What is competitive socialising?

Competitive socialising brings together a range of traditional activities such as tenpin bowling, crazy golf and darts, along with novel and innovative offerings such as racing car simulators and social cricket, into an immersive and contemporary environment. Many operators are taking advantage of large vacant retail spaces, and are also increasingly focusing on providing extensive food and beverage options alongside these activities.

Changing high street offers opportunities for leisure and competitive socialising brands

Even before the outbreak of the COVID-19 pandemic, high-street brands were grappling with multiple headwinds including online competition and increasing overheads. During the pandemic, online retailers gained millions of new online customers, with many keen to stick to digital purchasing.

This has placed increased pressure on retailers with physical stores, with Debenhams, Topshop and Gap all closing a number of outlets since the start of the pandemic. However, as consumers continue to crave in-person experiences following COVID-19 restrictions being lifted in the UK, leisure venues and competitive socialising brands have proved to be popular amongst consumers. With many retail sites sitting vacant during the pandemic, leisure operators took advantage of discounted rent and even rent-free periods. For example, in December 2022, the highly anticipated F1 Arcade took over a 17,000-square-foot venue in London’s One New Change in St Paul’s – which was formerly occupied by Next.

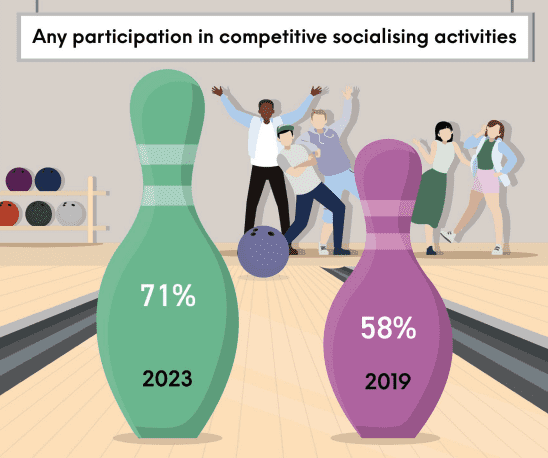

Competitive socialising participation

Our latest competitive socialising market report shows participation in competitive socialising activities has increased by 13 percentage points between 2019 and 2023. This is a result of leisure operators responding to increased consumer demand for in-person experiences by focusing on refurbishing tired venues, introducing new innovations such as integrated technology, and providing improved food and drink options.

Competitive socialising trends

So how can leisure and competitive socialising brands tap into this increased consumer demand? Here we outline 3 big trends in the competitive socialising market:

1) Cost remains at the forefront for consumers

When asked how much they spent on their most recent competitive socialising activity, over half of consumers said they spent less than £20 per person, and one-fifth spent under £10. The cost-of-living crisis has forced many consumers to re-evaluate their spending, especially those on lower incomes. Research conducted by Mintel found that many consumers expect to reduce spending on socialising/entertainment as a response to rising prices, increasing for those who describe their finances as tight or struggling. As such, it’s imperative for competitive socialising brands to promote affordable options for consumers where possible.

Of consumers who spent under £10 on their most recent activity, crazy golf courses and ping pong/table tennis were the most popular activities. Brands offering these activities often promote discounts for consumers. For example, Paradise Island Golf offers adult games for £10, or games for a family of four (two adults, two children) for £32. However, given most brands have also seen a significant increase in their overheads, this provides less room for operators to offer discounts to customers. Instead, brands should also look at offering annual passes and loyalty point rewards for consumers seeking good value for money. Paradise Island Golf also offers two-for-one entry, kids go free offers, as well as a loyalty card entitling visitors to claim 50% off after three visits, two-for-one courses after four visits and a free game after the fifth visit. This will encourage repeat visits from customers, who are also likely to visit the bar or café during their visit. Brands can also highlight the value associated with annual passes by promoting the fact that the membership will pay for itself once visitors have attended a certain number of times in a year.

2) But brands can still tap into premiumisation opportunities

However, the large majority of consumers remain robust about their finances. Affluent consumers have been more sheltered from the impacts of the rising cost of living, and as such, still have a healthy amount of disposable income. As a result, opportunities remain for operators to promote upgrades and premium options. For example, Lane 7 offers a Gimme All You Got package (which includes a game of bowling, a house drink, a meal, and one hour of a random game for £36 per person) for consumers seeking an upgraded experience. TeamSport go-karting also offers an upgraded package for keen racing fans to take part in a 50-lap, F1-style race for £50 per person.

Interestingly, satisfaction levels also increase in line with spending on an activity. Of those spending £40 or more, over half said they were very satisfied with their experience, compared to a quarter of those spending £20-39.99. Consumers who are spending more are likely to complement their activity with food and/or drinks. As a result, packages including food and drinks are a popular way for brands to encourage increased spending levels, and ensure consumers are getting value out of their activity.

3) Tech-focused venues should focus on attracting more young women

When asked about future interest in competitive socialising activities, young women (aged 16-34) said they were more likely to stick to more traditional activities such as bowling, crazy golf and escape rooms. On the other hand, young men (also aged 16-34) are more keen to try new activities such as racing car simulators, VR gaming bars and social cricket.

These experiences may typically be seen as more male-dominated, and so operators offering novel and innovative experiences should look at ways to encourage women to try such activities. This includes these venues holding female-only nights to make women feel more comfortable in these environments. For example, Sixes Social Cricket offers 50% off nets every Wednesday for all female groups of six or more guests, in order to introduce more women and girls to the social sport. Other brands should look at offering similar female-only initiatives to encourage more women to try new activities in a safe and comfortable environment.

What we think

Leisure brands are well placed to continue offering new and exciting experiences, particularly as the market evolves in line with technological advancements, as portrayed by the roaring success of the F1 Arcade. Younger generations are particularly drawn to competitive socialising activities, due to being more sober-curious than past generations, and as such, are increasingly seeking new and varied activities that provide a sense of adrenaline but don’t necessarily involve consuming alcohol. However, brands also need to focus on attracting older generations to competitive socialising activities. Operators could tailor activities towards older people’s interests during off-peak hours when retired people are available to participate, and focus on attracting a younger crowd during peak evening and weekend periods.