Investors in index funds have been well rewarded by a high concentration in the largest technology companies over the past decade. But there are also continuing warnings about the risk of such heavy concentrations, even in index funds that track the S&P 500. Solutions are offered to limit this risk, but if you expect Big Tech to continue to drive the broad market returns over the coming years, why not make an even more focused bet?

Comparisons of three index-fund approaches highlight how successful concentration in the “Magnificent Seven” has been.

The Magnificent Seven are Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Nvidia Corp.

NVDA,

Amazon.com Inc.

AMZN,

Alphabet Inc.

GOOGL,

GOOG,

Tesla Inc.

TSLA,

and Meta Platforms Inc.

META,

We have listed them in the order of their concentration within the Invesco S&P 500 ETF Trust

SPY,

which tracks the S&P 500

SPX.

The U.S. benchmark index is weighted by market capitalization, as is the Nasdaq Composite Index

COMP

and the Russell indexes.

SPY is 27.6% concentrated in the Magnificent Seven. One way to play the same group of 500 stocks but eliminate concentration risk is to take an equal-weighted approach to the index, which has worked well for certain long periods. But here, we’re focusing on how well the concentrated strategy has worked.

Let’s take a look at the group’s concentration in three popular index approaches, then look at long-term performance and consider what happened in 2022 as rising interest rates helped crush the tech sector.

Here are the portfolio weightings for the Magnificent Seven in SPY, along with those of the Invesco QQQ Trust

QQQ,

which tracks the Nasdaq-100 Index

NDX

and the Invesco S&P 500 Top 50 ETF

XLG

:

| Company | Ticker | % of SPY | % of QQQ | % of XLG |

| Apple Inc. |

AAPL, |

7.05% | 10.85% | 12.46% |

| Microsoft Cor. |

MSFT, |

6.65% | 9.53% | 11.76% |

| Amazon.com Inc. |

AMZN, |

3.30% | 5.50% | 5.84% |

| Nvidia Corp. |

NVDA, |

3.02% | 4.44% | 5.33% |

| Alphabet Inc. Class A |

GOOGL, |

2.17% | 3.12% | 3.83% |

| Alphabet Inc. Class C |

GOOG, |

1.88% | 3.11% | 3.32% |

| Tesla Inc. |

TSLA, |

1.79% | 3.10% | 3.17% |

| Meta Platforms Inc. Class A |

META, |

1.77% | 3.60% | 3.12% |

| Totals | 27.63% | 43.25% | 48.83% | |

| Sources: Invesco Ltd., State Street Corp. | ||||

The same group of seven companies (eight stocks with two common share classes for Alphabet) is at the top of each exchange-traded fund’s portfolio, although the top seven for QQQ aren’t in the same order as those for SPY and XLG. QQQ’s weighting was changed recently as the underlying Nasdaq-100 underwent a “special rebalancing” last month.

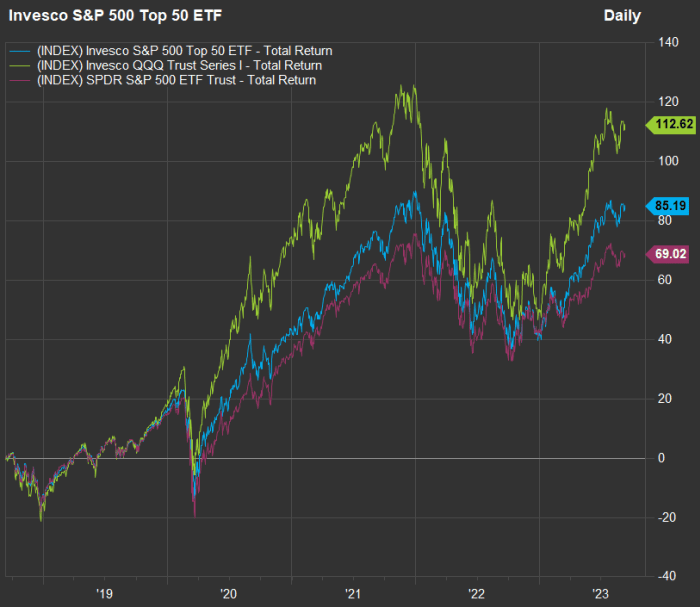

Here’s a five-year chart comparing the performance of the three approaches. All returns in this article include reinvested dividends.

FactSet

QQQ has been the clear winner for five years, but it is also worth noting how well XLG has performed when compared with SPY. This “top 50” approach to the S&P 500 incorporates many stocks that aren’t listed on the Nasdaq and therefore cannot be included in QQQ, which itself is made up of the largest 100 nonfinancial companies in the full Nasdaq Composite Index

COMP,

Examples of stocks held by XLG that aren’t held by QQQ include such non-tech stalwarts as Berkshire Hathaway Inc.

BRK.B,

Johnson & Johnson

JNJ,

Procter & Gamble Co.

PG,

Home Depot Inc.

HD,

and Nike Inc.

NKE,

Now let’s go deeper into long-term performance. First, here are the total returns for various time periods:

| ETF | 3 Years | 5 Years | 10 Years | 15 Years | 20 Years |

|

SPDR S&P 500 ETF Trust SPY |

40% | 69% | 223% | 370% | 531% |

|

Invesco QQQ Trust QQQ |

41% | 113% | 430% | 882% | 1,158% |

|

Invesco S&P 500 Top 50 ETF XLG |

41% | 85% | 262% | 404% | N/A |

| Source: FactSet | |||||

Click on the tickers for more about each ETF, company or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

There is no 20-year return for XLG because this ETF was established in 2005.

For five years and longer, QQQ has been the runaway leader, but for 5, 10 and 15 years, XLG has also beaten SPY handily, with broader industry exposure.

Something else to consider is that during 2022, when SPY was down 18.2%, XLG fell 24.3% and QQQ dropped 32.6%.

For disciplined long-term investors, the tech pain of 2022 may not seem to have been a small price to pay for outperformance. And it may have been easier to take the pounding when holding SPY or even XLG that year.

Here’s a look at the average annual returns for the three ETFs:

| ETF | 3 years | 5 years | 10 years | 15 years | 20 years |

|

SPDR S&P 500 ETF Trust SPY |

11.8% | 11.0% | 12.4% | 10.9% | 9.6% |

|

Invesco QQQ Trust QQQ |

12.0% | 16.3% | 18.2% | 16.4% | 13.5% |

|

Invesco S&P 500 Top 50 ETF XLG |

12.2% | 13.1% | 13.7% | 11.4% | N/A |

| Source: FactSet | |||||

So the question remains — do you believe that the largest technology companies will continue to lead the stock market for the next decade at least? If so, a more concentrated index approach may be for you, provided you can withstand the urge to sell into a declining market, such as the one we experienced last year.

Here is something else to keep in mind. In a note to clients on Monday, Doug Peta, the chief U.S. investment strategist at BCA, made a fascinating point: “The only novel development is that all the heaviest hitters now hail from Tech and Tech-adjacent sectors and are therefore more prone to move together than they were at the end of 2004, when the seven largest stocks came from six different sectors. “

Nothing lasts forever. Peta continued by suggesting that investors who are tired of big tech taking all the glory “need only wait.”

“[I]f history is any guide, their time at the top of the capitalization scale will be short,” he wrote.

Don’t miss: These four Dow stocks take top prizes for dividend growth