Jason doesn’t take the weekends off!

Get the latest updates on ALL the Journeys

(hint: they’re en fuego ?)

Happy Weekend, everyone (make sure to scroll to the end for a huge special where the LINK actually works now?)!

Come on – it had to happen. And I have been banging the table on this for the last week or so.

We hadn’t had even a 1% pullback on SPY or QQQ in around two months.

The Fitch credit downgrade on Tuesday night was the catalyst for what had to happen eventually.

What would you do if you were a hedge fund manager and caught a 15% rally in 3 months?

Take profits, of course (and buy a bigger house in the Hamptons).

Market psychology is actually really simple. Everyone is out to make a buck, just like you.

It’s just that traders like us don’t even cause a ripple. But when big institutions (you know dudes like Warren Buffet) decide to sell, it really moves the tape.

So it’s time for our end-of-week review.

Here’s how my Bullseye Trade worked out that I laid out for my members on Monday this week (before the market opened).

? Here Was the Plan

I was more optimistic about this week last Monday. Earnings weren’t a concern, and I assumed we’d just chop around.

The stocks and indices were so overextended it was making me dizzy.

So even though the charts were still bullish, I decided to tread carefully and stay away from high beta stocks.

You know, the ones that get crushed if the market drops.

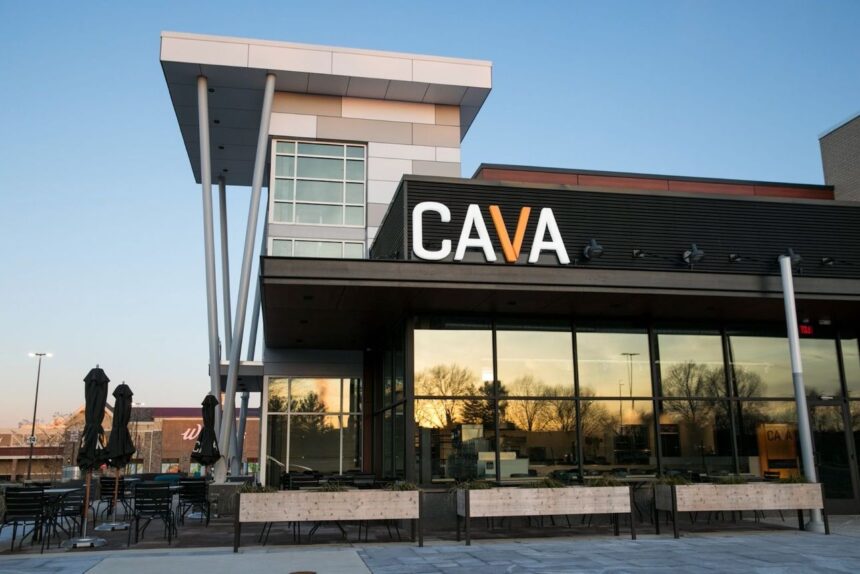

So CAVA came up on the list as my top idea.

A popular Mediterranean restaurant chain (which I can’t wait to try) that seemed to be marching to its own drum…and ready to MOVE.

So I sent out the following alert to my Bullseye Trade subscribers outlining my outlook on the stock.

I also included the EXACT option I wanted and how I would manage the trade.

So how did this trade work out?

? Here’s What Happened

Well…like the ERX idea from last week (yuge!), CAVA took off as soon as the bell rang Monday, it rocketed upwards and barely gave traders any dips that lasted more than a few minutes…

*results not typical. Trading is hard

While it had a great week, I missed my ideal entry, and didn’t get in the trade. I knew the price I would pay for that call but I know better than to chase something outside of my comfort zone.

Would it have been possible to pay more? Sure! But that’s not how I trade.

Folks, chasing trades is for suckers, especially with options. It’s like trying to hop onto a moving train.

When stocks move quickly, volatility causes option prices to SPIKE. It just isn’t a good deal anymore.

At best, I’d eke out a tiny profit not worth the risk. Most likely, they’d die a painful death on any pullback.

Plus, I have been doing this a looooong time now. I know there is another trade around the corner (hint: it is coming MONDAY next week!).

? Critical Lessons

When you see the BIG GREEN candle, it’s too late. The opportunity is likely over.

Just move on to the next opportunity and revisit the ticker later to see if there’s more upside potential.

It’s a psychology thing.

When you’re trading long, learn to enter on red days and take profits on the green–the exact opposite of what most people do.

If you like what you’re reading so far and want to learn more from me – WHY I trade WHAT I trade, today is your LUCKY DAY ?!

We’re offering the best deal you’ll likely ever see on Bullseye Trade RIGHT

That’s right, you can join me for $9.00! I am not going to let this price last long (I’m closing it on Monday) so if you have been on the fence about joining Bullseye Trades… you better get moving fast, or this will be “another one that got away” from you.

You’ll get my complete game plan every Monday, unlimited access to our training library, the trading ebook “How to Become an Alpha Hunter,” and alerts on trades I make sent directly to your Raging Bull app.

You’re not going to see a price this low again. I’m basically giving this away at 9 bucks. MAKE SURE you’re in before I close this deal on MONDAY.

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.