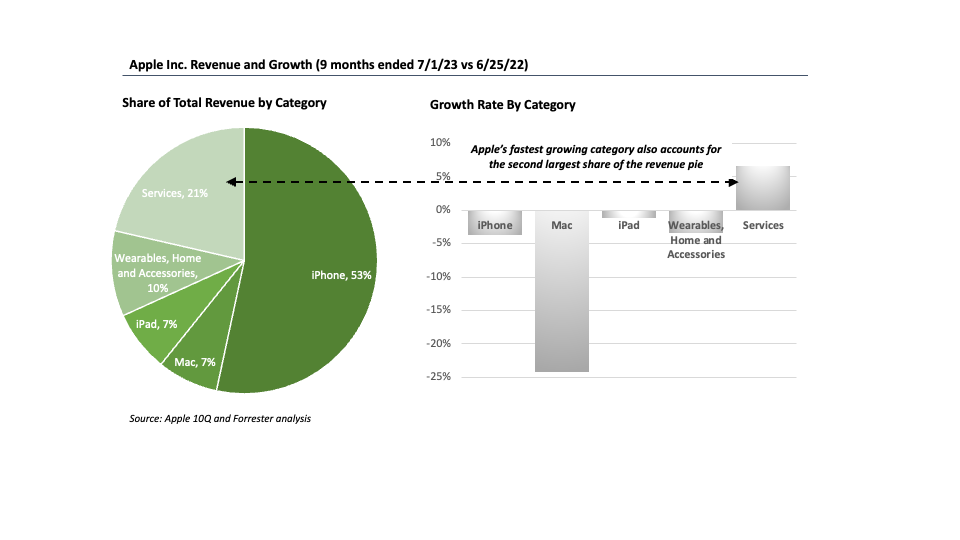

- The services business is Apple’s crowning glory. It may not be as big as the iPhone market, but it’s much bigger than any other device’s revenue. And at 8% YOY, it’s the fastest-growing category (when your fastest-growing category is your second-largest revenue bucket, that’s something to cheer about!).

- But wait, the best is yet to come. Services are much more profitable than products, and this favorable mix shift towards services has gone a long way in driving the third quarter’s overall margin improvement.

- If you thought that was it, there’s even more goodness – this short-term revenue growth indicates that Apple’s customer base is more engaged with the brand, more willing to connect to its ecosystem, and more likely to pay for incremental services. All of that sets the company up to capture significant long-term value.

These trends also hold good for the extended 9-month YOY comparison (as reported in the 10Q):

How else does a brand deeply penetrated in a mature market find growth? It finds other growing markets where it’s not well represented. Unsurprisingly, emerging markets remain the brightest spot in Apple’s world.

- China turned around a 3% decline last year into an 8% growth and even boasted record wearables sales for the June quarter, indicating greater engagement with Apple’s device portfolios beyond the iPhone.

- India set a June quarter revenue record, and the two brand-new Apple stores in Delhi and Mumbai have been “bearing expectations.” Apple’s share in India is modest, to put it generously, and the country remains a “huge opportunity.” In the future, as goes China and India, so will Apple.

Apple’s incredible ability to consistently find ways for what Tim Cook describes as “enriching people’s lives” has made it the world’s first trillion-dollar company. But it’s not ready to rest on its laurels. It has a strong record of thoughtful and deliberate innovation that’s not about being first to market but about making mass markets.

Forrester’s growth strategy framework can be found in this report: Unlock Your Revenue Growth Potential.

If you want to learn more about these topics, follow my research on Forrester and request a guidance session with me.