Who wants ice cream? Well, if we look at global ice cream consumption, the answer is: almost everyone! According to Mintel’s consumer research, nine in ten UK consumers enjoyed an ice cream between July and October 2023, and an almost identical number was seen in Germany. Frozen treats are also omnipresent in freezers across the pond, with over 94% of US adults purchasing ice cream, frozen novelties or frozen yogurt in 2023.

It’s clear that ice cream remains as popular as ever, and the global ice cream industry is in good health. Ice cream is still enjoyed primarily as a comfort food for many consumers. In the US, around nine in ten ice cream consumers agree that eating ice cream brings joy when they need a pickup, highlighting the product’s well-established role as an ‘emotional support food’ for consumers. However, consumer demands are changing: consumers’ increased focus on healthy eating has led to more scrutiny of foods with traditionally high sugar and fat content. Similarly in the APAC region, there is a demand for better-for-you ingredients and formulations. Naturally, it is essential that ice cream brands respond to consumer demand to avoid consumers turning elsewhere for a sweet treat. In this article, we examine the ice cream consumer trends shaping the industry, and how brands are responding with ice cream innovation.

What is a comfort food?

Comfort food is a food that consumers turn to in times of stress that provides a sense of emotional health and wellbeing. Typically, comfort foods are high in fat or sugar, energy-dense, and may have relatively low nutritional value. Popular comfort foods include crisps, chocolate, and of course, ice cream.

Explore Mintel’s Extensive Ice Cream Market Research

Global Ice Cream Industry Trends

Putting the ‘fun’ in ‘functional food’

The past few years have been a boon for popular comfort foods, with consumers experiencing the heightened stress and anxiety of the COVID-19 pandemic, and then followed by ongoing economic crises. The ice cream industry was particularly well-placed to benefit from rising prices and high inflation due to the lipstick effect. Ice cream’s positioning as an affordable treat appeals to consumers during times of economic crisis.

However, since the pandemic, Mintel has found there has been a global shift towards more health-conscious eating. Ice cream brands have therefore found themselves in a bit of a quandary. Do they take inspiration from the plant-based industry, embrace dairy alternatives, and focus on creating a healthier alternative to traditionally indulgent ice cream? Or do they dial up the indulgence, and heavily lean into the comfort food reputation? The answer isn’t a simple one. Mintel’s consumer research has found that it is unlikely that ice cream could ever establish itself as a truly healthy food, even amongst consumers who are actively looking for healthy ice cream: a quarter of Indian consumers who are willing to pay more for healthier ice cream believe that ice cream can never be healthy. As a result, ice cream needs to offer permissible indulgence to consumers, striking a balance between health and indulgence.

While nutrition is not a top priority when buying ice creams, almost a quarter of US consumers are interested in ice cream with functional health benefits. Brands are well placed to grow ice cream’s reputation as a functional food by targeting young consumers who are keen on high protein products, or take inspiration from the booming energy drinks sector, and provide a much sought-after energy kick to consumers. Although the functional ice cream market remains quite small, it is growing. Mintel’s GNPD data shows that ice cream product launches with functional claims increased by 10% between 2021-2023, highlighting that it is something brands should be considering when it comes to new product development.

Ready for an adventure

Functional ingredients and added health benefits are not the only new features drawing significant consumer interest in the global ice cream industry. Consumers are getting more adventurous, at least when it comes to new flavours and textures. Mintel has found that there is a growing interest in unconventional ice cream flavours.

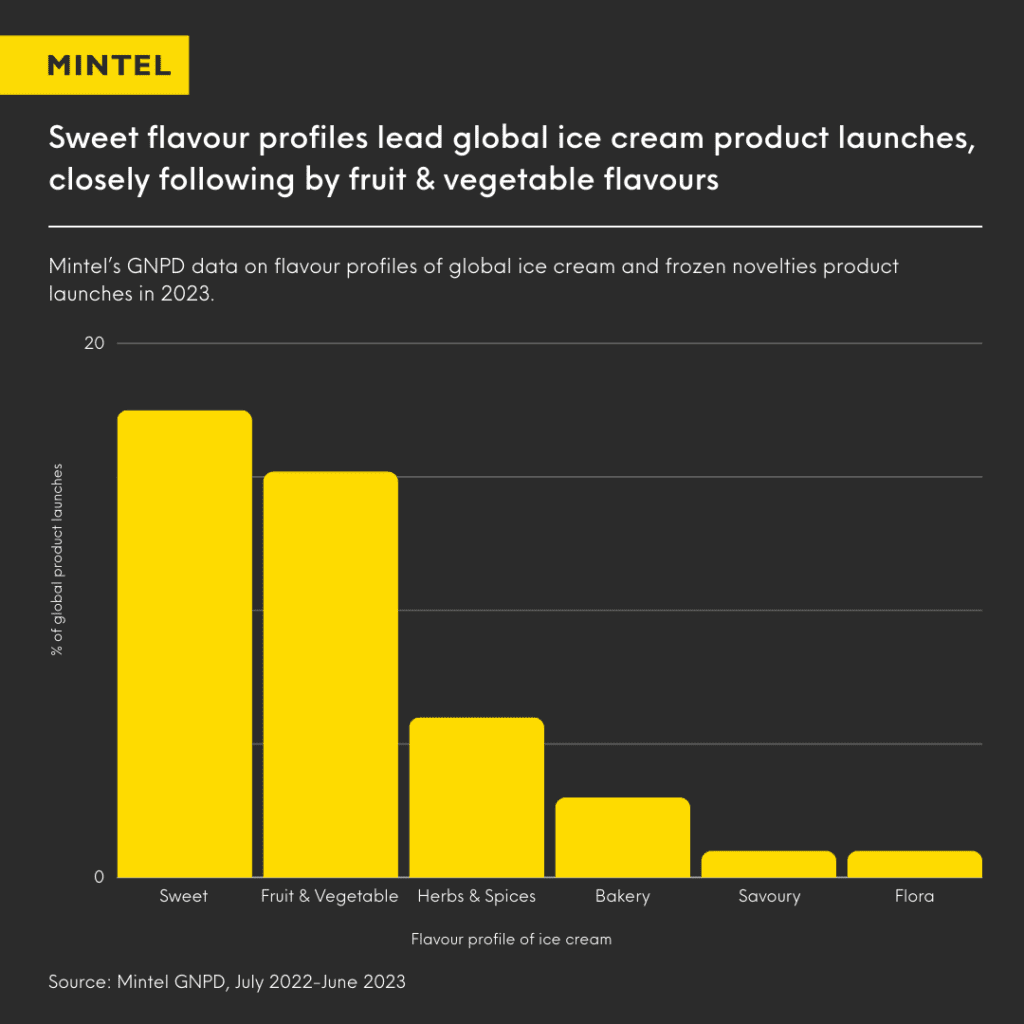

In the APAC region, floral flavours have been gaining interest, and half of Thai consumers aged 25-34 are interested in trying these flavours. Interest is also growing in other non-traditional flavour profiles, such as savoury, which, according to Mintel’s GNPD data, has seen an increase of over 50% in new product launches since 2021. However, despite this growing interest, non-traditional flavours remain quite niche. As demonstrated in the graph below, floral and savoury flavours were each only represented in and less than 1% of all global ice cream product launches in 2023. Nevertheless, brands should not discount consumer interest in flavour experimentation, and in the coming years should utilise AI to create new and customised taste experiences for consumers.

Despite the growing need for novelty, consumers continue to enjoy traditional ice cream flavours, such as strawberry, vanilla and chocolate. Almost two-thirds of UK adults agree that there should be more high-quality ice cream in classic flavours. This interest in higher quality classic flavours illustrates how consumers want the comfort of familiarity but also desire improvements to taste and texture quality at the same time. Ice cream brands should also innovate by putting a twist on familiar flavours to keep consumers engaged. This can be done by embracing an old friend: nostalgia.

If you would like to learn more about the latest trending flavours in the ice cream industry, try Mintel’s Flavourscape AI.

Ice Cold Comfort

Nostalgia is significantly influencing the global ice cream industry; consumers across various regions are drawn to flavours and brands that remind them of their childhood or past. In the UK, eating ice creams that evoke childhood memories resonates widely with consumers, particularly those under 35, suggesting that marketing focused on nostalgia can be highly effective in this market. But it’s not just consumers in the UK who are looking back to the ‘good old days’. In India, ice cream brands are connecting with consumers through nostalgic flavours, particularly targeting older Millennials with seasonal fruit flavours, and in Germany, eight in 10 consumers say that they enjoy rediscovering flavours that they grew up with, echoing the desire for more ice cream in classic and nostalgic flavours.

This all highlights that brands should seriously consider nostalgia as a marketing strategy. Offering inspiration for tapping into the appeal of nostalgia, a number of UK retro brands expanded into the ice cream category in 2023, such as Barratt’s sweets, Angel Delight and Wrigley’s Hubba Bubba. Meanwhile, established brands and market leaders have also used nostalgia in their marketing campaigns: Ben & Jerry’s has featured retro products alongside their ice cream in their social media campaigns, and Baskin-Robbins reverted to using colours from their original logo in their 2022 rebrand.

If you would like to learn more about nostalgia as a marketing strategy, take a look at Mintel’s highly informative Nostalgia Marketing Spotlight Article.

Looking Ahead with Mintel

Ice cream will always be a comfort food. It is unlikely that consumers will stop turning to their favourite indulgent frozen treat in times of uncertainty in the near future. However, how the concept of ‘comfort’ resonates with consumers is changing, and ice cream brands need to be conscious of different consumer expectations when considering new product development and marketing campaigns. Some consumers want to be reassured that they are not damaging their health, or even improving it, when eating ice cream. Some want to experience something new, and get a small portion of excitement through a novel flavour. Or some just want to feel the warm embrace of nostalgia, and it won’t even melt their ice cream.

Subscribe to Mintel’s free newsletter, Spotlight, to get exclusive content and insights delivered directly to your inbox.

Sign up to Spotlight

Mintel’s Most Innovative Food & Drink

Mintel is constantly tracking innovation, identifying trends and gaining insights. To learn more about the latest product innovations in the food and drink industry, download Mintel’s Most Innovative 2024 report today.

Download your copy