In 2023 global cloud vendors all came up with their own digital sovereignty solution to address rising concerns from their customers. However, when I ask customers and vendors to define what digital sovereignty means for them, silence is the most common response. The lack of an agreed definition makes the job of cloud vendors harder when they try to come up with “sovereign” IT environments and offerings that satisfy customer demands. This confusion explains why sovereign offerings from hyperscalers and global cloud vendors look very different from one another.

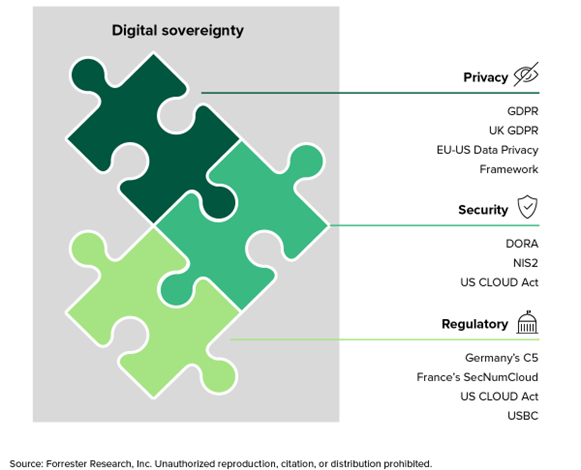

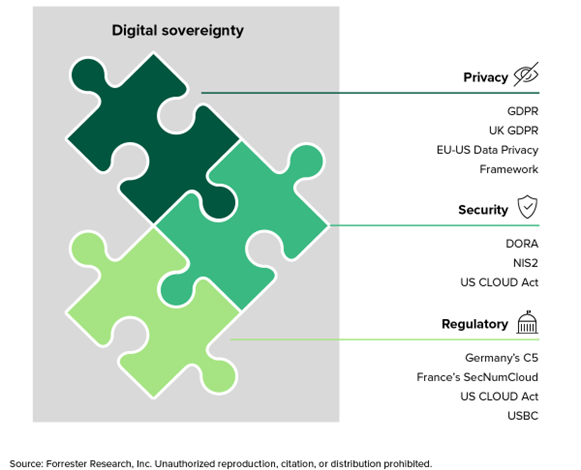

The Forrester report Digital Sovereignty Regulations Constrict Business Agility report gives a definition of digital sovereignty. Digital sovereignty concerns the data, hardware, network and the software protections that contribute to define your sovereign IT landscape in compliance with regulations (see Figure 1 below).

Hyperscalers’ Are Responding To Digital Sovereignty Demands

Hyperscalers and global cloud vendors’ sovereign offerings vary dramatically in how they tackle the digital sovereignty problem. Some of them focus on a single geographical area or country, while some others have global reach. Here is a summary of what is going on in the market:

- Microsoft launches Microsoft Cloud for Sovereignty to cater to global government sector. On October 3rd, 2023 Microsoft announced the public preview of the Microsoft Cloud for Sovereignty, meant to address digital sovereignty needs of public sector organizations. On the upside, Microsoft Cloud for Sovereignty will come at no additional cost for its existing customers. Regardless of this new offer, Microsoft is still in scope of the US CLOUD act, hence adoption will depend on how European regulation evolves and whether customers believe the guarantees in the new offering are credible enough to build confidence with their stakeholders and local regulators.

- AWS moves on with its Digital Sovereignty Pledge with a focus on the German market. On October 25th, 2023 AWS announced its AWS European Sovereign Cloud, an independent cloud for Europe. AWS’ offering is based on two key propositions: 1) keeping all customers’ metadata in the EU; 2) Only EU-resident AWS employees who are located in the EU have control of the operations and support the AWS European Sovereign Cloud. However, the huge focus on Germany and German customers means we are not confident recommending it to customers outside of Germany for now. More concerningly, the offering will feature its own billing and usage metering systems, ringing alarm bells for us that AWS intends to charge users a pretty penny for the privilege of using its European Sovereign Cloud.

- Google offers a portfolio of Sovereign Solutions but abandons customers to figure it out. Google Cloud has not yet come up with a comprehensive sovereignty proposition compared to other hyperscalers. The biggest announcement in 2023 was the Google Cloud’s Digital Sovereignty Explorer, an online tool to help organizations figure out their digital sovereignty requirements. The tool gives recommendations on potentially applicable solutions from Google Cloud and its partners. Google’s DIY approach shows a lack of customer care in dealing with customers’ concerns regarding digital sovereignty – and we expect customers to react accordingly.

- Oracle focuses on commercial and public sector organizations in Spain and Germany. Oracle EU Sovereign Cloud offers customers access to more than 100 services from its commercial public cloud. Among the positives, Oracle’s customers can leverage OCI services in Oracle EU Sovereign Cloud at the same pricing as Oracle commercial cloud regions. Furthermore, in October 2023 Oracle announced that the European Commission (EC) agreed to incorporate Oracle Cloud Infrastructure (OCI) and its platform services into the cloud service offerings available to the EU administration. However, Oracle has three key challenges to overcome: 1) Oracle is still in the scope of the CLOUD Act; 2) Oracle lacks several publicly available customer references compared to other providers; 3) and the presence of EU Sovereign Cloud regions only in Spain and Germany leaves customers in other EU countries with requirements to store data in the country because of regulatory requirements without a solution.

Digital sovereignty offerings from cloud providers are complicated and clients need to define their digital sovereignty requirements and approach. Our report for Forrester clients Digital Sovereignty Regulations Constrict Business Agility will help customers define digital sovereignty and design an effective approach. Forrester clients can book a guidance session with me to discuss this further. Also, be sure to heck out our latest episode of the What It Means podcast Tech Trends To Watch In 2024.