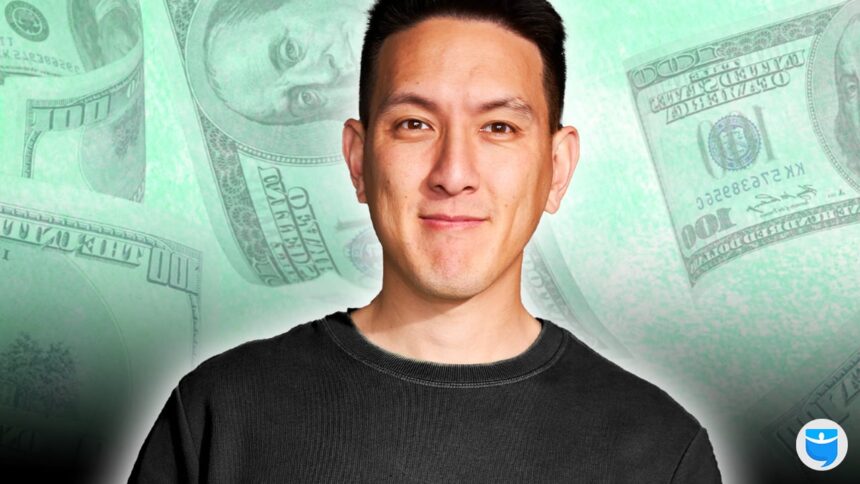

You probably already know who Humphrey Yang is, and even if you don’t, there’s a good chance you’ve seen one of his YouTube, TikTok, or Instagram videos. A few years ago, Humphrey’s internet presence was almost non-existent. He was living off savings, trying to find a business that would hit traction, until one day, he started posting financial content online. Within thirty days, he had a six-figure follower count. But this wasn’t by luck or accident; it was by design.

Humphrey knew that to start any successful business, it would take testing—a lot of testing. So, he set out to test content that not many other people were making, showing anyone and everyone on the internet what not to buy, the best ways to invest, and how they, too, could become wealthy, or at least not end up broke.

But Humphrey was ONLY able to do this after saving up a significant amount of money from past jobs, going extremely frugal, and realizing that he needed to do whatever it took to work for himself. And if you’re struggling to find your path and feel like being an entrepreneur is what you’re meant to do, Humphrey can help! In this episode, he’ll show you EXACTLY how he “tested” his way to wealth, made financial and entrepreneurial “hypotheses,” and grew an online following to over a million people in just a few years.

Mindy:

Today’s show is about a 36-year-old online entrepreneur who started his entrepreneurial journey after amassing $150,000 in savings in his 20s working in the gaming industry and as a financial advisor.

Scott:

You are going to learn the power of what a baseline level of frugality coupled with using that frugality to empower you to take calculated risks, also known as testing hypotheses, what that can do to turbocharge your success and allow you to build a business that reaches millions of people.

And while you might not be able to become the next YouTube star, you can certainly replicate our guest Humphrey’s formula for success. And we hope that you come out of this with some ideas for hypotheses that you can and will test in 2024.

Mindy:

Hello, our dear listeners, and welcome to the BiggerPockets Money Podcast where we interview Humphrey Yang and talk about his path to over a million YouTube subscribers and a successful content business. Hello. Hello. Hello. My name is Mindy Jensen, and with me as always is my “makes money both on and off the internet” co-host Scott Trench.

Scott:

Thanks, Mindy. It’s great to be here with my “always has a World Wide Web of opportunities to make money” personal finance co-host Mindy Jensen.

Mindy:

Scott and I are here to make financial independence less scary, less just for somebody else, to introduce you to every money story because we truly believe that financial freedom is attainable for everyone no matter when or where you are starting.

Scott:

That’s right. Whether you want to retire early and travel the world, go on to make big-time investments in assets like real estate, or start your own nine or 10 businesses, with most of them failing and one succeeding, we’ll help you reach your financial goals and get money out of the way so you can launch yourself towards your dreams.

Mindy:

Without further ado, let’s bring in Humphrey. Humphrey Yang is a former financial advisor turned YouTube financial superstar. With over 1 million subscribers, Humphrey shares video explainers breaking down complex financial concepts and telling stories about the tech and finance worlds. Humphrey, welcome to the BiggerPockets Money Podcast. I am so excited to talk to you today.

Humphrey:

Awesome. Thank you for having me, Mindy and Scott. How are you?

Mindy:

We’re doing good. I’m doing good. Scott, I shouldn’t talk for you. How are you doing, Scott?

Scott:

We’re doing great. Humphrey, we’d love to start off with hearing a little bit about your upbringing and what your family’s relationship with finances was like growing up.

Humphrey:

Oh, yeah. So I got a lot of my personal finance, I guess, interest from my dad. My dad grew up very poor in China. And my dad’s really old also. So this is a fact that some people know maybe from the channel, but my dad’s in his 90s now. And so he actually grew up during a really rough time at the time that was in China, and he grew up very poor, without any money to even buy food some days.

And so for him, I think he immigrated to the United States when he was in his early 40s, I believe, after a stint in the Air Force and flying for some airlines. Excuse me. And money has always been an interesting subject because I feel like my dad views it in terms of a scarcity mindset. So in his view, having money meant safety, which meant he never had to go hungry again. And he didn’t want his kids to experience that.

And so throughout my entire upbringing, money has always been a pretty central topic in just conversation, like this is why you need to save all your money. This is why you should not spend money frivolously. This is why you should be frugal. Because you never know what’s going to happen. This is why you don’t really want to get into debt because debt can erode your money. And if you make a few mistakes, you could lose it all.

And so for us, growing up, me and my siblings, it’s always been like we view money from a scarcity mindset. And I’m now trying to reprogram myself to more of an abundance mindset if you will, because I also am probably more risk-averse than your average 35, 36-year-old because of what I’ve been taught from my parents.

I feel like money is usually a subject that you learn from your parents and your family. So for me, I need to break free from that mindset in particular.

Mindy:

Do you find yourself being more frugal because of your upbringing or more spendy because of your upbringing?

Humphrey:

Definitely more frugal. So, usually, if I’m going to buy something, I always think about do I actually need this item? Will this item actually fulfill my needs in some sort of way?

And if the answer is even a shadow of a doubt a little bit no, then I might hold off on that purchase, at least for 24 hours, sometimes up to a week. And then I see if I still want it after a week or maybe even a month. And if I ultimately still want that thing, then I will go and buy it. But if it’s not a huge necessity, I oftentimes just don’t. I just opt for not buying it.

Scott:

Humphrey, did this mentality around frugality translate to a rapid accumulation of wealth in your college years and right afterwards?

Humphrey:

Yeah, I would say compared to my peers, yes. I always think I could be better, obviously, and it also depends on how much money you’re making. But that’s all wealth is; it’s just the difference between how much you spend versus how much you make. And if you’re able to accumulate a big difference of that and invest it accordingly, then you are going to become wealthier than someone else might be if they’re spending the majority of their income.

So I would say yes, I think that… I still go into it these days with… If I make $10, I try to only spend $2 to $3. Obviously, that’s sometimes not very realistic because rent is so expensive, food is so expensive, and all these things.

That’s my goal, that’s my ultimate target, but oftentimes it plays out a lot higher. I might spend seven of those 10 dollars. But the idea is that at least a 30% savings rate is still way higher than the average American does. I like to view any savings percentages over 15% as a win. And so if I’m overshooting my target, I’m going for eight and I can only save four, it’s not the end of the world. Right?

Mindy:

So do you feel like you’re depriving yourself of things? Do you wish you could spend more and feel guilty when you do? She asked as though that was her exact same story.

Humphrey:

Yeah. There’s a lot of things that I could spend money on. I’m going to Phoenix this weekend. I could have bought a first-class ticket, but I decided to choose economy instead.

Or I can eat a $30 lunch every day if I wanted to. I’ve done the math. I can spend $30 on lunch every day and not have to worry about it, yet I go to Chipotle or I go somewhere that’s really cheap because I know it’s easier, or I make food at home because it’s going to save me X amount of money.

Sometimes it’s just like, I like to not spend money because it’s more fun that way. I don’t know why, but that’s the deal, I guess.

Mindy:

It’s a game. It’s a game, and you’re like, “Ooh, how little can I spend today? How little can I spend this week?” You play these games with yourself because when you’re saving money, then that’s better, according to these frugal rules that we tell ourselves and that our parents tell us as they’re raising us in frugality.

Because I’m a grandchild of the Great Depression, so kind of a similar situation with your dad. I also don’t spend the money that I could spend because why would I? I could just save it instead.

Humphrey:

The other thing is that sometimes you have to think about why you’re saving. And so sometimes I’m irrationally frugal. It’s like, okay, I’m not going to take it with me when I pass away, so what’s the point half the time? But I feel like I still have so many more years left in my life, knock on wood, that I’d rather save it for now. So let’s see where I can get to.

Mindy:

Okay, so how do you break out of that mindset? Have you tried to break out of that frugality mindset and spending on things? This is a work in progress for me too.

Humphrey:

Yeah. I think a really good exercise is to… I put in a Google Sheet or a spreadsheet what my dream spend is per category. So if I didn’t have to worry about money at all, how much would I love to spend on every single category?

Do I want a $7 coffee every day? How much is that going to cost me? Do I want a $30 lunch every day like I just talked about? How much is that going to cost me? Dinner, I do the same thing. How much money do I want to spend on clothes? And oftentimes what you’ll find is that you don’t actually need that much money to hit your dream spend, or it might be closer than you think.

Scott:

I try to spend a percentage of the passive income that I’m generating and save essentially all of the active income. That makes me feel good and sleep well at night. That probably resulted in way too much sacrifice for the first 10 years of that journey, but that’s because I’m very hardcore and have that kind of mentality.

Humphrey:

That’s amazing. So, basically, you’ve gotten your passive income to a point where… Is it your fund money or you’re just completely living off of your passive income now?

Scott:

I spend less than my passive income, the passive income that I generate. I just also work this full-time job many hours a week because I love it here at BiggerPockets, perhaps like you with your business. You’re a highly successful entrepreneur.

And one of the reasons why I wanted to ask about the frugality and spend so much time here on this is because I believe, I have a hypothesis, I like to test, and you can tell me I’m wrong, that there’s a huge interplay between this long-term habit of frugality and discipline with your spending and the opportunities that have been presented to you in the twists and turns in your career. Can we hear about it and let me know if that’s close?

Humphrey:

Are you saying that the long-term compounding of frugality leads to better opportunities or are you saying that it affords you better opportunities in a way?

Scott:

Both. I think it allows an opportunity, for example, to start a YouTube channel to be an opportunity and not a risk.

Humphrey:

Yeah, I definitely agree. All the risks I’ve taken in my life are due to a safety net that I’ve accumulated over time, and knowing that my cost of living is so low that I don’t need that much to survive. And I’d like to keep my means, or sorry, my cost of living… I’d like to keep the amount that it takes to run my life as low as possible in order to take more risks in the future. Yes, definitely.

Scott:

Well, can we hear about your career and the college years and what you’ve been up to in order to get to this point?

Humphrey:

Yeah. So I didn’t know what I wanted to do in college. I went to the University of Washington for two years, and I was kind of depressed up there because it’s so rainy. And so I actually transferred to a school called Loyola Marymount University in Los Angeles when I finished up.

And I finished up at the end of the financial crisis of 2008. I actually graduated in 2009, so jobs were hard to come by at that time. I spent some time in Asia for six months afterwards on a study abroad program just trying to strengthen my Chinese. It’s a very procrastinating thing to do.

And then I came back to America and lived with my dad for a long time. And I just didn’t know what I wanted to do, but I was interested in a few things. I got my degree in finance, so I was interested in finance. I was also a big video gamer growing up, so I also wanted to try a career in gaming.

And my first job out of college was customer support for a Facebook game company. They made Facebook games similar to FarmVille if you remember those. I did customer support there for a year or year and a half. And then I ultimately didn’t like that job because it’s customer support.

I was interviewing with Merrill Lynch at the time, at the same time, and I got a position as a financial advisor. So I was a financial advisor for about a year to a year and a half as well. I got my Series 7 and 66 while I was there. And then after that, I practiced for about six months.

Scott:

Was the financial advisor role… Sometimes those can be very high-commission roles and sometimes those are salaried roles. Which one of those was it for you?

Humphrey:

They gave me a base salary of $49,000 a year, I believe. This was in 2012, 2011/2012, with the expectation of it transitioning slowly over the course of four years into a commission-only salaried role. And I think a large portion of the role was to prospect your network and try to get assets under management for Merrill, and that was basically their program.

It was called the PMD program. In exchange for the Series 7 and 66, the expectation was you’re going to be prospecting clients after you’re fully licensed, and you might work on a team, and you might help some of the more senior advisors.

Scott:

What happens next?

Humphrey:

Yeah. What happens next? A lot of uncertainty. I wasn’t sure what I wanted to do. I definitely wasn’t happy at the financial advisor role. I just realized that a lot of these… not Merrill in particular, but a lot of these big banks and their financial advisory programs, what they do is, in terms of investing, they just put you in standardized products that are approved by the big firms.

And so a lot of these big products are typically some sort of fancier ETF or a mixture of ETFs that are low-risk, predictable for their clients. And a lot of the financial advisory business was managing the relationship.

I think we had one advisor who was very successful who said, “I don’t actually manage money. I manage relationships. I manage expectations and I manage relationships. And people are happy. And that’s who they call. They call me when things are not going well in the market, for example.”

Obviously, I still think financial advisors are good for certain use cases. For example, if you need estate planning, tax planning, certain college fund planning, if you have specific situations, then you might need a financial advisor. That’s what I tell my friends that are looking into one.

However, if you’re just looking for investment returns, I’m sure you guys have heard that active fund managers don’t ever beat the market or most of them don’t beat the market, so you might as well just invest in a low-cost S&P 500 index fund. I still believe in that. And it was reinforced to me that way when I learned about that at the job.

Scott:

I always wanted to be a financial advisor. That was one of the things that I was really… Because I’ve always loved personal finance if you can tell from this podcast here. But I realized pretty quickly into the first year of my career that becoming a financial advisor was doing that kind of stuff.

It’s almost a little disheartening, isn’t it? A lot of people love talking about this, help people build wealth. It’s a shame that such a huge percentage of the industry monetizes with those AUM fees or, you didn’t even mention this, but life insurance products for example, and not the nitty-gritty helping people actually plan their estates and do that kind of work. That is really where I think the real value is added to the clients’ lives.

Humphrey:

Yeah. I definitely agree with you. I think there are definitely some advisors that are doing, I don’t know, God’s work, and they’re actually helping people with their finances. But a large percentage of the industry is just, “Yes, let’s get your assets under management, let’s charge you a fee, and let’s put you in some products. And we’ll have a call once a quarter, and hopefully, that’ll be that.” Yep, so that’s that. And then I guess you wanted to know what I did after that, I suppose?

Scott:

Yes, please.

Humphrey:

Yeah. After that, I did an investment banking internship for six months because I thought it was better finance if you will. I don’t know if that meant anything. But at this point, I was kind of lost in my life, I suppose.

And then I decided I wanted to go back into video games. So it was like 2014, I find a new company that a friend refers me to, it’s called Machine Zone. And I start off there as a quality assurance specialist, but then quickly I get a job helping them with monetization. So I’m about six months into this job, into the quality assurance, and I get a job switch to monetization.

And Machine Zone was a really interesting company. Machine Zone was Y Combinator-backed, and they had just raised a bunch of money because their games were monetizing very heavily. Their flagship game was called Game of War, and their second flagship game was called Mobile Strike. And if you remember those two games, they had Super Bowl commercials back in 2015/2016.

Arnold Schwarzenegger was in one. Kate Hudson, not Kate Hudson, Kate Upton was in another one. Mariah Carey was in one. This was the rage back then.

As a monetization specialist, what I was doing was I was designing in-game packages, in-app purchases packages for people to buy whenever they logged into the game. So whenever you log into the game, you would get an offer thrown at you like, Hey, do you want to buy this package for 50 bucks? These are all the in-game items you get.

You had to manage it a little bit. You want to make sure you’re not putting too many great items in the package so that it’s ruining your in-game economy. And you also have to title it and make a cool piece of art. You want to make it look as beautiful as possible.

And so I did that for two straight years, and that was a pretty grueling job. It was almost like a trading desk because we got real-time stats of how much money was being spent in the video game every single minute. And there were hourly targets and there were daily targets, and there were monthly targets of how much money we needed to make every single month in order to continue our upward growth trajectory.

And this game was pulling in a couple of million dollars a day. This thing was crazy. At one point, this company was valued at $5 or $6 billion in its heyday. And I helped sell these in-ad purchases.

So I got a lot of real-time feedback, real-time data. I learned how to A/B test really well. I learned how to look at this data and make experimental inferences about what was going on. And I would say this period in my life, which was two straight years of almost 24/7 all the time, really taught me a lot about just marketing, psychology, data analytics, A/B testing, everything that you could think of to grow a business, I would say.

Scott:

Awesome. And so what years were you there and then what’d you do next?

Humphrey:

Early 2014 to late 2016. So it would’ve been two years and change maybe. In 2017, I started a business called YourOwnMaps. I wanted to sell posters online. I don’t know why. A friend of mine came to me and said, “Hey, we should sell some posters online.” I’m like, “Okay.” Well, I quit my job and I wanted to start my own business.

Scott:

Okay, perfect. I want to ask about this transition. So you’ve been working for a couple of years. Is this the point in your journey where the frugality that’s an underpinning behind all of this career progression begins to pay off and affords you the opportunity to take a risk on a business?

Humphrey:

Yeah. Yeah, it definitely did. I think I had at least $150,000 saved up. I was living at home too, which was great because I’m not spending any money on rent. I have $150K saved up. And I’m like, “Okay, I can quit my job for a few months. I can think of something.”

I wanted to start a business, and I didn’t know what to start. So, January 2017, a friend of mine comes to me. He had just came from Europe and he was working for Facebook. And he was like, “Hey, I’ve seen this business model in Europe do really well where they sell these custom posters of these maps, and we could do that here in America.” I was like, “Okay, great. Let’s do it.”

And so I didn’t know what I was doing, but I knew that I could do… I’m always a big believer that I can learn how to do anything. And so we spent a few months developing the website and what it will look like.

I spent a couple of months looking for a supplier, so someone to print the actual product and then ship the products to end customers. I guess I’m kind of fast-forwarding a little bit, but it was a tough time of six months of not sure what to do. I spent about $20K on the website initially of the $150K. I still had $130K.

Of course, I was still spending money eating food and seeing my friends and doing entertainment stuff. But because of the frugality, that definitely afforded me that opportunity. And I could have done it for another year or two without making any money at all and been totally fine.

And so that’s what I tell some people who want to do something entrepreneurial on their own. It’s like, you need at least a good nest egg of six months to a year of living expenses for a real shot at these things. Because my own business wasn’t even successful until maybe month nine. And so if you’re thinking… And that’s good, by the way. A lot of these businesses don’t break even until year three.

And so, for me, I was lucky in that we started to make some profit right away and see some success there. I still wasn’t drawing that much money from the business. My first year salary was maybe $35,000, 38,000. And then the next year was 40, 45. It showed me that I could do it, but it showed me that I also needed to think of something different if I wanted to make more than $40,000 or $50,000 if that makes sense.

Scott:

You were mapping out the journey to financial independence.

Mindy:

Oh, Scott, what a terrible pun.

Humphrey:

Yeah.

Scott:

Sorry.

Humphrey:

Good pun.

Scott:

Thank you for the groan. I appreciate it, guys.

Humphrey:

Yeah. So I did this business from 2017 to middle 2019. And at the same time, I’m trying all these other different types of things. I tried to create a budgeting app. I hired someone on Upwork. I’m trying different things. I wrote an E-book on how to email market, and I tried to market that on Twitter. And then I also tried dropshipping, which I failed at. Dropshipping was way harder than actually starting a real business, in my opinion.

Mindy:

Wait, but the guys on the internet say that you just start it and you make all this money. What do you mean? That’s not true?

Humphrey:

I think it’s a really great way for people to get into online E-commerce for a very low price point, but it comes with a lot of risks, and I think it’s more of an art form to do it right correctly. And what’s funny is that if you become really great at dropshipping, you actually just want to create a white-label business or a real E-commerce business.

So it’s like you’re doing all these steps to just get to where I already was at. So for me, I was happy doing just the straight-up E-commerce business. But dropshipping is hard, definitely not easy. And I think it’s hard not because of selling the product. I think it’s hard because of the logistics behind the scenes.

The products are coming from China. If they’re coming from China, it’s like a three-week ship time. And so now you have to deal with customers that are pissed off at you because of the three-week ship time. And then you have to deal with the payment processors that are getting charged back from those customers because the product’s not coming in time.

And then you have quality issues, and you have all these… It’s just not the best model if you want to have a great experience for the customer. But it’s a good model for those entrepreneurs that are trying business for the first time and they don’t have more than like $3,000 to spend.

Scott:

So you tried an E-book, we have a dropshipping business, we have a map business. What else is going on here? And how many of these initiatives go on until you settle on making videos?

Humphrey:

Yeah. I probably had four to five different initiatives from 2017 to 2019 that I tried, some with other friends, some by myself. I also did some consulting on the side just to make an extra income.

I would consult for this one marketing company. It was, at the time, called MarketerHire. And so other E-commerce businesses would hire me to help them with their email marketing or their marketing in general. And all these principles I learned from the video game business, by the way, just marketing and psychology.

Scott:

A/B testing, right? That seems like that’s a huge competency.

Humphrey:

Yeah. And it’s actually not too hard, but then it’s understanding if the data that you have is statistically significant and making hypotheses about the next test and next iteration. So it was about middle 2019 that I was like, okay, maybe I should try making some videos on YouTube.

Because I’d just listened to a Naval Ravikant podcast, and he was all about scaling yourself through either code or media. And I was like, okay, let’s try some YouTube videos. I really believe in what he says there.

So I tried three YouTube videos, they went nowhere. I had 10 views on each one because I sent them to all my 10 friends. I kind of gave up on it, to be honest. I made three. I was like, “Okay, that was a good try. Whatever.” It was just another initiative at the time.

But then I caught myself watching TikTok in 2019, and this was at a time when people my age weren’t watching TikTok. It was mostly teens, I would say. And I would watch it every night before bed. I thought it was pretty funny and I was pretty addicted to it.

And then at some point that fall, it kind of dawned on me like, hey, I should check if anyone’s making personal finance videos on TikTok. And nobody was. There was one video. I searched #PersonalFinance. There was literally one video. And there was one guy making videos about stocks, and they weren’t that good.

So I said, okay, if I can be first to market on here, maybe I can get some traction and get people over to my YouTube channel. And then eventually, I can make YouTube videos. That was my whole goal. And so towards the end of 2019, I decided to have a goal of making 30 straight TikToks in a row, 30 days.

I think on day 11, I had a video that got 100,000 views on day 11, and that got me like 1,500 followers. And I was like, “Wow, that’s cool. That’s way more than I’ve ever gotten on YouTube.” And I think on day 17, I had a video go viral and get 3 million views, and I got 100,000 subscribers, sorry, 100,000 followers on TikTok at the time from that one video.

So by the end of 30 days, I had 120K followers on TikTok. And I was like, all right, well, I’m going to keep going because clearly there’s demand for this type of content. And so by the time the pandemic actually started, I already had 350,000 followers, which was great.

And then I had nothing to do because it was COVID, there was nothing to do. So I was like, oh, I might as well just keep making a video every day because it’s like, dude, I’m already here. There’s nothing else to do. It’s easy to make a video. It gave me some purpose throughout COVID.

At that time, I started to slow down on the maps business because it wasn’t doing that well anymore. And so it just was a slow shift towards video creation. And then at the same time during COVID, I started to make YouTube videos again, and I’ve just been going ever since.

Scott:

They say that nine out of 10 businesses fail, and so your approach is to start 10 businesses.

Humphrey:

I probably tried 10 different initiatives, for sure, throughout my life. And they might not have been great initiatives, but at least a month here and there, a couple of months here and there, etc. Yeah.

Scott:

I mean, if you think about it, it took you three years to find what worked for you with these things. You kept your expenses really low. You applied a skillset and the scientific method to a variety of different businesses. And when you hit one, you went all in, and you love it, clearly, with it, and it’s been super successful.

I think that should be inspiring to folks. If you can actually commit the capital and have the time and space to try these initiatives, you can fail six, seven, eight, nine times over a two or three-year period and hit a winner on that. That’s not unachievable for a lot of folks, I think, listening to this.

Humphrey:

Yeah. I definitely think it takes more than one shot. I have friends that take one shot at something and they give up. But I also think I had an unfair advantage because I was able to live at home. Not many people can live at home for free in the Bay Area. I was saving $2K, $3K a month on rent.

And I was okay living at home. That’s another thing. And some people in their early 30s might not want to live at home because of embarrassment or whatever, and it didn’t bother me. Before the podcast, Mindy asked me if I was married and have kids, and the answer is no because I probably spent four of my prime years living at home and not really dating.

Scott:

Well, let’s get into your processes for making these videos. What was it? You just stick a camera, take a look at it? How did it start and what is it like now?

Humphrey:

Oh, yeah. It’s way different now than when it started. When it started, I’m literally making a video about any topic that comes to mind that I think is remotely financially personal finance-related. And there’s no thought behind the topic. It’s just like, “Hey, that sounds interesting. Let’s make a video about that.”

Or, “Airbnb is IPOing this week. Why don’t we make a video about that?” Or, “The presidential election is here. Why don’t we make a video about that?”

Some of those topics could be good, but I was literally just turning out… There was one video I made that was comparing the difference between Bitcoin and Pokémon cards as an investment, and it was just a bad… That’s such a bad topic, but I thought it was great at the time.

So in the beginning, it was very much like, let’s just make whatever and see what sticks. And I still think that’s a really great method. You’re testing all these different things and seeing what sticks and what doesn’t.

But as I’ve gotten better at YouTube over the years, it’s definitely more methodical in terms of what topics we choose. And topic selection is, I think, one of the most important things on YouTube because it determines your market size. If you make a topic about coconut water from Bali or something like that, the ceiling for that might be 100,000 views.

But if you made a video about the toxicity of carbonated water, I don’t know, I just saw you drinking a bubly, you might be able to get 2 million views on that because it’s a way wider, broader topic. I always think about market size now when I think about making a YouTube video.

Scott:

I have a mini fridge with nothing but cherrybubly in it right next to my office. That’s not a joke or an exaggeration.

Humphrey:

Well, there you go.

Mindy:

If somebody is listening to this episode right now and thinks, “I want to be the next Humphrey Yang,” what is your advice to somebody who wants to start making money online?

Humphrey:

Yeah. So if you want to do YouTube videos, my advice is always make searchable content in the beginning. Have a library of 50 to 100 searchable video topics at the beginning because that builds you a strong base.

You know that certain topics are always going to be searched. For example, what is asset allocation? That is a great video that you can make that’s four to five minutes long, talking about what it exactly is. If you think about it, if you have 50 different topics like that, like what is asset allocation, what is risk, what are some of the index… what things should you look for in index funds? All these searchable-type topics, eventually, every one of those videos is going to start compounding for you with views over time, and you’re going to build a nice base of views on your channel over the course of a year or two.

And then that’s when you can start to play around with the types of topics you can do to try to hit more trendy type of topics and try to capitalize on high viewership. It’s like, imagine you had a channel with 50 of those financial explainers. I’m just talking about finance because that’s what I got.

And then all of a sudden, Silicon Valley Bank crashes, you can make a Silicon Valley Bank video which would’ve gotten you an outsized number of views, and then people would be interested in all your other topics because it’s financially adjacent. And then you can build your brand that way. I think too many people just give up on their YouTube videos.

I was about to give up after video three, but I think Ali Abdaal says this, he’s a productivity YouTuber, he says it takes 50 to 100 videos. And I think even Mr. Beast has said, “Hey, if you’re trying to become a YouTuber, make 100 videos and then talk to me. Don’t talk to me before 100 videos.” So I think it takes a long-term mindset of let’s do this for a really long time and see what happens, and then adjust.

Mindy:

Is this just you doing this or do you have a team? Is there a bunch of people behind you helping you out?

Humphrey:

It’s mostly me and an editor. So my editor has been with me since November 2020, and he actually reached out to me in June of 2020. This was very early on. I had no YouTube presence. I had 500,000 people on TikTok maybe, and he just DMed me cold and said, “Hey, I’d like to edit for you one day.” And I kind of ignored him for a few months, and then I needed one in November.

I edited my first 100 videos myself probably, and then I hired him. And then he’s been working with me since. And he’s actually improved his editing skills so much, and he definitely wants to learn. He’s someone who’s entrepreneurial as well, so we get along really well.

And a huge reason why we have so much success is because of his animations on the channel. If you notice, a lot of our videos are animated quite well. And he’s an editor plus animator, which is hard to find. Usually, you have to find two different people that are editors plus animators. But he taught himself animation throughout the last three years. So, very thankful for him.

So it’s just me and him, and then I have a guy that helps me make thumbnails, and that’s it. And I’m trying to find another editor so that I can come out with more videos next year.

Mindy:

Okay. Well, that leads me to my last question. What is the future of your content and your financial journey? Where are you going next year? What are you focusing on?

Humphrey:

Yeah. I have a lot of financial YouTuber friends. They make a lot of money. And sometimes I feel bad because I don’t make as much as them. And I think they make a lot of money because they’re hyper-focused on their niche. They might sell a product or they might offer a service, or they might offer a course or something like that, and they’re able to capitalize on that. They might have better affiliate links for the certain niche that they’re in.

I still don’t know how I feel about selling a course. I don’t love it. I think a lot of the information that you can get online is free anyway, so what would my value of a course be? Maybe it would be to concisely condense everything so it was just really easy for you and really easily served.

But right now, I don’t think I have a product or a service or a course offering that really fits my channel perfectly that I could offer to my audience. So right now, I’m not creating a side business off of the audience right now, off of my channel.

And so my goal is still to do YouTube in five, 10 years. And so I really want to continue to grow the presence that I have online, continue to grow viewership. And I think sometimes just making videos is all I need to do. I think that all the biggest YouTubers, if you look at Marques Brownlee in the tech space, he’s been doing YouTube videos for 15 years.

He hasn’t really sold a product or a service too hard either. He has a merch line ish, but it’s not like he’s got a flagship product or a flagship business that he runs on the side. His main business is videos. And for 15 years, it has worked. So, clearly, there’s that business model that works. It’s like, let’s just make great videos, and I just want to keep doing that.

Mindy:

That’s fantastic. You need to protect your audience. You’re not selling anything right now, and that’s what your audience loves. You’re giving them great content without just bombarding them with stuff. You’re genuine in your delivery.

And when somebody is trying to sell something and be skeezy, that comes across. It oozes out of every pore that they have. And you’re like, “Nope. Next.” I don’t know if you know this, you’re not the only guy on YouTube. There’s no shortage of guys on YouTube. So they’ll just go find somebody else that they connect with better.

On the other hand, you have an audience, and they watch you because they like you. They want to learn from you. So if you have something that aligns with what they’re looking for, even if it’s all over the internet for free, there is a value for somebody whose voice that they appreciate gathering it all together in one place for them to find this information.

If you do do a course, give them $200,000 worth of information for 20 bucks, not 20 bucks worth of information for $200,000, because there’s no shortage of those guys either.

Humphrey:

Yeah. I think it’s just I haven’t found something that aligns with me perfectly just yet, and I’m definitely searching for something like that. I know it’s part of my longer-term vision. But for now, I don’t feel an immense pressure to do that right now.

Mindy:

Yeah, you don’t have to. How about just a T-shirt with Humphrey Yang’s face?

Humphrey:

I don’t know if anybody’s going to buy that.

Scott:

Humphrey, before we adjourn here, is there a place where people can go find out more about you?

Humphrey:

Yes. Please subscribe to my YouTube channel, it’s Humphrey Yang. And then I also have a newsletter, it’s called Hump Days. It’s on Substack. So we come out with business news twice a week for free, Wednesdays and Fridays. Humpdays.substack.com. That’s perfect. That’s where you can find me.

Mindy:

Humphrey, thank you so much for your time today. This was so much fun. And we will talk to you soon.

Humphrey:

Cool. Thank you, Mindy and Scott, for having me on BiggerPockets.

Mindy:

All right. Scott, that was Humphrey Yang, and that was super fun. I love his story. I felt a kinship with him with the whole growing up frugal and now saving everything you have. Yeah, we both need to work on that a little bit more. What did you think of his story?

Scott:

I thought it was dangerous because I have a clear and obvious bias for how I think is a really good formula for building wealth, and he largely fit right into that bias by spending so little, finding opportunities to increase his income, saving a bunch, and then trying 10 entrepreneurial journeys, which is my dream blueprint for success. If only he’d house hacked as well, but he got to live for free, so I guess that’s part of it. But yeah.

Mindy:

He kind of house hacked.

Scott:

Yeah.

Mindy:

He hacked his housing by not paying anything.

Scott:

Yeah. It does not make a rule, but I just think it’s such a high-probability path for success. And you can swap out the living with the parents with a house hack, for example, and have many of the same opportunities there in many parts of the country, probably not San Francisco where he’s from, but in many parts of the country.

Mindy:

Yes. And he mentioned unfair advantages. I think that everybody has an advantage. I don’t like the phrase “unfair” because everybody has an advantage. Take advantage of your advantages. There’s a lot of people who have advantages. They don’t take advantage of them. They don’t use them at all. They just let them sit. And then it’s just a waste.

So if you have an advantage, use it. Use what you have to further… Scott, you have a big brain. You use that in your day-to-day life. You use that in your job. That’s giving you an advantage over anybody else that was going to be CEO. They didn’t have the same brain that you had. And therefore, they’re not CEO. It’s just what you have. You use the tools in your toolbox to further your career, to further your steps. So yeah, when you have something that you can use, take advantage of it.

Scott:

Well, thank you for the big-brain comment, Mindy. I really appreciate it. I also have incredible admiration for your enormous brain and the ways that you put that to use. And I’ll throw in another one for you, which is your community. You’re an incredible community builder, and you use that advantage in a lot of “unfair” ways to bring happiness, joy, and business into your life, and business opportunities. So, love that in so many ways.

I do want to throw out a question here. What hypothesis, Mindy, are you going to test in 2024?

Mindy:

I am going to test… Wow, Scott, put me on the spot. What are you going to test while I think of one?

Scott:

I am going to test the hypothesis that there are a large number of people who are losing money investing in passive syndications at this point in time because of the market dynamics and unfortunate realities of higher interest rates, and that those folks are going to take this opportunity as a lesson and spend a large amount of time learning how to run the nuts and bolts of analysis on passive investment opportunities like apartment complexes and syndication deals like self-storage, like debt funds, and that there’s an opportunity for BiggerPockets to provide an educational platform that does very rigorous analysis on those types of deals and helps people make really highly informed decisions about what the bet they’re actually making is in those types of things.

So we’re going to call it Passive Pockets, and we’re going to launch it sometime in 2024. That’s my hypothesis.

Mindy:

My hypothesis that I’m going to test throughout the entirety of 2024 is that spending on things that bring me joy or that make my life easier is not going to hurt my overall financial position and will, in fact, make my life better. So I am going to do that. And I have started and stopped and started and stopped. And I’ve got a list of things that I want to accomplish next year, and spending money to get them done is now going to be the way that I go, as opposed to doing it all myself.

Scott:

Those who are listening here, thank you so much for joining us today. We’d love to hear what your hypothesis that you’re going to test for 2024 is. Please share that with us in the Facebook group at facebook.com/groups/BPmoney, and we’ll be looking there.

Mindy:

All right, Scott, should we get out of here?

Scott:

Let’s do it.

Mindy:

That wraps up this episode of the BiggerPockets Money Podcast. He is Scott Trench, and I am Mindy Jensen, saying toodles Goldendoodles.

Scott:

If you enjoyed today’s episode, please give us a five-star review on Spotify or Apple. And if you’re looking for even more money content, feel free to visit our YouTube channel at YouTube.com/BiggerPocketsMoney.

Mindy:

BiggerPockets Money was created by Mindy Jensen and Scott Trench, produced by Kailyn Bennett. Editing by Exodus Media. Copywriting by Nate Weintraub. Lastly, a big thank you to the BiggerPockets team for making this show possible.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.