Throughout 2023, the spotlight has been on the impressive weight-loss results caused by drugs like Ozempic, Mounjaro, and Wegovy. With influential figures such as Elon Musk, Emily Simpson, Tracy Morgan, and Micheal Rubin openly endorsing these drugs, awareness has grown and their potential to combat the global obesity epidemic has caught the eye of investors.

However, as these GLP-1 receptor agonists, namely Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro, were initially designed to address diabetes by stimulating insulin production and lowering blood sugar, a new dilemma arises. The unexpected side effect of significant weight loss has captivated users and prompted a growing curiosity among food and drink brands. The question becomes: How will these drugs impact their industry and what should they do now?

Below are three ways food and drink companies can prepare for the impact of weight-loss drugs on consumer behavior.

1. Invest in portion-controlled packaging

The food and drink industry should continue to invest in portion-controlled packaging because it appeals both to people who are using the drugs and to those interested in weight management.

Portion-controlled packaging is a traditional food and drink option for weight management that is primed for a resurgence in the new era of GLP-1 weight-loss drugs. Smaller pack sizes will appeal to people on the drugs because users have reported feeling full after consuming less food or drink.

However, portion-controlled packaging can also resonate with any consumer wanting to maintain or lose weight. Packs with a specific calorie count or serving size make it easy for people who are currently trying to manage their weight and say they find it hard to tell what the right food serving size is for them.

Brands can offer portion control across occasions and the UK brand, Whitworths Shots, showcased this by advertising the calorie count on the front of their Raisin and Chocolate Mix snack.

2. Provide targeted solutions

Brands can provide tailored products for people who are using GLP-1 drugs, including small servings of fitness formulations and products that relieve the drugs’ common gastrointestinal side effects.

Small portions of sports and energy products can help people who are on the drugs maintain their fitness regimens. Pharmaceutical companies and medical professionals recommend pairing GLP-1 weight-loss drugs with a nutritious, reduced-calorie diet and increased physical activity. Since the drugs reduce appetite, smaller portion sizes should be considered by brands that provide benefits before, during, or after physical activity like the French brand, Andros.

Brands should also consider offering relief for gastrointestinal side effects since that is the most common side effect reported by users of GLP-1 drugs. The frequent experience of gastrointestinal side effects creates opportunities for medications, supplements and other products that can relieve these symptoms. US brand, Shaklee, offers stomach soothing drops that contain ginger and Vitamin B6.

3. Appeal to weight-conscious consumers who aren’t on these drugs

Food, drink and supplement companies can reach people who are curious but hesitant about GLP-1 drugs with products that emulate their benefits, including satiety and functional formulations for weight-related health conditions.

People who are on GLP-1 weight-loss drugs report feeling fuller for longer. Awareness of this feature could inspire consumers in general to seek satiety claims from brands because they want to achieve a similar feeling of fullness, without having to take the drugs. Chinese brand, Shapetime, achieves this by advertising that their Dried Coconut and Cashew Yogurt Cup “fights hunger”.

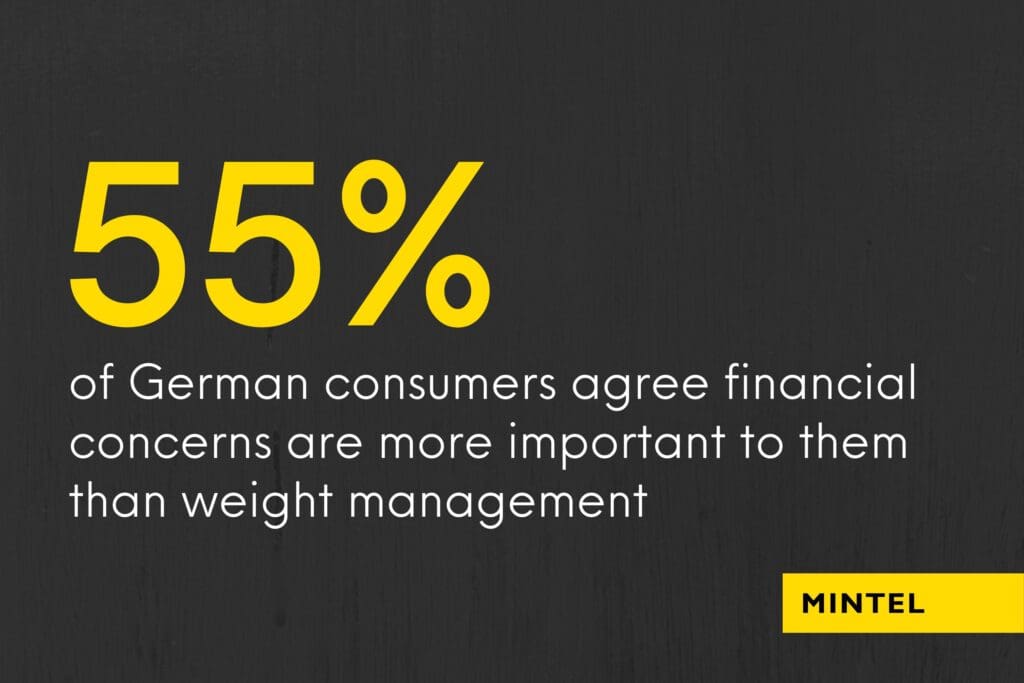

In contrast to the drugs, which are currently very expensive, nutritious and filling food and drink can be seen as having good value, as explored by Mintel’s 2023 Food & Drink Trend Savvy Sustenance. Value is crucial, given that price can be a barrier to dieting.

Consumer interest could grow in products with cholesterol or blood pressure benefits as well. In the US, Wegovy and Zepbound are approved for weight loss for people with obesity, as well as for overweight people who have a weight-related medical condition such as high blood cholesterol or high blood pressure. Since not everyone with these conditions can access or want GLP-1 drugs, publicity around the cardiovascular benefits of taking the drugs could renew the potential for products that are said to lower blood cholesterol or blood pressure. Portuguese brand, Danacal, showcases this by advertising that their Drinking Yogurt’s plant sterols lower cholesterol.

What we think

The food and drink industry should continue to invest in portion-controlled packaging because it appeals both to people who are using the drugs and to those interested in weight management. Food, drink, and supplement companies can also connect with non-users who might be looking for alternatives that deliver similar benefits to the key features of the drugs, including satiety and blood sugar control.

Interested to learn more about the potential impact of GLP-1 weight-loss drugs on the food and drink industry? Reach out today.

Subscribers of Mintel’s premium food and drink content can log in now to read the full article by Jenny Zegler, Director of Mintel Food and Drink.