Pinterest, Inc (NYSE: PINS), the company that pioneered the concept of image search on the internet, witnessed an increase in user engagement in recent years even as the platform evolved into an online marketplace and became more actionable. The transition gathered steam after Bill Ready took charge as CEO earlier this year.

Since early last year, Pinterest’s stock has been struggling to rebound from a long-drawn decline that erased millions of dollars in market value. But in a sign that PINS is on the recovery path, this year the stock regained strength and moved up after every short-term drop. As far as investing in the company is concerned, the stock looks fully valued right now. The key is to patiently wait for the right entry point because the business has the potential to create shareholder value in the long term.

Outlook

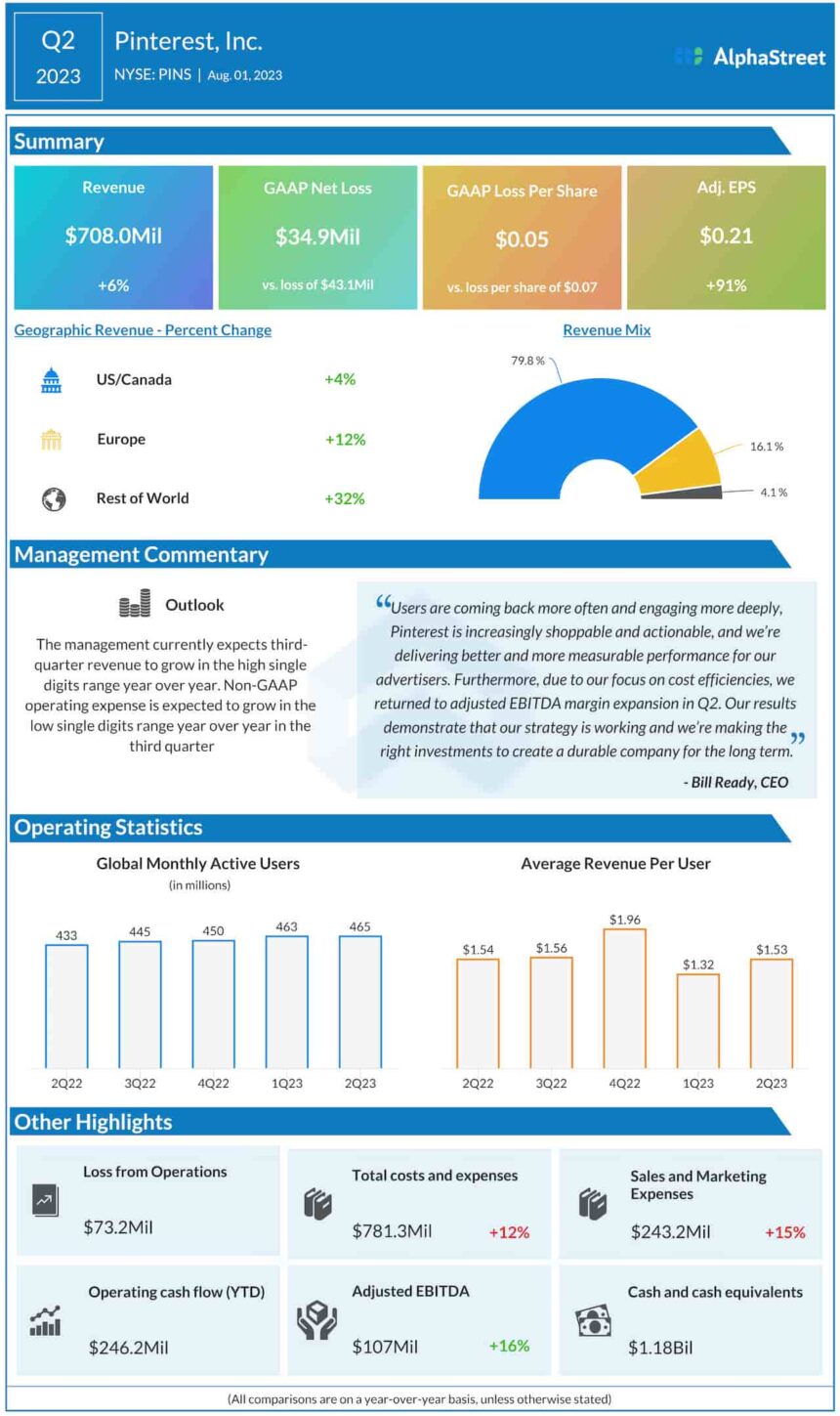

While the U.S. accounts for 80% of its revenues, the company is steadily gaining traction in other regions. The management expects third-quarter revenues to grow in the high single-digit range. Meanwhile, market watchers are looking for 11% revenue growth and $0.20/share earnings for the September quarter. The results are expected to come on October 26, after the closing bell.

Pinterest executives are optimistic about scaling the business and better monetizing the services in the coming years. Their current priorities include empowering existing advertisers and attracting more to the platform, since advertising is the main revenue source. The company’s unique business model that differentiates it from other networking-focused online platforms, gives it an edge over peers.

From Pinterest’s Q2 2023 earnings call:

“We’re now seeing strong growth in engagement with shopping-related content on our core surfaces and for the past four quarters, shopping ads revenue has grown multiples of our total revenue growth. I believe we are just scratching the surface when it comes to monetizing lower funnel behavior on Pinterest. Importantly, we also accelerated innovation on behalf of our advertisers, tripling the number of ad product formats released so far this year versus last and introducing important measurement solutions that prove our value to advertisers.”

Key Numbers

Pinterest reported a sharp increase in adjusted profit for the second quarter when its revenues rose by 6% year-over-year. Revenues increased across all geographical regions, driving up the top line to $708 million. Adjusted for special items, Q2 earnings surged 91% annually to $0.21 per share. Earnings beat estimates for the fourth time in a row. The company has constantly expanded its user base over the years and ended the last quarter with a total of 465 million users.

Shares of Pinterest closed the last trading session lower. This week, PINS traded close to where it was six months ago.