Lemonade Inc. shares fell in the extended session Wednesday after the mobile-based insurance company’s results and outlook came in slightly above Wall Street expectations following a strong rally by the stock this year.

Lemonade

LMND,

shares fell more than 6% after hours, following a 2.4% loss to $22.07 in Wednesday’s regular session, putting the stock at a year-to-date gain of 61.3%, compared with the S&P 500 index’s

SPX

17.6% gain.

The company reported a second-quarter loss of $67.2 million, or 97 cents a share — compared with a loss of $67.9 million, or $1.10 a share, in the year-ago period — as total revenue rose to $104.6 million from $50 million in the year-ago quarter.

Analysts surveyed by FactSet had forecast a loss of $1.03 a share on revenue of $97.6 million.

Lemonade expects revenue of $102 million to $104 million for the third quarter, and $402 million to $408 million for the year. Analysts forecast revenue of $102 million for the third quarter, and $397.7 million for the year.

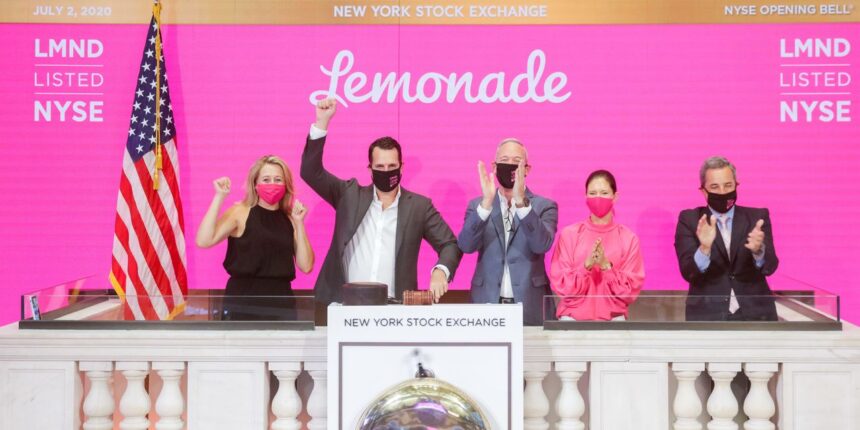

A little more than three years after its IPO, Lemonade shares finished Wednesday’s regular session nearly 24% below the original IPO price of $29. The stock ranked as the best IPO of 2020, debuting 139% above its initial pricing.